Exploring Three KRX Growth Companies With High Insider Ownership

The South Korean stock market recently experienced a slight downturn, breaking a two-day winning streak and closing modestly lower amidst mixed performances across various sectors. As investors navigate these fluctuations, companies with high insider ownership often attract attention for their potential alignment of interests between shareholders and management, which can be particularly appealing in uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

Devsisters (KOSDAQ:A194480) | 27.2% | 71.9% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

HANA Micron (KOSDAQ:A067310) | 19.8% | 76.8% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 78.1% |

Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Let's dive into some prime choices out of from the screener.

Advanced Nano Products

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Nano Products Co., Ltd. specializes in manufacturing and selling high-tech materials for displays, semiconductors, secondary batteries, and solar cells, operating both in South Korea and internationally, with a market capitalization of approximately ₩1.39 billion.

Operations: The company generates revenue from the production and international sale of sophisticated materials used in displays, semiconductors, secondary batteries, and solar cells.

Insider Ownership: 23.9%

Revenue Growth Forecast: 58.2% p.a.

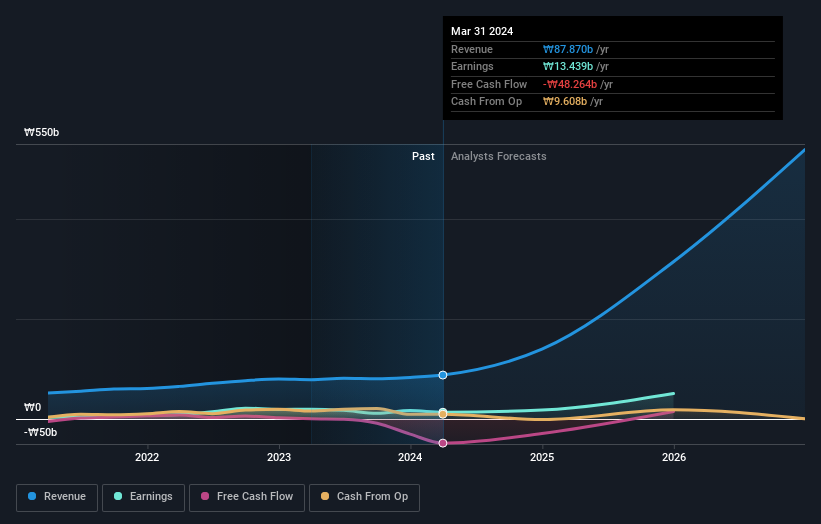

Advanced Nano Products, a South Korean company with high insider ownership, shows a mixed financial landscape. While its revenue increased to KRW 22.37 billion in Q1 2024 from KRW 17.67 billion year-over-year, net income significantly dropped to KRW 1.15 billion from KRW 4.48 billion. Despite this decline, the company's earnings are projected to grow by an impressive 80.2% annually over the next three years, outpacing the broader Korean market's growth forecast of 28.7%. However, it’s important to note that shareholders have experienced dilution over the past year and return on equity is expected to remain low at around 15.8%.

People & Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: People & Technology Inc. specializes in providing machinery services including coating, calendaring, slitting, and automation with a market capitalization of approximately ₩1.54 billion.

Operations: The company specializes in machinery services such as coating, calendaring, slitting, and automation.

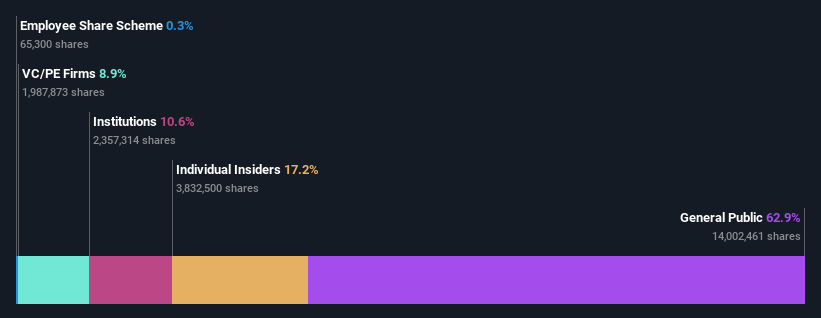

Insider Ownership: 17.2%

Revenue Growth Forecast: 30% p.a.

People & Technology, a South Korean growth company with high insider ownership, is trading at 79.3% below its estimated fair value. Despite recent volatility in share price, earnings have grown by 31.4% over the past year and are expected to increase significantly by approximately 29.41% annually over the next three years, surpassing the broader Korean market's forecast of 28.7%. Additionally, revenue growth projections are robust at about 30% per year, also outpacing market expectations of 10.3%.

ALTEOGEN

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biopharmaceutical company engaged in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of approximately ₩12.40 billion.

Operations: The company generates revenue primarily from the development of long-acting biobetters, proprietary antibody-drug conjugates, and biosimilars.

Insider Ownership: 26.6%

Revenue Growth Forecast: 48.3% p.a.

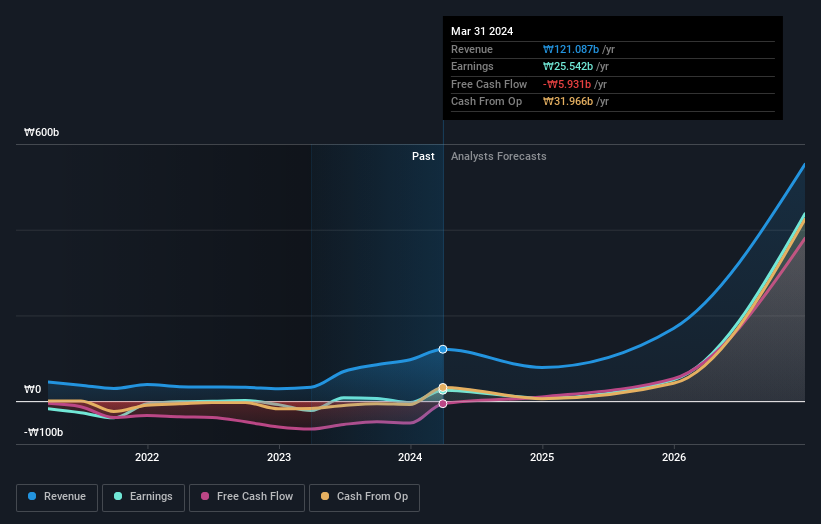

ALTEOGEN, a South Korean growth company with high insider ownership, showcases promising financial prospects. Despite a highly volatile share price in recent months, the company became profitable this year and is trading at 73.5% below its estimated fair value. Forecasted earnings are expected to grow by 73.06% annually, significantly outpacing the broader market's 28.7%. Additionally, anticipated revenue growth at 48.3% yearly exceeds market expectations of 10.3%, highlighting robust potential for expansion.

Dive into the specifics of ALTEOGEN here with our thorough growth forecast report.

Our expertly prepared valuation report ALTEOGEN implies its share price may be too high.

Taking Advantage

Access the full spectrum of 81 Fast Growing KRX Companies With High Insider Ownership by clicking on this link.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A121600 KOSDAQ:A137400 and KOSDAQ:A196170

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance