Exploring Undervalued Small Caps With Insider Buying In Canada July 2024

As central banks like the Bank of Canada initiate rate cuts amid softening economic indicators, investors may find opportunities in sectors less tied to broad market swings, such as undervalued small-cap stocks. These stocks often present unique growth potential, especially when insider buying suggests confidence in the company's future prospects amidst current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Canada

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Nexus Industrial REIT | 2.4x | 3.0x | 20.79% | ★★★★★★ |

Dundee Precious Metals | 8.9x | 3.1x | 42.18% | ★★★★★★ |

Calfrac Well Services | 2.3x | 0.2x | 28.96% | ★★★★★☆ |

Primaris Real Estate Investment Trust | 11.3x | 2.9x | 36.12% | ★★★★★☆ |

Guardian Capital Group | 10.6x | 4.1x | 31.22% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -93.68% | ★★★★☆☆ |

Trican Well Service | 8.2x | 1.0x | -14.89% | ★★★☆☆☆ |

Westshore Terminals Investment | 14.2x | 3.8x | 1.98% | ★★★☆☆☆ |

Russel Metals | 8.6x | 0.5x | -0.65% | ★★★☆☆☆ |

Freehold Royalties | 15.3x | 6.6x | 49.03% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

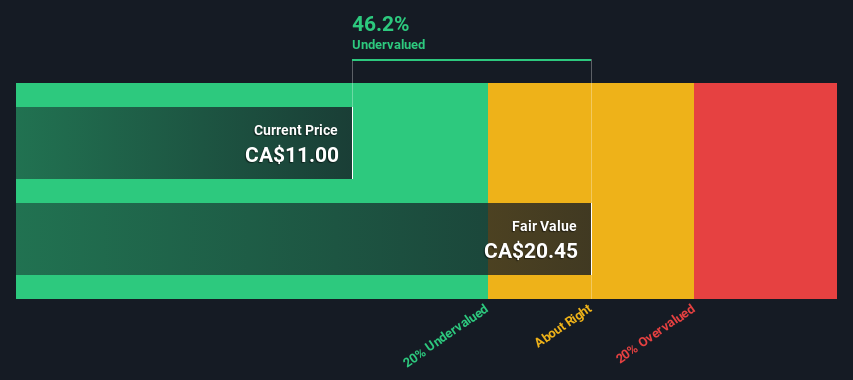

Black Diamond Group

Simply Wall St Value Rating: ★★★☆☆☆

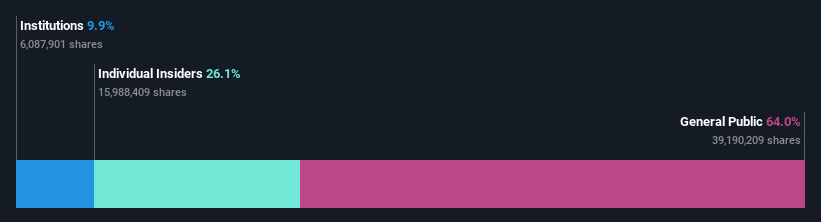

Overview: Black Diamond Group specializes in providing workforce accommodation and modular space solutions, with a market capitalization of approximately CA$195 million.

Operations: The company generates its revenue through two primary segments: Workforce Solutions and Modular Space Solutions, contributing CA$187.95 million and CA$197.70 million respectively. It has experienced a net income margin of 0.071% as of the latest reporting period, with a gross profit margin consistently around 44.83%.

PE: 18.9x

Recently, Black Diamond Group expanded its asset footprint by acquiring 329 modular space units for CA$20.45 million, enhancing its position in Western Canada's robust construction and infrastructure sectors. This strategic move coincides with a new partnership with Gitxaala Enterprises, signaling strong local collaboration and market confidence. Despite a high debt level, the company remains optimistic about its future prospects, underpinned by CA$137.1 million in contracted rental revenues and a modest increase in capital expenditures year-over-year. Insider confidence is evident as they recently announced a substantial share repurchase program targeting up to 7.33% of issued shares, reflecting a positive outlook from within the company itself.

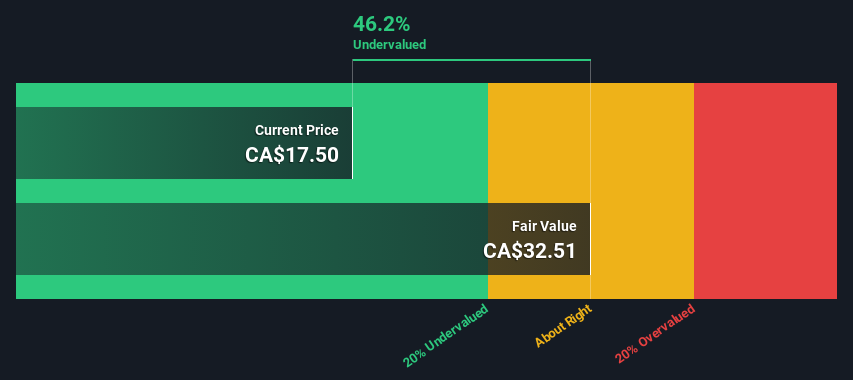

Dundee Precious Metals

Simply Wall St Value Rating: ★★★★★★

Overview: Dundee Precious Metals is a Canadian-based international gold mining company with operations at Ada Tepe in Bulgaria and Chelopech, and a market capitalization of approximately $1.10 billion.

Operations: Ada Tepe and Chelopech generated revenues of $243.33 million and $274.18 million respectively, contributing to a gross profit margin that has shown significant variability over the years, with recent figures reaching as high as 53.34%.

PE: 8.9x

Dundee Precious Metals, recently enhancing its executive team and reaffirming robust production guidance, demonstrates a compelling narrative of growth and operational efficiency. With insiders showing confidence through recent share purchases, the company underscores a strong belief in its value proposition. This aligns with their strategic advancements in projects like Coka Rakita in Serbia, expected to bolster their production profile significantly. Their financial health is further evidenced by consistent dividend payments, reinforcing their position as a promising entity within the Canadian mining sector.

Softchoice

Simply Wall St Value Rating: ★★★★☆☆

Overview: Softchoice is a technology company specializing in IT solutions and services, with a market capitalization of approximately $1.11 billion.

Operations: Direct Marketing generated revenue of $777.35 million, with a gross profit margin that increased from 23.91% in 2018 to 41.82% by mid-2024, reflecting significant efficiency improvements in cost management relative to sales over this period.

PE: 20.2x

Softchoice, navigating through a challenging quarter with a sales drop to US$169.76 million and a shift to a net loss of US$1.03 million, still signals potential resilience by maintaining its dividend at CA$0.13, reflecting an 18% increase year-over-year. Notably, insider confidence is evident as they recently purchased shares, underscoring belief in the company's recovery trajectory despite current financial headwinds and high debt levels. With earnings expected to grow by 17.66% annually, Softchoice remains an intriguing prospect within the Canadian tech sector for those eyeing overlooked opportunities.

Get an in-depth perspective on Softchoice's performance by reading our valuation report here.

Examine Softchoice's past performance report to understand how it has performed in the past.

Next Steps

Click this link to deep-dive into the 34 companies within our Undervalued TSX Small Caps With Insider Buying screener.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:BDI TSX:DPM and TSX:SFTC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance