Exploring Top TSX Dividend Stocks In June 2024

As the Canadian market experiences a phase of stabilization and potential recovery, amidst broader global economic shifts and central bank policy adjustments, investors are keenly observing how these dynamics influence various investment opportunities. In this context, dividend stocks on the TSX stand out as potentially appealing options for those looking to navigate through these changing tides with a focus on steady income generation.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.53% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.28% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.38% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.38% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.36% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.92% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.36% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.33% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.34% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 9.20% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bank of Nova Scotia

Simply Wall St Dividend Rating: ★★★★★★

Overview: The Bank of Nova Scotia, operating globally, offers a diverse range of banking products and services across regions including Canada, the U.S., Latin America, and the Caribbean, with a market capitalization of CA$78.35 billion.

Operations: The Bank of Nova Scotia's revenue is primarily derived from Canadian Banking (CA$11.46 billion), International Banking (CA$9.60 billion), Global Wealth Management (CA$5.43 billion), and Global Banking and Markets (CA$5.35 billion).

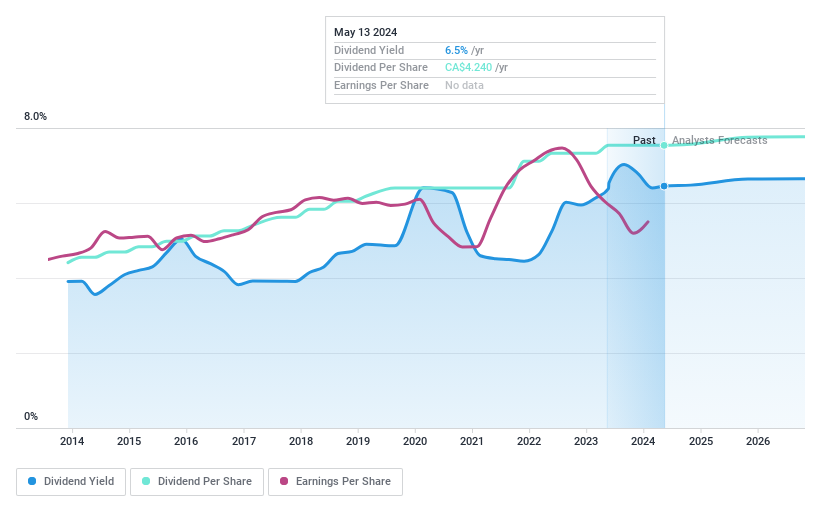

Dividend Yield: 6.5%

Bank of Nova Scotia's dividend yield is among the top 25% in the Canadian market at 6.53%. While its dividends have shown growth over the past decade, recent financials indicate a slight dip in net income from CAD 2,122 million to CAD 2,066 million as of Q2 2024. However, earnings are projected to grow by approximately 6.48% annually. The bank maintains a reasonable payout ratio of 69.7%, supporting sustainable dividend payments with current and forecasted earnings coverage ratios well within manageable limits for the foreseeable future.

Delve into the full analysis dividend report here for a deeper understanding of Bank of Nova Scotia.

High Liner Foods

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: High Liner Foods Incorporated, a company specializing in the processing and marketing of frozen seafood products across North America, has a market capitalization of approximately CA$403.79 million.

Operations: High Liner Foods generates CA$1.03 billion from its manufacturing and marketing of prepared and packaged frozen seafood.

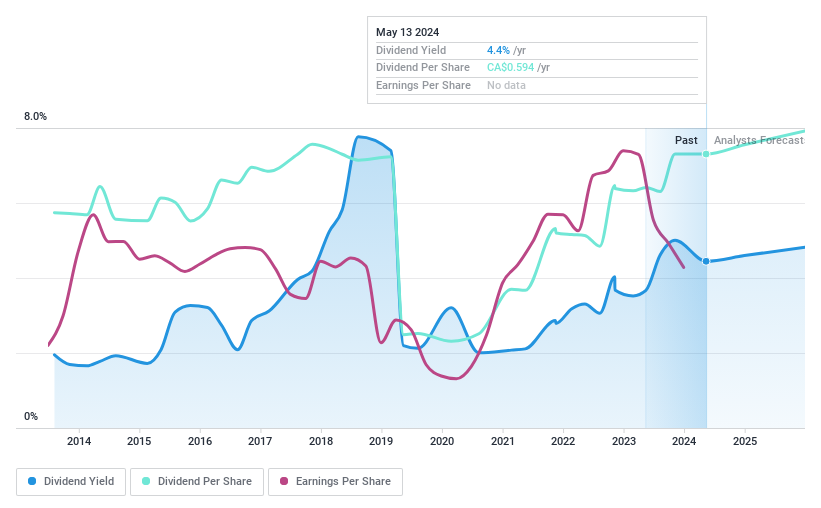

Dividend Yield: 4.5%

High Liner Foods recently announced a share repurchase program and appointed Darryl Bergman as CFO, signaling potential strategic financial management shifts. Despite a 13% drop in Q1 sales volume and lower profit margins year-over-year, the company maintains a dividend of CAD 0.15 per share. The dividends, with a low payout ratio of 41.5% and an even lower cash payout ratio of 8%, appear sustainable despite historically unstable payments and modest yield compared to top Canadian dividend stocks.

Unlock comprehensive insights into our analysis of High Liner Foods stock in this dividend report.

Upon reviewing our latest valuation report, High Liner Foods' share price might be too pessimistic.

K-Bro Linen

Simply Wall St Dividend Rating: ★★★★★☆

Overview: K-Bro Linen Inc. operates in Canada and the United Kingdom, offering laundry and linen services primarily to healthcare institutions and hotels, with a market capitalization of approximately CA$342.66 million.

Operations: K-Bro Linen Inc. generates CA$330.33 million in revenue from its laundry and linen services provided to the healthcare and hospitality sectors.

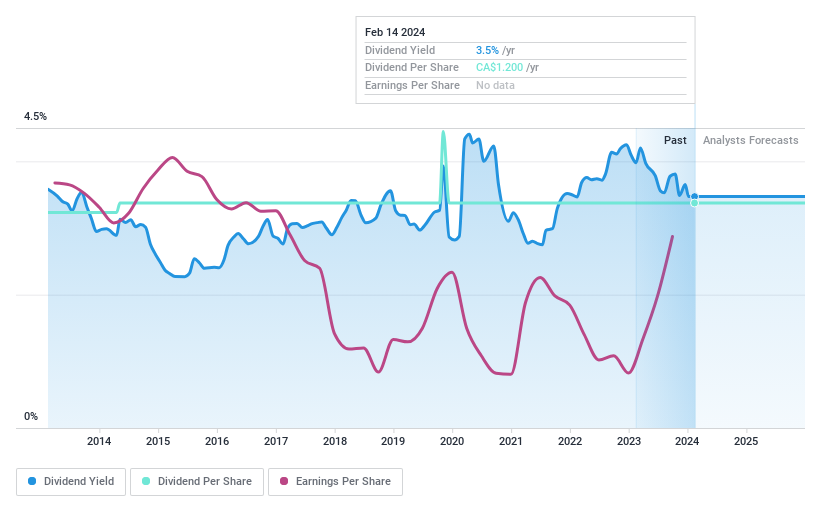

Dividend Yield: 3.7%

K-Bro Linen has initiated a share repurchase program, planning to buy back 7.17% of its shares by May 2025, signaling confidence in its financial health. Despite a slight dip in Q1 2024 earnings with net income at CAD 1.81 million down from CAD 2 million year-over-year, the company maintains consistent dividend payments, recently declaring CAD 0.10 per share for May. However, with a dividend yield of 3.69%, it falls below the top quartile of Canadian dividend payers at 6.42%.

Turning Ideas Into Actions

Dive into all 31 of the Top TSX Dividend Stocks we have identified here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:BNS TSX:HLFTSX:KBL

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance