Exploring Tong Ren Tang Technologies And Two Other Key Dividend Stocks In Hong Kong

Amidst a backdrop of fluctuating global markets, with the Hang Seng Index recently experiencing a notable decline, investors are increasingly seeking stable returns through dividend stocks. In this context, companies like Tong Ren Tang Technologies offer potential due to their dividend yield strategies in the uncertain economic climate of Hong Kong.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 7.71% | ★★★★★★ |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.89% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.77% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 9.25% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.21% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.78% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.43% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.00% | ★★★★★☆ |

Lion Rock Group (SEHK:1127) | 7.69% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.55% | ★★★★★☆ |

Click here to see the full list of 88 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

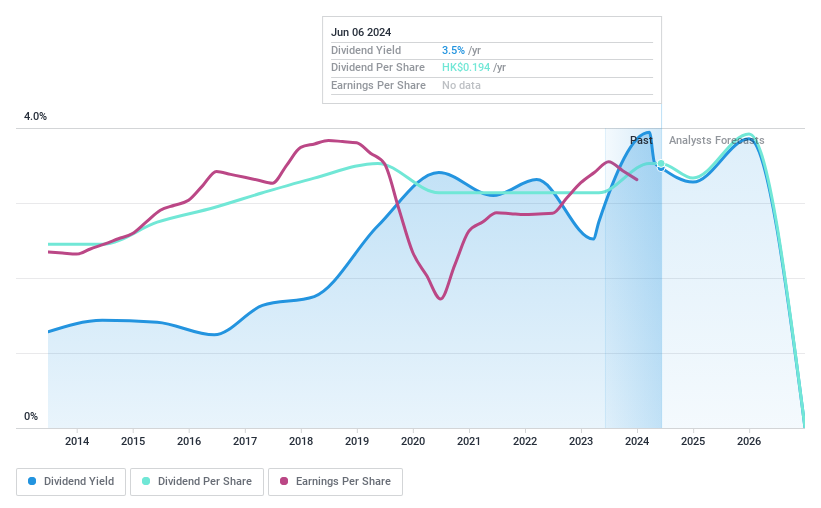

Tong Ren Tang Technologies

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tong Ren Tang Technologies Co. Ltd. is a company that manufactures and sells Chinese medicine products both in Mainland China and internationally, with a market capitalization of approximately HK$7.16 billion.

Operations: Tong Ren Tang Technologies Co. Ltd. generates revenue primarily through its core segment, which contributed CN¥4.07 billion, and its Tong Ren Tang Chinese Medicine segment, which added CN¥1.38 billion.

Dividend Yield: 3.5%

Tong Ren Tang Technologies has demonstrated a consistent approach to dividends, with a decade of stable and growing payments. Recent financials show earnings growth of 1.3% last year, with expectations for future growth at 4.54% annually. Dividends are well-supported by both earnings and cash flows, maintaining payout ratios of 39.1% and 51.1%, respectively. However, its current yield of 3.47% trails behind Hong Kong's top dividend payers. The proposed final dividend is RMB 0.18 per share for the year ended December 31, 2023.

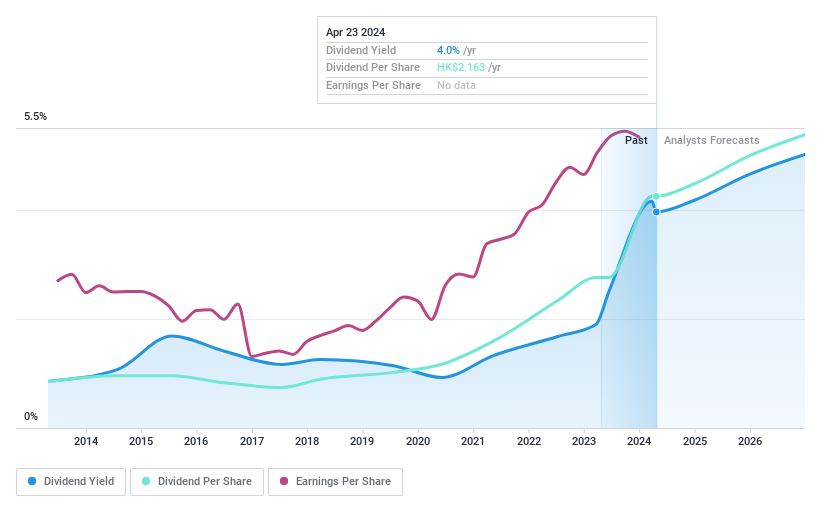

Tsingtao Brewery

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tsingtao Brewery Company Limited operates globally, focusing on the production, distribution, wholesale, and retail of beer products, with a market capitalization of approximately HK$98.23 billion.

Operations: Tsingtao Brewery Company Limited generates its revenue primarily through the production and sale of beer globally.

Dividend Yield: 3.8%

Tsingtao Brewery has maintained stable dividends over the past decade, with recent proposals to increase dividends to RMB 2 per share for FY 2023. While its dividend yield of 3.8% is below the top quartile in Hong Kong, earnings growth remains robust at 21.4% annually over five years, supporting future payouts despite a high cash payout ratio of 145.5%. Recent financials show a slight decline in quarterly revenue but an increase in net income, suggesting efficient cost management and profitability.

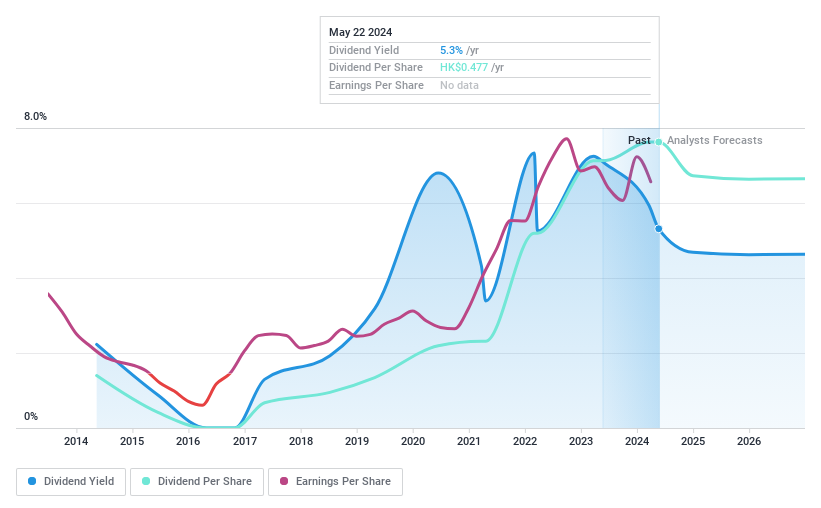

China Coal Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Coal Energy Company Limited operates primarily in coal production and trading, as well as coal chemical businesses within the People's Republic of China and globally, with a market capitalization of approximately HK$167.67 billion.

Operations: China Coal Energy Company Limited generates its revenue mainly from coal production, trading, and coal chemical operations.

Dividend Yield: 4.9%

China Coal Energy's dividends are supported by a payout ratio of 33.9% and a cash payout ratio of 33.4%, indicating financial stability in covering distributions. However, dividend reliability has been questioned due to volatility over the past decade, despite an overall increase in payments during this period. Recently, the company announced a special dividend of RMB 1.5 billion, signaling potential confidence in its financial health despite forecasted earnings declines averaging 0.3% annually over the next three years. The current yield stands at 4.91%, lower than many top Hong Kong dividend payers.

Next Steps

Delve into our full catalog of 88 Top Dividend Stocks here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1666 SEHK:168SEHK:1898 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance