Exploring Three KRX Stocks With Estimated Intrinsic Discounts Ranging From 25.8% To 47.5%

The South Korean stock market has shown a steady performance, remaining flat over the last week and achieving a 5.7% increase over the past year, with earnings expected to grow by 29% annually. In such an environment, identifying stocks that are potentially undervalued could offer investors opportunities for growth as these stocks may be priced below their intrinsic value relative to current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

Name | Current Price | Fair Value (Est) | Discount (Est) |

Poongsan Holdings (KOSE:A005810) | ₩27600.00 | ₩49415.20 | 44.1% |

Solum (KOSE:A248070) | ₩20950.00 | ₩39897.55 | 47.5% |

Grand Korea Leisure (KOSE:A114090) | ₩12940.00 | ₩24522.87 | 47.2% |

Protec (KOSDAQ:A053610) | ₩29200.00 | ₩55076.00 | 47% |

Caregen (KOSDAQ:A214370) | ₩23300.00 | ₩43428.59 | 46.3% |

Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49550.40 | 49.7% |

Intellian Technologies (KOSDAQ:A189300) | ₩61500.00 | ₩107838.35 | 43% |

IMLtd (KOSDAQ:A101390) | ₩7120.00 | ₩13609.78 | 47.7% |

SK Biopharmaceuticals (KOSE:A326030) | ₩77000.00 | ₩137549.91 | 44% |

NEXON Games (KOSDAQ:A225570) | ₩14620.00 | ₩25836.28 | 43.4% |

Here we highlight a subset of our preferred stocks from the screener

NEXON Games

Overview: NEXON Games Co., Ltd. is a game developer with a market capitalization of approximately ₩939.13 billion.

Operations: The company generates revenue through its game development operations.

Estimated Discount To Fair Value: 43.4%

NEXON Games, valued at ₩14.62 billion, is trading 43.4% below its fair value of ₩25.84 billion, highlighting significant undervaluation based on discounted cash flow analysis. Despite a low forecasted Return on Equity of 14.1%, the company's earnings are expected to grow by a robust 81.49% annually, outpacing the market's growth expectations significantly. Revenue has increased by 17.1% over the past year and is projected to continue expanding faster than the Korean market average.

Solum

Overview: Solum Co., Ltd. is a South Korean company that manufactures and markets power modules, digital tuners, and electronic shelf labels both domestically and internationally, with a market capitalization of approximately ₩1.02 billion.

Operations: The company generates revenue primarily through its ICT Business, which brought in ₩630.59 million, and its Electronic Components Division, with revenues of ₩1.13 billion.

Estimated Discount To Fair Value: 47.5%

Solum, priced at ₩20.95 billion, is significantly undervalued with a fair value estimate of ₩39.90 billion according to discounted cash flow analysis. The company's earnings have grown by 5.1% over the past year and are projected to increase at an annual rate of 29.28%, surpassing the Korean market's forecast growth rate. Additionally, Solum's revenue growth is expected to outpace the market at 11.7% annually, and its Return on Equity is anticipated to be strong at 26.5% in three years' time.

DAEDUCK ELECTRONICS

Overview: Daeduck Electronics Co., Ltd. specializes in manufacturing a range of printed circuit boards (PCBs) for both domestic and international markets, with a market capitalization of approximately ₩1.07 trillion.

Operations: The firm specializes in the production of various PCBs, serving both local and global markets.

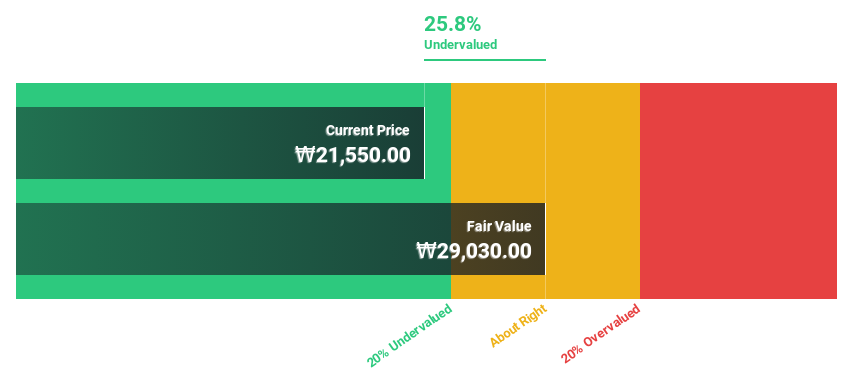

Estimated Discount To Fair Value: 25.8%

Daeduck Electronics, priced at ₩21550, is trading below its estimated fair value of ₩29030, reflecting a significant undervaluation. The company's earnings are expected to grow by 56% annually, outpacing the Korean market's growth. However, its recent financial performance showed a sharp decline in net income and basic earnings per share year-over-year. Additionally, Daeduck has made strides in the semiconductor market with its new FCBGA substrate technology for AI servers and data centers.

Get an in-depth perspective on DAEDUCK ELECTRONICS' balance sheet by reading our health report here.

Key Takeaways

Embark on your investment journey to our 34 Undervalued KRX Stocks Based On Cash Flows selection here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSDAQ:A225570 KOSE:A248070 and KOSE:A353200.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance