Exploring Three Top TSX Dividend Stocks With Yields Up To 5.8%

As the Canadian market navigates through a phase of cautious interest rate cuts and persistent consumer spending, investors are closely monitoring the broader economic indicators. Amidst this backdrop, dividend stocks on the TSX are attracting attention for their potential to offer stable returns in a fluctuating economic environment. In relation to our discussion on top TSX dividend stocks with yields up to 5.8%, it's important to note that such stocks can be particularly appealing in times of economic uncertainty, providing both income and a degree of security against market volatility.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.78% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.25% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.47% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.56% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.34% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.91% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.56% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.34% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.21% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 9.09% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

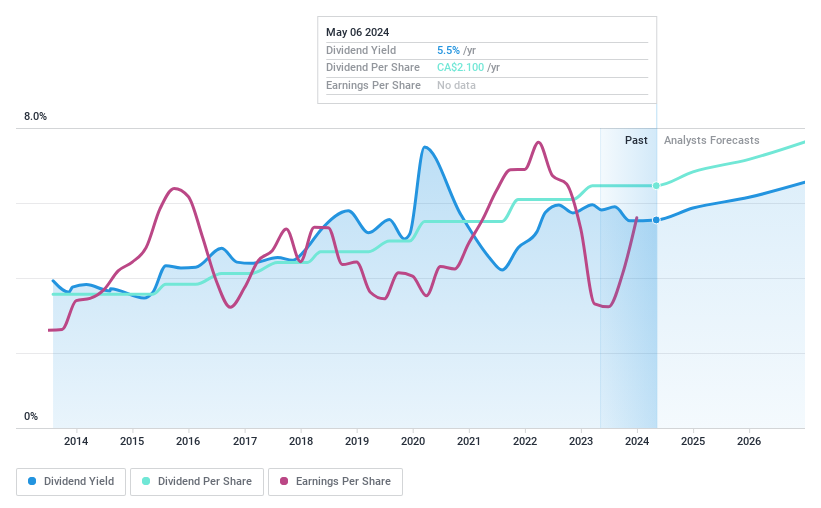

Aecon Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aecon Group Inc. operates as a construction and infrastructure development company serving private and public sector clients in Canada, the U.S., and internationally, with a market cap of approximately CA$1.03 billion.

Operations: Aecon Group Inc. generates revenue primarily through its Construction segment, which brought in CA$4.33 billion, and its Concessions segment, contributing CA$59.50 million.

Dividend Yield: 4.6%

Aecon Group's dividend yield of 4.61% is modest compared to the top Canadian dividend payers and its dividends are not sufficiently covered by cash flows, with a high cash payout ratio of 4232.8%. However, dividends have shown stability and growth over the past decade, supported by a reasonable earnings payout ratio of 27.9%. Recent board changes could influence strategic directions, potentially impacting future dividend policies. Despite recent earnings growth, forecasts suggest a decline in earnings over the next three years.

Power Corporation of Canada

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada, an international management and holding company, operates in the financial services sector across North America, Europe, and Asia with a market capitalization of CA$24.94 billion.

Operations: Power Corporation of Canada's revenue is primarily derived from its Lifeco segment at CA$23.51 billion, followed by Power Financial - IGM and Alternative Asset Investment Platforms, contributing CA$3.67 billion and CA$1.59 billion respectively.

Dividend Yield: 5.9%

Power Corporation of Canada reported a significant increase in Q1 2024 earnings, with net income rising to CAD 722 million. The company declared stable dividends across various share types, maintaining a quarterly dividend of 56.25 Canadian cents per share for Participating Preferred and Subordinate Voting Shares. Despite shareholder proposals suggesting changes to enhance ESG and compensation transparency being rejected, the dividends appear sustainable with a payout ratio of 49.9% covered by earnings and a cash payout ratio of 28.4%. However, its dividend yield at 5.89% remains below the top quartile in the Canadian market.

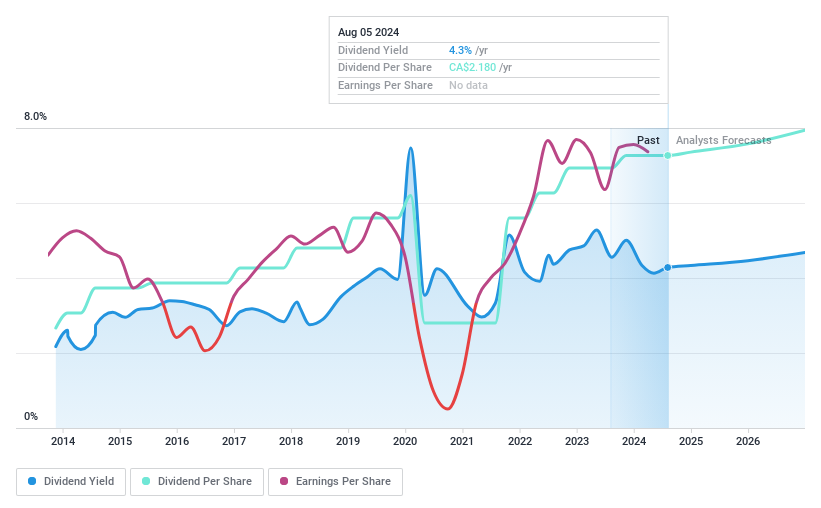

Suncor Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations in Canada, the United States, and internationally, boasting a market capitalization of approximately CA$66.34 billion.

Operations: Suncor Energy's revenue is primarily derived from its Oil Sands segment, which generated CA$23.76 billion, and its Refining and Marketing segment, which produced CA$31.51 billion, along with a contribution of CA$2.17 billion from its Exploration and Production segment.

Dividend Yield: 4.2%

Suncor Energy, despite a robust increase in oil sands production and refinery throughput in Q1 2024, reported a decline in net income to CAD 1.61 billion from CAD 2.05 billion year-over-year. The company maintained its quarterly dividend at CAD 0.545 per share, reflecting a payout ratio of 35.2%, indicating dividends are well-covered by earnings and cash flows. However, Suncor's dividend history has been marked by volatility over the past decade, and its yield of 4.23% trails behind the top quartile of Canadian dividend stocks at 6.63%. Recent shareholder rejections of climate-related proposals suggest potential ESG concerns among investors.

Next Steps

Unlock our comprehensive list of 33 Top TSX Dividend Stocks by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:ARE TSX:POW and TSX:SU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance