Exploring Undervalued Stocks on the SIX Swiss Exchange in July 2024

The Switzerland market recently showed resilience, closing modestly higher as investors displayed sustained interest in buying, pushing the benchmark SMI to a gain of 45.52 points or 0.38% at 12,051.66. In light of these conditions, identifying undervalued stocks on the SIX Swiss Exchange could offer interesting opportunities for investors seeking value in a market that demonstrates potential for recovery and growth.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

Name | Current Price | Fair Value (Est) | Discount (Est) |

Sulzer (SWX:SUN) | CHF136.40 | CHF222.79 | 38.8% |

COLTENE Holding (SWX:CLTN) | CHF48.90 | CHF77.66 | 37% |

Burckhardt Compression Holding (SWX:BCHN) | CHF606.00 | CHF860.67 | 29.6% |

Temenos (SWX:TEMN) | CHF64.00 | CHF85.03 | 24.7% |

Julius Bär Gruppe (SWX:BAER) | CHF51.16 | CHF95.72 | 46.6% |

Sonova Holding (SWX:SOON) | CHF274.20 | CHF468.57 | 41.5% |

SGS (SWX:SGSN) | CHF80.86 | CHF125.37 | 35.5% |

Comet Holding (SWX:COTN) | CHF376.00 | CHF590.35 | 36.3% |

Medartis Holding (SWX:MED) | CHF69.30 | CHF131.32 | 47.2% |

Sika (SWX:SIKA) | CHF258.60 | CHF335.75 | 23% |

We're going to check out a few of the best picks from our screener tool

Barry Callebaut

Overview: Barry Callebaut AG operates in the production and sale of chocolate and cocoa products, with a market capitalization of approximately CHF 8.45 billion.

Operations: The company's revenue is divided into segments, with the Global Cocoa segment generating CHF 5.31 billion.

Estimated Discount To Fair Value: 15.5%

Barry Callebaut, trading at CHF 1544, is positioned below our fair value estimate of CHF 1827.66, marking a modest undervaluation. Despite this, the company's debt is poorly covered by operating cash flow and it has experienced significant share price volatility recently. On a positive note, earnings are projected to grow by 25.2% annually over the next three years, outpacing the Swiss market's growth. However, its return on equity is expected to be low at 14.7% in three years' time.

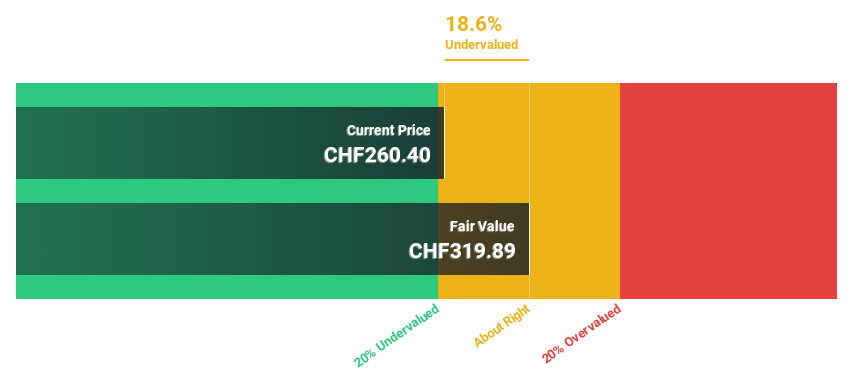

Sika

Overview: Sika AG is a specialty chemicals company that offers solutions for bonding, sealing, damping, reinforcing, and protecting in the building and automotive industries globally, with a market capitalization of CHF 41.49 billion.

Operations: The company generates CHF 9.45 billion from its construction industry products and CHF 1.78 billion from industrial manufacturing products.

Estimated Discount To Fair Value: 23%

Sika, priced at CHF 258.6, is valued below our fair value estimate of CHF 335.75, indicating a significant undervaluation based on discounted cash flows. Despite a high level of debt, Sika's return on equity is expected to be robust at 20.3% in three years. Earnings are forecasted to grow by 12.7% annually, surpassing the Swiss market's average. Recent expansions in China and Peru underscore its strategic growth initiatives, enhancing its manufacturing capabilities and market reach.

Our growth report here indicates Sika may be poised for an improving outlook.

Unlock comprehensive insights into our analysis of Sika stock in this financial health report.

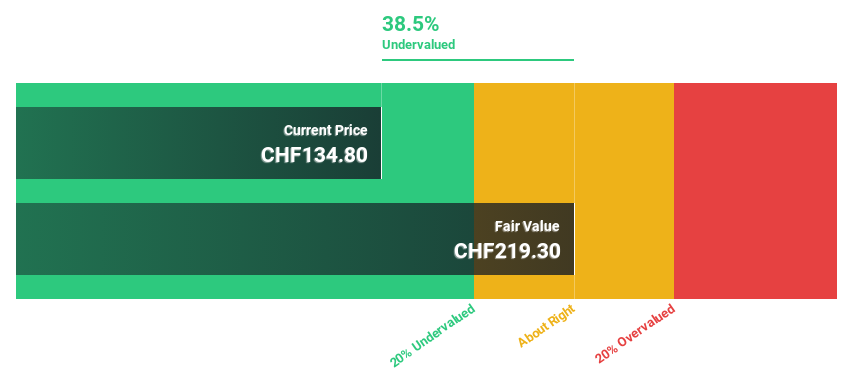

Sulzer

Overview: Sulzer Ltd is a global company specializing in fluid engineering and chemical processing solutions, with a market capitalization of CHF 4.61 billion.

Operations: The company's revenue is divided into three main segments: Chemtech at CHF 772.50 million, Services at CHF 1.15 billion, and Flow Equipment at CHF 1.35 billion.

Estimated Discount To Fair Value: 38.8%

Sulzer, with a current price of CHF136.4, is trading at a substantial discount to our fair value estimate of CHF222.79, highlighting its undervaluation based on cash flows. Despite an unstable dividend history, Sulzer's earnings have surged by 701% over the past year and are projected to outpace the Swiss market with an annual growth rate of 9.7%. Recent presentations in Zambia and Germany emphasize its active engagement in industry events, potentially boosting investor confidence.

Make It Happen

Unlock our comprehensive list of 14 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BARN SWX:SIKA and SWX:SUN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance