Exploring Three SGX Dividend Stocks For Your Portfolio

As global financial markets navigate through uncertainties, such as the recent disruptions caused by the collapse of a major Banking-as-a-Service platform, investors are increasingly looking for stability and reliability in their investment choices. In this context, dividend stocks listed on the Singapore Exchange (SGX) offer an appealing option for those seeking potential income generation and lower volatility in their portfolios.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Civmec (SGX:P9D) | 6.06% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.52% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 9.64% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.97% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.70% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 7.73% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.84% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.09% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Sing Investments & Finance (SGX:S35) | 5.88% | ★★★★☆☆ |

Click here to see the full list of 18 stocks from our Top SGX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

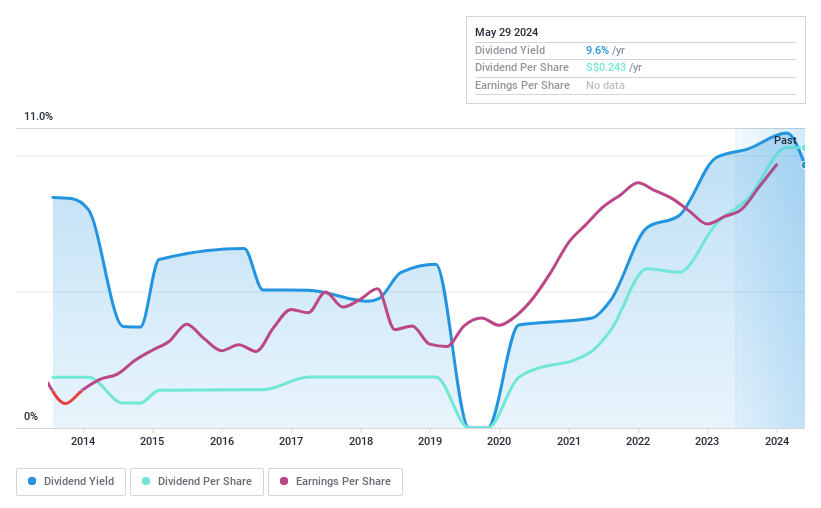

Multi-Chem

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited is an investment holding company that distributes information technology products across regions including Singapore, Greater China, Australia, and India, with a market capitalization of SGD 227.04 million.

Operations: Multi-Chem Limited generates revenue primarily through its IT business in Singapore (SGD 372.78 million), followed by other regions (SGD 153.93 million), Australia (SGD 54.60 million), India (SGD 40.56 million), and Greater China (SGD 34.96 million).

Dividend Yield: 9.6%

Multi-Chem Limited, a dividend-paying entity in Singapore, has shown a mixed track record with its dividends. The company’s payout ratio stands at 80.7%, indicating that earnings sufficiently cover the dividend payments. However, dividends have been volatile over the past decade, with some annual drops exceeding 20%. Despite this instability, Multi-Chem's dividend yield is competitive at 9.64%, positioning it in the top quartile of Singaporean dividend payers. Recent board changes could influence future governance and stability, potentially impacting dividend policies moving forward.

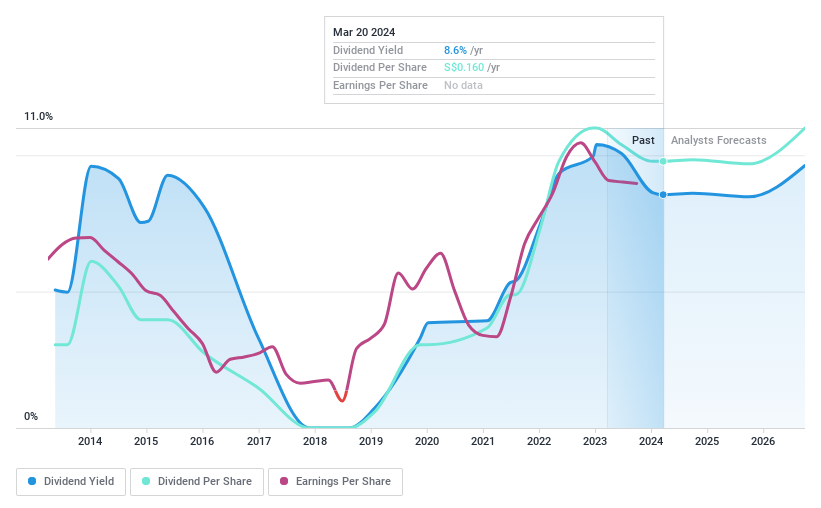

BRC Asia

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited operates in the prefabrication of steel reinforcement for use in concrete across multiple regions including Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, and India, with a market capitalization of approximately SGD 567.90 million.

Operations: BRC Asia Limited generates revenue primarily through two segments: Trading, which brought in SGD 413.27 million, and Fabrication and Manufacturing, contributing SGD 1.21 billion.

Dividend Yield: 7.7%

BRC Asia has exhibited inconsistent dividend reliability over the past decade, with payments showing significant volatility. Despite this, the dividends are reasonably supported by both earnings and cash flows, with payout ratios of 38% and 28.1% respectively. Additionally, BRC Asia's dividend yield of 7.73% ranks well above the Singapore market average of 6.19%. However, concerns persist due to its high debt levels and unstable dividend history.

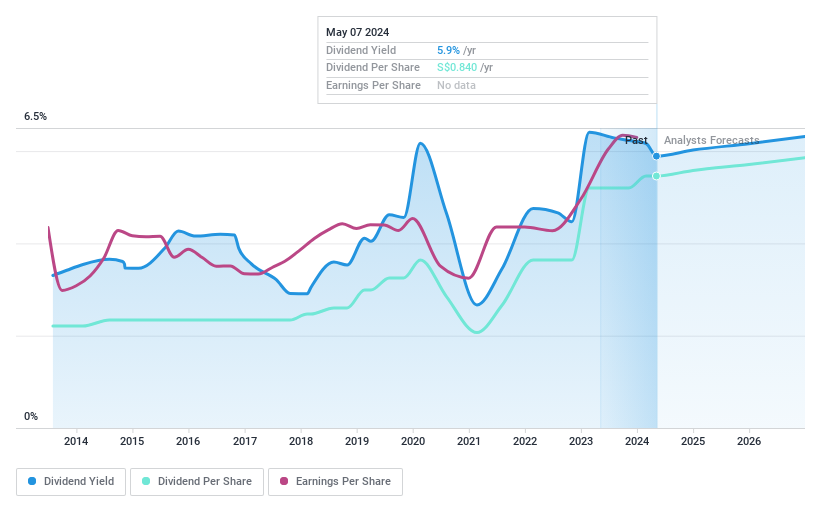

Oversea-Chinese Banking

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oversea-Chinese Banking Corporation Limited operates globally, providing financial services across Singapore, Malaysia, Indonesia, Greater China, and other Asia Pacific regions with a market capitalization of SGD 65.46 billion.

Operations: Oversea-Chinese Banking Corporation Limited generates its revenue through financial services across various regions including Singapore, Malaysia, Indonesia, Greater China, and the broader Asia Pacific area.

Dividend Yield: 5.8%

Oversea-Chinese Banking Corporation has shown a mixed performance in dividend reliability, with a history of volatility over the past decade. Despite this, dividends are currently and forecast to be covered by earnings with payout ratios of 52.9% and 54.1%, respectively. Recent financial activities include a $500 million fixed-income offering and initiating share repurchases, which may influence future dividend sustainability. However, its current dividend yield of 5.77% remains below the top tier in Singapore's market.

Where To Now?

Click through to start exploring the rest of the 15 Top SGX Dividend Stocks now.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:AWZ SGX:BEC and SGX:O39.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance