Exploring Top Dividend Stocks In Sweden June 2024

As of June 2024, the Swedish market, like much of Europe, is navigating through a landscape marked by rising inflation and economic policy adjustments. These conditions underscore the importance of selecting dividend stocks that offer not only yield but also stability and potential growth in uncertain times.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 6.26% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 3.93% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.17% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.21% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.15% | ★★★★★☆ |

Duni (OM:DUNI) | 4.60% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.20% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.68% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.22% | ★★★★★☆ |

G5 Entertainment (OM:G5EN) | 5.95% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Betsson

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Betsson AB operates an online gaming business across the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market capitalization of approximately SEK 15.97 billion.

Operations: Betsson AB generates its revenue primarily from its Casinos & Resorts segment, totaling €974.50 million.

Dividend Yield: 6.3%

Betsson AB has recently increased its dividend, with a redemption totaling EUR 0.645 per share in 2024. Despite this, the company's dividend history has been marked by volatility over the past decade. Betsson reported a solid first quarter in 2024 with sales rising to EUR 248.2 million and net income growing to EUR 41.3 million. The dividends are reasonably covered by earnings and cash flows, with payout ratios of 48.9% and 46.9% respectively, suggesting sustainability despite past inconsistencies in dividend reliability.

Click here and access our complete dividend analysis report to understand the dynamics of Betsson.

The valuation report we've compiled suggests that Betsson's current price could be quite moderate.

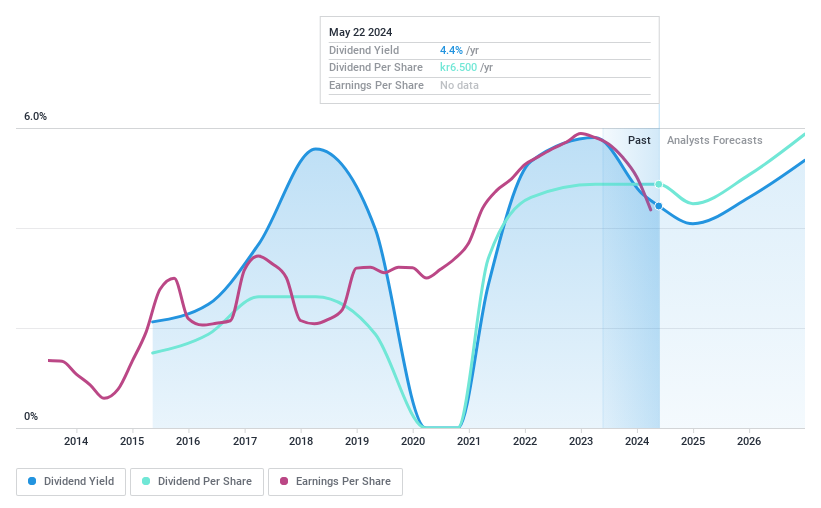

Inwido

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inwido AB (publ) specializes in the development, manufacturing, and sale of windows and doors, with a market capitalization of approximately SEK 8.35 billion.

Operations: Inwido AB generates its revenues primarily from Scandinavia at SEK 4.21 billion, followed by Eastern Europe with SEK 1.92 billion, Western Europe at SEK 1.54 billion, and E-Commerce contributing SEK 1.04 billion.

Dividend Yield: 4.5%

Inwido's recent AGM confirmed a dividend of SEK 6.50 per share, with payment starting May 23, 2024. Despite its top-tier yield at 4.51%, Inwido's dividend history is marked by volatility and unreliability over the past nine years. The company’s dividends are reasonably covered by both earnings and cash flows, with payout ratios of 63.9% and 62.8% respectively, suggesting potential sustainability issues given its unstable track record in maintaining consistent dividend growth.

Click to explore a detailed breakdown of our findings in Inwido's dividend report.

Upon reviewing our latest valuation report, Inwido's share price might be too pessimistic.

Zinzino

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zinzino AB, a direct sales company based in Sweden, operates internationally offering dietary supplements and skincare products with a market capitalization of approximately SEK 2.62 billion.

Operations: Zinzino AB generates its revenue primarily through two segments: Faun, which contributed SEK 161.20 million, and Zinzino (including VMA Life), which added SEK 1737.25 million.

Dividend Yield: 3.9%

Zinzino's recent financial performance shows robust growth, with a significant revenue increase to SEK 802.2 million in the first five months of 2024, up 21% year-over-year. Despite its dividend yield of 3.93% being slightly below the top Swedish payers, Zinzino maintains a stable dividend history over the past decade and reasonable coverage through earnings and cash flows, with both payout ratios around 59%. This suggests a sustainable dividend policy even though it's not among the highest yields in Sweden.

Summing It All Up

Investigate our full lineup of 22 Top Dividend Stocks right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BETS B OM:INWI and OM:ZZ B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance