Exploring Undervalued Small Caps With Insider Action In Hong Kong June 2024

In recent trading sessions, the Hong Kong market has shown resilience, with the Hang Seng Index gaining modestly amid mixed economic signals from China. This backdrop sets an intriguing stage for investors to explore undervalued small-cap stocks, particularly those with recent insider buying activity, which can be a positive signal about a stock's future prospects in current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Wasion Holdings | 11.4x | 0.8x | 29.31% | ★★★★★☆ |

Xtep International Holdings | 11.1x | 0.8x | 41.21% | ★★★★★☆ |

Far East Consortium International | NA | 0.3x | 40.18% | ★★★★★☆ |

Sany Heavy Equipment International Holdings | 7.9x | 0.7x | -22.07% | ★★★★☆☆ |

Nissin Foods | 14.4x | 1.3x | 38.69% | ★★★★☆☆ |

China Leon Inspection Holding | 10.5x | 0.8x | 22.84% | ★★★★☆☆ |

China Overseas Grand Oceans Group | 2.9x | 0.1x | -3.79% | ★★★★☆☆ |

China Lesso Group Holdings | 4.0x | 0.3x | 8.51% | ★★★★☆☆ |

Transport International Holdings | 11.0x | 0.6x | 45.79% | ★★★★☆☆ |

Giordano International | 8.6x | 0.8x | 36.59% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

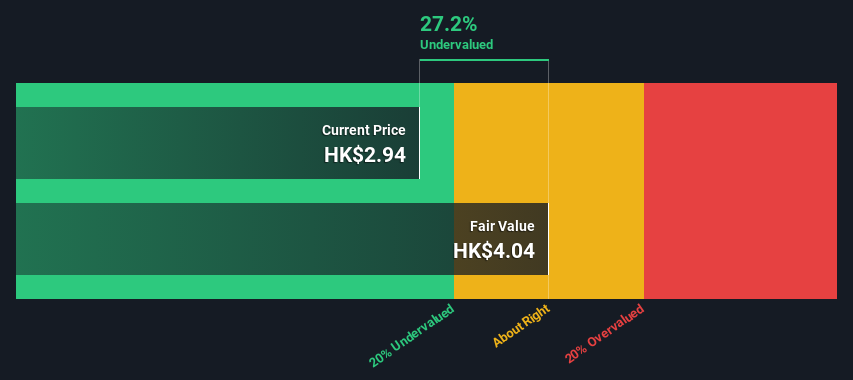

iDreamSky Technology Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: iDreamSky Technology Holdings is a company primarily engaged in the provision of game and information services, including SaaS and other related services.

Operations: Game and Information Services, including SaaS and related services, generated CN¥1.92 billion in revenue. The gross profit margin stood at 35.14%, reflecting the cost of goods sold at CN¥1.24 billion and gross profit at CN¥673.46 million for the latest reported period ending December 31, 2023.

PE: -9.4x

iDreamSky Technology Holdings Limited, with its notable rebound in financial health, reported a significant reduction in net loss to CNY 556.35 million for the year ending December 2024 from CNY 2.49 billion the previous year. This improvement is underscored by a robust forecast of earnings growth at an annual rate of 104%. Despite challenges from high-risk funding sources—entirely from external borrowing—the company has not diluted shareholders over the past year, maintaining stability in share value. Recently purchased shares by insiders signal confidence in the firm’s trajectory, aligning with its promising prospects amid Hong Kong's undervalued entities.

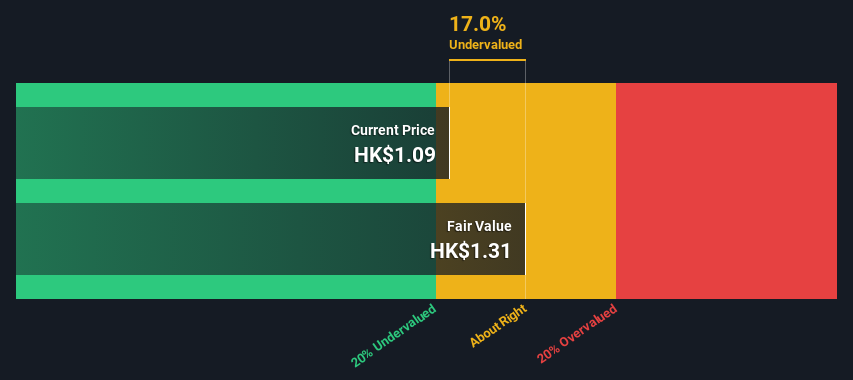

Kinetic Development Group

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kinetic Development Group is a company involved in various business operations, with a market capitalization of approximately CN¥1.27 billion.

Operations: The company's gross profit margin has shown a notable increase, rising from 9.66% in June 2013 to 59.07% by June 2024, reflecting improved efficiency or pricing power over the period. This growth trend is supported by revenues that escalated significantly from CN¥79.13 million in June 2013 to CN¥4745.07 million by June 2024, indicating substantial expansion in its business scale and operational scope.

PE: 4.1x

Kinetic Development Group, a lesser-known entity in Hong Kong's vibrant market, recently showcased its financial prudence by declaring a modest final dividend of HK$0.05 and a special dividend of HK$0.03 per share, reflecting a strategic distribution despite the broader economic context. With amendments to its corporate governance structures approved at the latest AGM, the firm signals robust internal confidence and adaptability. Notably, insider confidence was evident as insiders recently purchased shares, underscoring their belief in the company’s potential despite external funding risks highlighted by 100% reliance on higher-risk external borrowings. This combination of financial actions and insider activity suggests Kinetic is poised for thoughtful growth in challenging markets.

Dive into the specifics of Kinetic Development Group here with our thorough valuation report.

Gain insights into Kinetic Development Group's past trends and performance with our Past report.

Abbisko Cayman

Simply Wall St Value Rating: ★★★★☆☆

Overview: Abbisko Cayman is a company focused on the development of innovative medicines, with a market capitalization of approximately CN¥19.06 million.

Operations: The company's gross profit margin has consistently been 1.0%, reflecting full conversion of revenue to gross profit due to the absence of reported COGS. However, significant operating expenses, primarily from R&D which reached CN¥433.74 million in the most recent period, have led to consistent net losses, with the latest being CN¥431.58 million.

PE: -4.6x

Abbisko Cayman, a company with a focus on innovative pharmaceuticals, recently authorized a significant share repurchase on June 18, 2024, reflecting strong insider confidence and commitment to enhancing shareholder value. Despite facing revenue challenges with CN¥19M and projected earnings decline over the next three years, the firm is poised for substantial revenue growth at an annual rate of 38.51%. This growth potential is underscored by their recent Orphan Drug Designation from the FDA for their novel drug irpagratinib, aimed at treating Hepatocellular Carcinoma—a market with urgent unmet needs.

Click to explore a detailed breakdown of our findings in Abbisko Cayman's valuation report.

Evaluate Abbisko Cayman's historical performance by accessing our past performance report.

Make It Happen

Gain an insight into the universe of 21 Undervalued Small Caps With Insider Buying by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1119 SEHK:1277 and SEHK:2256.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance