Exploring Undervalued Small Caps With Insider Buying In The United States June 2024

In recent times, the United States stock market has shown remarkable resilience, maintaining a steady position over the last week and achieving a 23% increase over the past year with earnings expected to grow by 15% annually. In this context, undervalued small caps with insider buying present an intriguing opportunity for investors seeking potential growth in a flourishing market environment.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Columbus McKinnon | 21.3x | 1.0x | 42.58% | ★★★★★★ |

Ramaco Resources | 11.4x | 0.9x | 27.12% | ★★★★★★ |

PCB Bancorp | 8.5x | 2.3x | 46.93% | ★★★★★☆ |

AtriCure | NA | 2.7x | 42.50% | ★★★★★☆ |

Hanover Bancorp | 8.5x | 1.9x | 49.11% | ★★★★☆☆ |

Franklin Financial Services | 9.0x | 1.8x | 38.79% | ★★★★☆☆ |

Papa John's International | 20.9x | 0.7x | 30.43% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Delek US Holdings | NA | 0.1x | -151.77% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -155.91% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

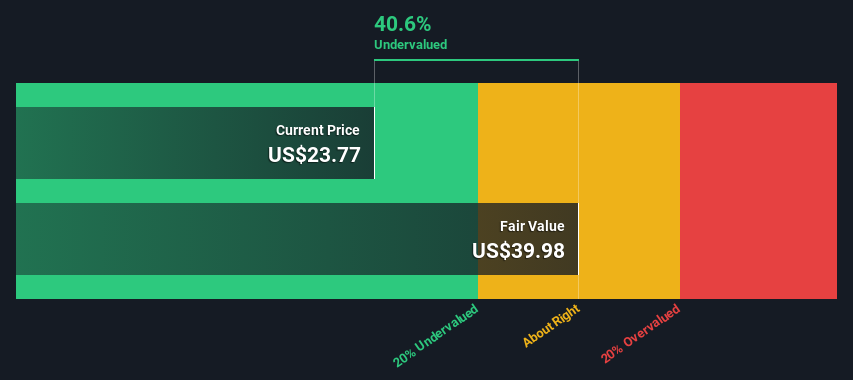

AtriCure

Simply Wall St Value Rating: ★★★★★☆

Overview: AtriCure is a medical device company specializing in surgical and medical equipment, with a market capitalization of approximately $2.76 billion.

Operations: Surgical & Medical Equipment generated $414.60 million in revenue, with a gross profit margin of 75.26%. Operating expenses totaled $348.26 million for the same period.

PE: -29.9x

AtriCure, despite its current unprofitability with a net loss of US$13.27 million in Q1 2024, shows promising growth prospects with projected annual revenues increasing to between US$459 million and US$466 million. This reflects an anticipated growth of up to 17% from the previous year. Recently, they have launched the cryoSPHERE+ device, enhancing their product line with technology that reduces operative times by 25%. This innovation underscores their commitment to advancing medical technology and improving patient outcomes in pain management, which is increasingly adopted by physicians nationwide.

Click here to discover the nuances of AtriCure with our detailed analytical valuation report.

Gain insights into AtriCure's historical performance by reviewing our past performance report.

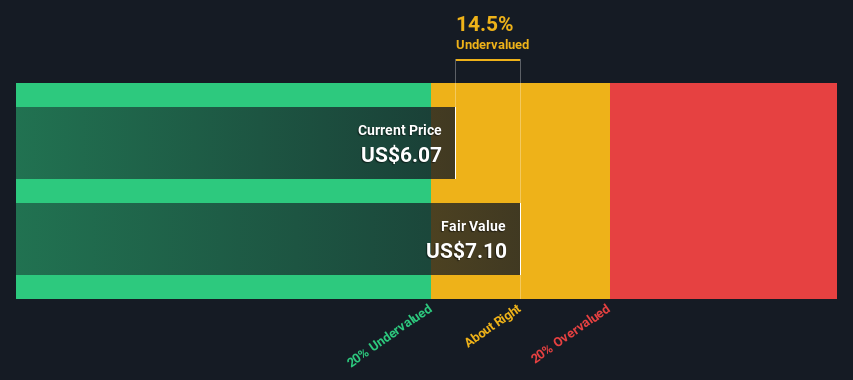

Delek US Holdings

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Delek US Holdings is a diversified energy company primarily engaged in petroleum refining, with additional operations in retail fuel and logistics, boasting a market capitalization of approximately $1.22 billion.

Operations: The company generates a substantial portion of its revenue from refining, amounting to $15.72 billion, complemented by retail and logistics segments which contribute $871.2 million and $1.03 billion respectively. Over the observed periods, gross profit margin showed variability but significant figures were noted in certain quarters like 0.13% in March 2019, indicating the profitability before accounting for operating expenses and other costs.

PE: -20.5x

Delek US Holdings has recently navigated a challenging quarter, with sales dropping to US$3.23 billion and transitioning from a net profit last year to a current net loss of US$32.6 million. Despite these hurdles, the company's commitment to shareholder returns remains evident through a slight dividend increase. Insider confidence is underscored by recent share purchases, suggesting belief in long-term value despite short-term volatility. Looking ahead, earnings are expected to surge by nearly 99% annually, painting an optimistic future for this entity within its sector.

Granite Ridge Resources

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Granite Ridge Resources is a company engaged in the development, exploration, and production of oil and natural gas.

Operations: The company's gross profit margin showed a notable increase from 74.03% in 2020 to a peak of approximately 90.27% by mid-2022, before slightly declining to around 82.08% by mid-2024. During this period, revenue grew significantly from $81.10 million in 2020 to $491.24 million in late 2022, then stabilized at around $367.66 million by mid-2024, reflecting fluctuations in its core operations of oil and natural gas development, exploration, and production.

PE: 13.2x

Granite Ridge Resources, a lesser-known yet promising player in the energy sector, recently declared a steady quarterly dividend alongside providing stable production guidance for 2024, reflecting management's confidence in operational stability. Despite a dip in profit margins from last year and some asset impairments, insider confidence is evident as they have recently purchased shares, signaling belief in the company’s growth trajectory. Their participation at key industry conferences further underscores their active engagement and strategic positioning within the market.

Explore historical data to track Granite Ridge Resources' performance over time in our Past section.

Make It Happen

Navigate through the entire inventory of 60 Undervalued Small Caps With Insider Buying here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGM:ATRC NYSE:DK and NYSE:GRNT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance