Exploring Top Dividend Stocks In May 2024

In the past week, the United States stock market has remained steady, while it has experienced a significant 26% increase over the past year with earnings projected to grow by 15% annually. In this context, dividend stocks emerge as particularly appealing for investors seeking stable returns in a growing market.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.65% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.02% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.04% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.02% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.75% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.70% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.80% | ★★★★★★ |

Carter's (NYSE:CRI) | 4.86% | ★★★★★☆ |

Helmerich & Payne (NYSE:HP) | 4.70% | ★★★★★☆ |

Marine Products (NYSE:MPX) | 5.43% | ★★★★★☆ |

Click here to see the full list of 205 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Star Bulk Carriers

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Star Bulk Carriers Corp. is a global shipping company specializing in the ocean transportation of dry bulk cargoes, with a market capitalization of approximately $3.06 billion.

Operations: Star Bulk Carriers Corp. primarily generates its revenue from the ocean transportation of dry bulk cargoes globally.

Dividend Yield: 5.3%

Star Bulk Carriers recently reported a significant increase in Q1 2024 earnings, with revenue rising to US$259.39 million and net income up to US$74.86 million. Despite this positive financial performance, the company's dividend history is marked by instability, having a volatile track record over less than a decade of payments. The recent dividend increase to $0.75 per share underscores an attempt to maintain attractiveness to dividend investors, supported by a payout ratio of 49.5% and cash payout ratio of 50.6%, suggesting dividends are well-covered by both earnings and cash flow despite historical unpredictability and high debt levels.

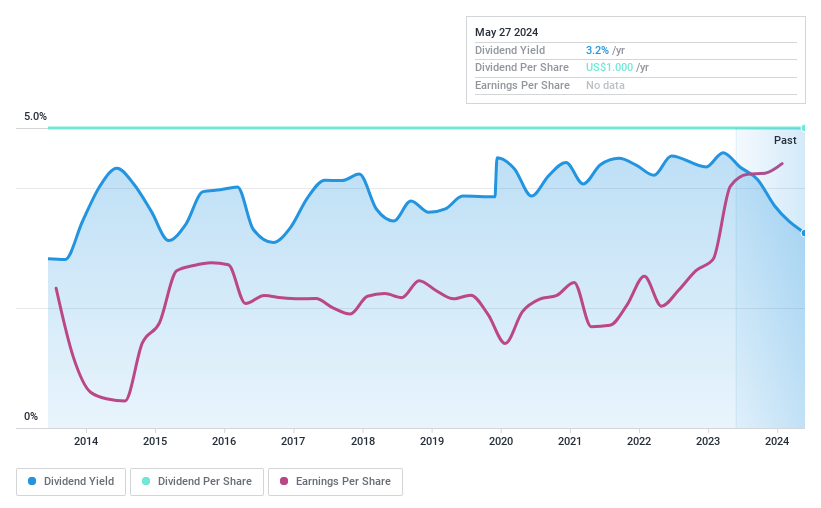

Village Super Market

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Village Super Market, Inc. operates a chain of supermarkets in the United States with a market capitalization of approximately $455.18 million.

Operations: Village Super Market, Inc. generates $2.20 billion from the retail sale of food and non-food products.

Dividend Yield: 3.2%

Village Super Market recently declared quarterly dividends of US$0.25 per Class A share and US$0.1625 per Class B share, payable on April 25, 2024. Despite a stable dividend yield of 3.25%, which is below the top quartile of US dividend payers at 4.7%, the company's dividends are well-supported by earnings and cash flow with both payout ratios around 28%. However, there has been no growth in dividend payments over the past decade, reflecting a lack of progression in shareholder returns despite consistent earnings growth, including a notable increase to US$26.07 million over the last six months from previous years.

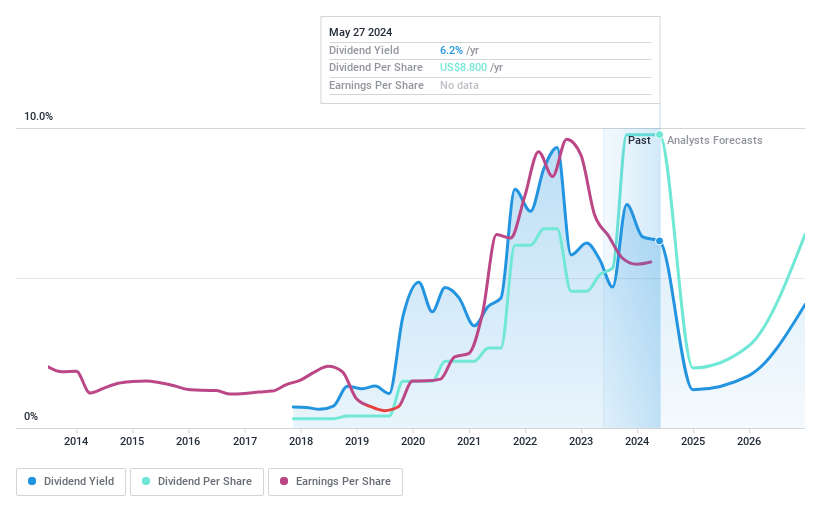

Boise Cascade

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boise Cascade Company operates in the manufacturing of wood products and distribution of building materials across the United States and Canada, with a market capitalization of approximately $5.57 billion.

Operations: Boise Cascade Company generates revenue through two primary segments: Wood Products, which brought in $1.96 billion, and Building Materials Distribution, which accounted for $6.30 billion.

Dividend Yield: 6.2%

Boise Cascade, with a quarterly dividend of US$0.20 per share payable on June 17, 2024, exhibits a mixed dividend profile. Despite its high yield placing it in the top quartile of US dividend payers, the company's dividends have shown volatility and an unstable track record over the past seven years. Financially, Boise Cascade's dividends are well-covered by earnings with a low payout ratio of 6.1% and by cash flows at 77.7%. However, forecasted earnings decline could impact future payouts. Recent executive changes and ongoing share buybacks reflect active management and capital return strategies but also highlight potential shifts in operational focus that could influence dividend sustainability.

Where To Now?

Explore the 205 names from our Top Dividend Stocks screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:SBLK NasdaqGS:VLGE.A and NYSE:BCC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance