Exploring Three Leading Stocks Estimated To Be Up To 47.7% Below Intrinsic Value Calculations

As global markets exhibit mixed performances with key indices like the S&P 500 and Nasdaq Composite showing varying trends, investors continue to navigate through a landscape marked by economic updates and policy adjustments. In such an environment, identifying stocks that appear undervalued relative to their intrinsic value could offer potential opportunities for discerning investors.

Top 10 Undervalued Stocks Based On Cash Flows

Name | Current Price | Fair Value (Est) | Discount (Est) |

RVRC Holding (OM:RVRC) | SEK44.00 | SEK87.77 | 49.9% |

Plus Alpha ConsultingLtd (TSE:4071) | ¥1848.00 | ¥3692.91 | 50% |

SouthState (NYSE:SSB) | US$76.02 | US$151.58 | 49.8% |

Acerinox (BME:ACX) | €9.98 | €19.91 | 49.9% |

Arcadis (ENXTAM:ARCAD) | €59.40 | €118.30 | 49.8% |

Hexcel (NYSE:HXL) | US$64.74 | US$128.96 | 49.8% |

Elkem (OB:ELK) | NOK20.50 | NOK40.97 | 50% |

Shinsung E&GLtd (KOSE:A011930) | ₩2010.00 | ₩4007.72 | 49.8% |

Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$248.68 | US$495.30 | 49.8% |

Hecla Mining (NYSE:HL) | US$5.18 | US$10.35 | 50% |

Let's uncover some gems from our specialized screener

Cellnex Telecom

Overview: Cellnex Telecom, S.A. manages wireless telecommunication infrastructure across multiple European countries including Austria, Denmark, Spain, and the United Kingdom, with a market capitalization of approximately €22.09 billion.

Operations: The firm operates and manages wireless telecom infrastructure in several European nations, including Austria, Denmark, Spain, France, Ireland, Italy, the Netherlands, Poland, Portugal, the UK, Sweden, and Switzerland.

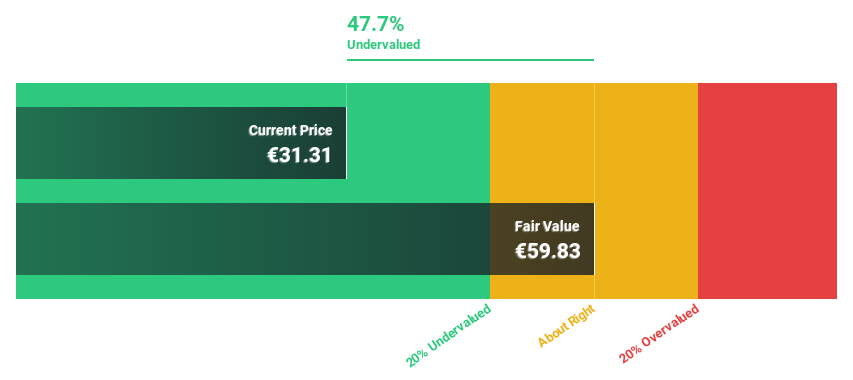

Estimated Discount To Fair Value: 47.7%

Cellnex Telecom, currently trading at €31.31, is significantly undervalued based on a discounted cash flow (DCF) analysis with an estimated fair value of €59.83, indicating a 47.7% undervaluation. Despite a slow revenue growth forecast at 5.9% annually—slightly above the Spanish market's 4.7%—the company is expected to turn profitable within three years, contrasting its current net loss of €39 million in Q1 2024 from €91 million year-over-year. Recent strategic moves include issuing shares and multiple fixed-income offerings to strengthen its financial position.

Innovent Biologics

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on developing and commercializing monoclonal antibodies and other drug assets for oncology, ophthalmology, autoimmune, and cardiovascular and metabolic diseases in China, with a market capitalization of approximately HK$60.24 billion.

Operations: The company generates revenue primarily from its biotechnology segment, which amounted to CN¥6.21 billion.

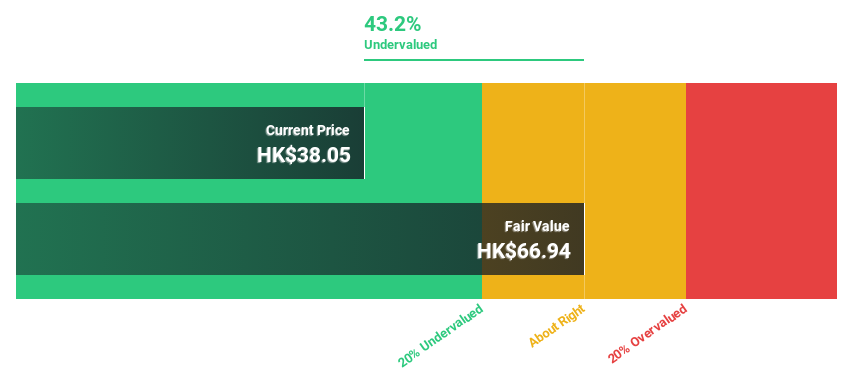

Estimated Discount To Fair Value: 36.3%

Innovent Biologics, priced at HK$39.65, is well below its estimated fair value of HK$62.28, reflecting a significant undervaluation based on DCF analysis. Despite recent insider selling and shareholder dilution over the past year, the company's earnings have grown 27.1% annually over five years and are expected to rise by 50.81% yearly. Revenue growth is also robust at 21.1% annually, outpacing the Hong Kong market's 7.7%. The recent positive Phase 3 trial results for mazdutide could further enhance its financial outlook if approved for weight management in China.

Zijin Mining Group

Overview: Zijin Mining Group Company Limited operates in the exploration, mining, processing, refining, and sale of gold, non-ferrous metals, and other mineral resources both in Mainland China and globally, with a market capitalization of approximately HK$504.78 billion.

Operations: The company generates revenue from the exploration, mining, processing, and refining of gold and non-ferrous metals.

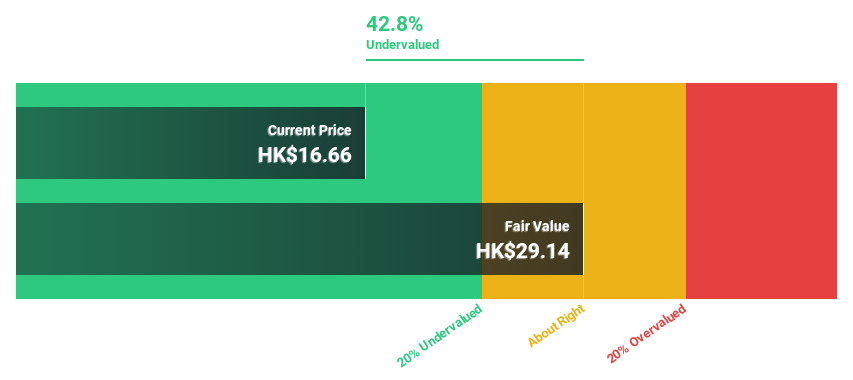

Estimated Discount To Fair Value: 44.8%

Zijin Mining Group, trading at HK$17.66, is identified as undervalued based on DCF analysis with a fair value estimate of HK$31.99. The company's revenue and earnings growth are forecasted to outpace the Hong Kong market at 9.1% and 20.6% per year respectively. Despite carrying a high level of debt, its significant expected earnings growth and recent inclusion in the Hang Seng China Enterprises Index highlight its potential under current market evaluations.

Get an in-depth perspective on Zijin Mining Group's balance sheet by reading our health report here.

Make It Happen

Click this link to deep-dive into the 952 companies within our Undervalued Stocks Based On Cash Flows screener.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include BME:CLNXSEHK:1801 and SEHK:2899.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance