Exploring Three TSX Dividend Stocks For Your Portfolio

As global economic fluctuations continue to pose challenges, the Canadian market remains a focal point for investors seeking stability and growth. Dividend stocks on the TSX are particularly appealing as they offer potential for regular income alongside opportunities for capital appreciation. In this context, understanding what constitutes a robust dividend stock is crucial, especially considering current market dynamics and economic indicators.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.55% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.15% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.59% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.44% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.46% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 5.53% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.86% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.31% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.27% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 9.10% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

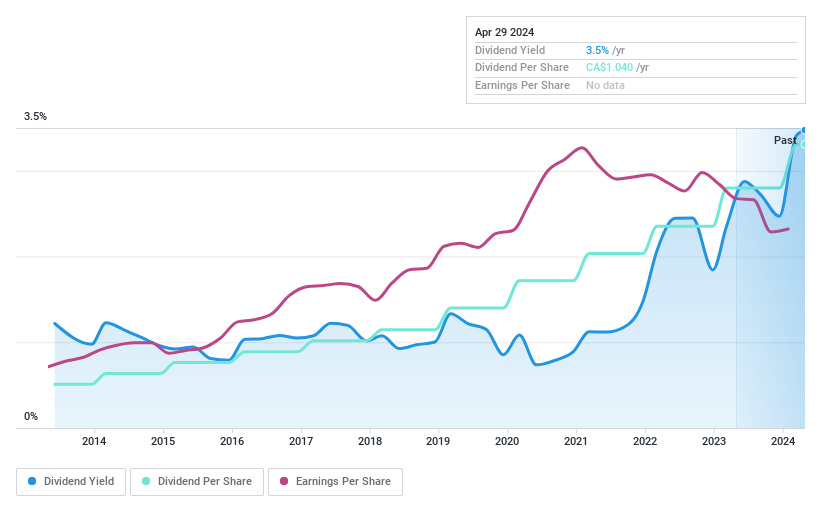

Enghouse Systems

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Enghouse Systems Limited, a global provider of enterprise software solutions, has a market capitalization of approximately CA$1.60 billion.

Operations: Enghouse Systems Limited generates revenue through two primary segments: the Asset Management Group, which brought in CA$184.48 million, and the Interactive Management Group, with revenues of CA$283.60 million.

Dividend Yield: 3.6%

Enghouse Systems has recently increased its quarterly dividend to CA$0.26 per share, reflecting an 18.2% hike, showcasing its commitment to returning value to shareholders. Despite a low yield of 3.59% relative to the top Canadian dividend payers, the company maintains a stable and growing dividend history over the past decade. Financially, Enghouse supports these dividends with a solid payout ratio of 69.3% and a cash payout ratio of 55%, ensuring dividends are well-covered by both earnings and free cash flow. Additionally, recent strategic share buybacks underline confidence in the stock's valuation, further supported by trading at 47.2% below estimated fair value and positive analyst projections expecting a price rise of 32.5%.

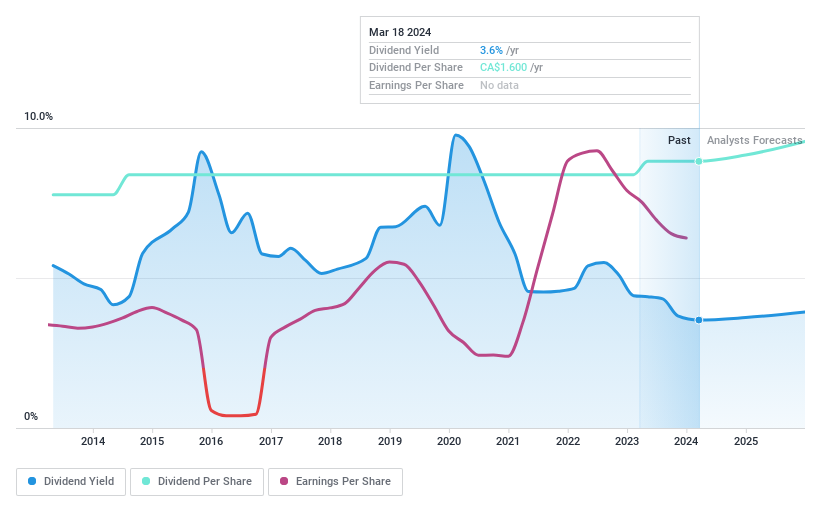

North West

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. operates as a retailer offering food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market capitalization of approximately CA$1.86 billion.

Operations: The North West Company Inc. generates its revenues primarily from the retail sale of food and everyday items across northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Dividend Yield: 3.8%

North West Company Inc. has demonstrated consistent dividend growth over the past decade, with a current yield of 3.84%, which is lower than the top Canadian dividend payers. Recent financial performance shows an upward trend, with sales reaching CAD 617.52 million and net income at CAD 25.53 million in Q1 2024, both increases from the previous year. Dividends are sustainably covered by earnings and cash flows, with payout ratios of 56.8% and 59.7% respectively, ensuring reliability despite a comparatively modest yield.

Get an in-depth perspective on North West's performance by reading our dividend report here.

Our valuation report unveils the possibility North West's shares may be trading at a discount.

Russel Metals

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. is a metal distribution and processing company with operations in Canada and the United States, boasting a market capitalization of approximately CA$2.30 billion.

Operations: Russel Metals Inc. generates its revenue primarily through three segments: Steel Distributors at CA$429 million, Energy Field Stores at CA$982.20 million, and Metals Service Centers at CA$2.95 billion.

Dividend Yield: 4.3%

Russel Metals recently increased its quarterly dividend to CA$0.42, reflecting a stable payout supported by a 10-year track record of reliable dividends. Despite lower earnings in Q1 2024, with sales dropping to CA$1.06 billion from CA$1.19 billion the previous year and net income falling to CA$49.7 million from CA$73.9 million, the company maintains healthy cash reserves (CA$629 million as of late 2023) and has demonstrated financial prudence by redeeming all outstanding senior unsecured notes using cash on hand. The dividend is well-covered by both earnings and cash flow, with payout ratios of 40.3% and 32.1% respectively, though its yield at 4.31% remains below the top Canadian payers' average.

Click to explore a detailed breakdown of our findings in Russel Metals' dividend report.

Our valuation report here indicates Russel Metals may be undervalued.

Make It Happen

Take a closer look at our Top TSX Dividend Stocks list of 32 companies by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:ENGH TSX:NWC and TSX:RUS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance