Exploring Three UK Growth Companies With High Insider Ownership On The Exchange

The UK market is showing signs of resilience and optimism, with the FTSE 100 poised for a third consecutive day of gains amid broader positive trends in global markets. In such an environment, growth companies with high insider ownership can be particularly compelling, as these insiders often have a deep commitment to the company's success and a unique insight into its operations and potential.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

Petrofac (LSE:PFC) | 16.6% | 115.4% |

Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

Plant Health Care (AIM:PHC) | 26.4% | 94.4% |

Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

B90 Holdings (AIM:B90) | 22% | 142.7% |

Afentra (AIM:AET) | 38.3% | 99.2% |

Here we highlight a subset of our preferred stocks from the screener.

Craneware

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc is a company that develops, licenses, and supports computer software for the healthcare industry in the United States, with a market capitalization of approximately £859.85 million.

Operations: The company generates its revenue primarily from the healthcare software segment, totaling $180.56 million.

Insider Ownership: 17%

Earnings Growth Forecast: 28.5% p.a.

Craneware exhibits promising growth with earnings expected to increase by 28.5% annually, outpacing the UK market's average. Despite this, its revenue growth is moderate at 7.3% yearly and return on equity is projected to be low at 11.2% in three years. Recent activities include extending a buyback plan and participating in several industry conferences, signaling active engagement and potential stability but lacking substantial insider transactions recently which could temper investor enthusiasm for those looking closely at governance dynamics.

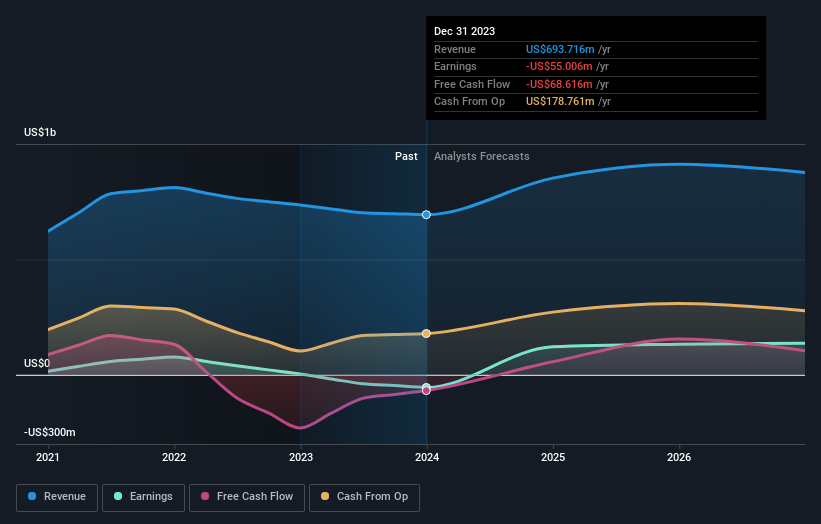

Hochschild Mining

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company that specializes in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market capitalization of approximately £0.96 billion.

Operations: The company generates revenue primarily from its three key mines: Inmaculada contributed $396.64 million, San Jose added $242.46 million, and Pallancata brought in $54.05 million.

Insider Ownership: 38.4%

Earnings Growth Forecast: 58.2% p.a.

Hochschild Mining is poised for growth with earnings expected to surge, becoming profitable within three years. Despite a modest revenue growth forecast of 8.4% per year, it outstrips the UK market average. Insider activities underscore confidence, with more shares bought than sold recently. Recent production guidance confirms operational upturns in gold and silver outputs, supporting its strategic focus on disciplined capital allocation and value-accretive acquisitions aimed at bolstering its portfolio.

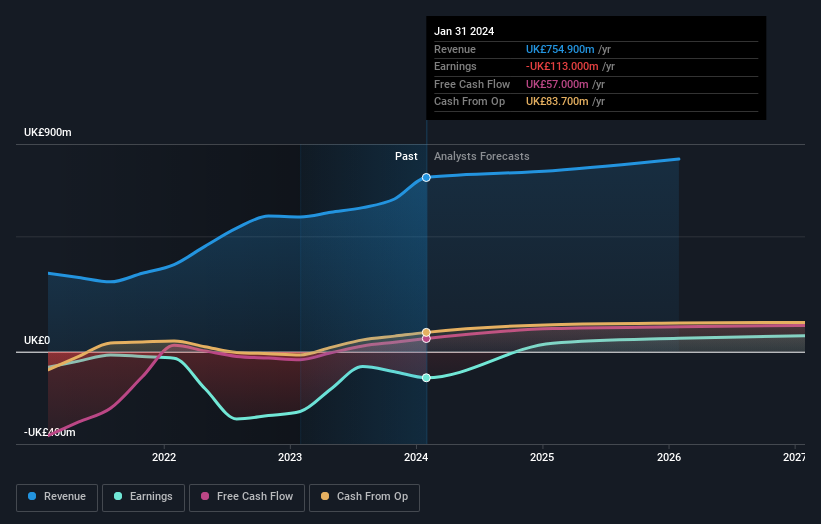

Saga

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Saga plc operates in the United Kingdom, offering package and cruise holidays, general insurance, and personal finance products and services, with a market capitalization of approximately £197.54 million.

Operations: Saga's revenue is generated primarily from cruise and travel (£410.80 million), with additional contributions from insurance underwriting (£179.40 million), home broking (£55.40 million), motor broking (£45.30 million), and other insurance broking (£41.80 million).

Insider Ownership: 33.1%

Earnings Growth Forecast: 64.9% p.a.

Saga plc, while not a standout in high-growth sectors, shows potential with its earnings forecast to grow 64.9% annually. The company is expected to turn profitable within three years, outpacing average market growth predictions. Despite recent shareholder dilution and modest revenue growth of 5% per year—slightly ahead of the UK market's 3.7%—the firm’s recent financial results indicate improvement, with a significant reduction in net loss from GBP 273.1 million to GBP 113 million year-over-year.

Next Steps

Navigate through the entire inventory of 67 Fast Growing UK Companies With High Insider Ownership here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:CRW LSE:HOC and LSE:SAGA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance