Exploring Undervalued Small Caps With Insider Actions In Australia June 2024

In recent times, the Australian market has shown a steady increase, rising 8.9% over the past year despite remaining flat in the last week. Given these conditions and with earnings expected to grow by 14% annually in the near future, undervalued small caps with insider buying actions can present intriguing opportunities for investors looking to potentially benefit from market inefficiencies.

Top 10 Undervalued Small Caps With Insider Buying In Australia

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Corporate Travel Management | 17.6x | 2.7x | 40.28% | ★★★★★★ |

Tabcorp Holdings | NA | 0.7x | 21.97% | ★★★★★★ |

Nick Scali | 14.1x | 2.6x | 42.09% | ★★★★★☆ |

Amotiv | 13.8x | 1.4x | 8.34% | ★★★★★☆ |

Codan | 28.6x | 4.2x | 22.17% | ★★★★☆☆ |

Eagers Automotive | 9.7x | 0.3x | 29.23% | ★★★★☆☆ |

Elders | 20.6x | 0.4x | 46.36% | ★★★★☆☆ |

Tasmea | 13.6x | 0.9x | 16.72% | ★★★☆☆☆ |

Dicker Data | 21.6x | 0.8x | -1.63% | ★★★☆☆☆ |

Coventry Group | 278.9x | 0.4x | -26.16% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Codan

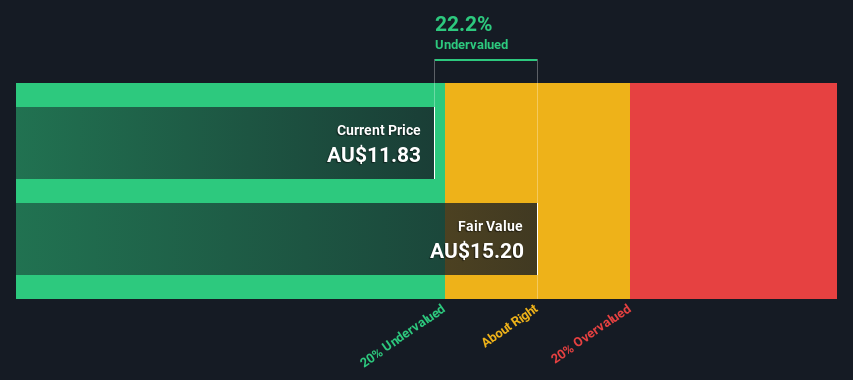

Simply Wall St Value Rating: ★★★★☆☆

Overview: Codan is a diversified technology company specializing in communications equipment and metal detection, with a market capitalization of approximately A$1.02 billion.

Operations: The company generates its revenue primarily from communications and metal detection, with respective contributions of A$291.50 million and A$212.20 million. Its gross profit margin has shown a trend, averaging approximately 0.56% over recent periods, indicating the cost-effectiveness of its operations relative to sales.

PE: 28.6x

Recently, Codan has demonstrated insider confidence with significant share purchases, underscoring a belief in the company's potential. With earnings expected to grow by 16% annually, this reflects not just resilience but an optimistic outlook despite its reliance on external borrowing for funding. This strategic financial posture might raise eyebrows due to higher risk; however, it also suggests a proactive approach to leveraging opportunities within their market sector. These elements collectively suggest that Codan remains undervalued amidst its peers, presenting a noteworthy opportunity for discerning investors looking toward future growth prospects in the Australian market.

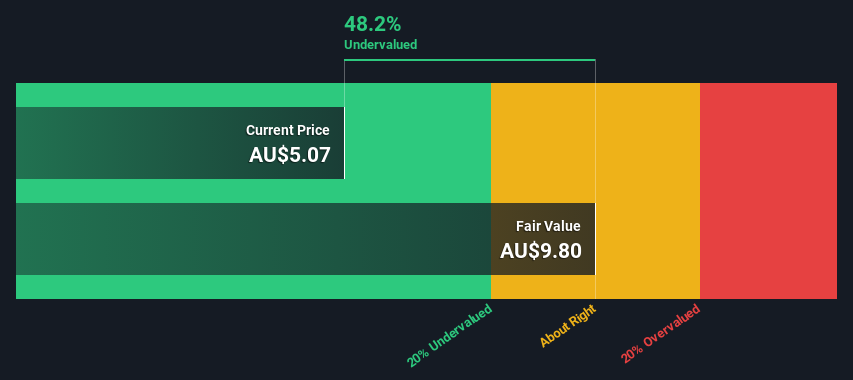

Clarity Pharmaceuticals

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Clarity Pharmaceuticals is a company focused on the development of radiopharmaceuticals.

Operations: Radiopharmaceutical Development generated A$9.49 million in revenue, with a consistent gross profit margin of 100%. The net income margin has deteriorated over recent periods, reaching -3.22% by the end of 2024.

PE: -51.7x

Clarity Pharmaceuticals, an Australian entity, recently bolstered its financial position through a series of follow-on equity offerings totaling A$121 million. These strategic moves, including presentations at major international medical conferences, underscore its proactive approach in the biopharmaceutical sector. Despite current unprofitability with no immediate turnaround projected, insider confidence is reflected by recent share purchases. This activity suggests a belief in long-term potential among those closest to the company's operations and strategy.

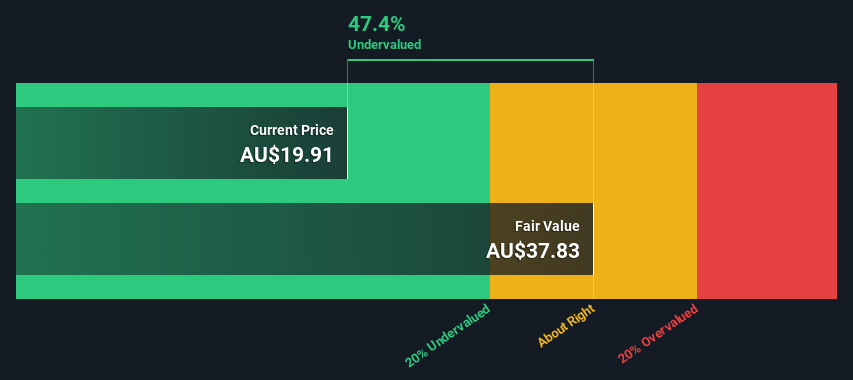

Neuren Pharmaceuticals

Simply Wall St Value Rating: ★★★★★★

Overview: Neuren Pharmaceuticals is a company focused on developing pharmaceutical products, with a market capitalization of approximately A$231.94 million.

Operations: Pharmaceutical Products generate annual revenue of A$231.94 million, with a gross profit margin of 88.47%. Operating expenses for the year total A$5.95 million.

PE: 16.8x

Neuren Pharmaceuticals recently spotlighted its innovative potential at multiple industry conferences, underscoring its leadership in developing treatments for rare neurological disorders. Their latest Phase 2 trial results showcased significant improvements in children with Pitt Hopkins syndrome, a market with no approved treatments, highlighting their niche expertise. With revenue projected to grow annually by 10.53%, and insider confidence demonstrated through recent share purchases, Neuren's strategic position within the biotech sector appears increasingly compelling.

Taking Advantage

Click through to start exploring the rest of the 25 Undervalued ASX Small Caps With Insider Buying now.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CDA ASX:CU6 and ASX:NEU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance