FDA Expands AstraZeneca's (AZN) Farxiga Label in Pediatric T2D

AstraZeneca AZN announced that the FDA granted label expansion to its blockbuster drug Farxiga (dapagliflozin) to treat pediatric patients aged 10 years and older with type-2 diabetes (T2D).

Farxiga is now approved as an adjunct to diet and exercise to improve glycemic control in individuals aged 10 years and older with T2D. Prior to this label expansion, the drug was approved for improving glycemic control in adults with T2D.

This latest approval is based on data from the phase III T2NOW study that evaluated the efficacy and safety of Farxiga as an add-on treatment in children and adolescents with T2D. The study achieved its primary endpoint — treatment with Farxiga achieved a significant reduction in A1C (a marker of average blood sugar) after 26 weeks of treatment when compared to the placebo.

An oral SGLT2 inhibitor, Farxiga is already approved by the FDA for heart failure (HF) and chronic kidney disease (CKD) indications in adults.

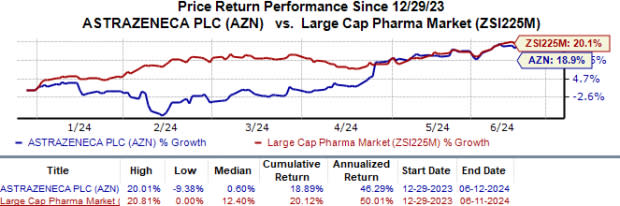

AstraZeneca’s shares have risen 18.9% year to date compared with the industry’s 20.1% growth.

Image Source: Zacks Investment Research

Such label expansions are likely to help boost AstraZeneca’s top line, which has been experiencing higher product sales across all its therapeutic areas, driven by strong demand growth and market share. Management estimates that around 30,000 patients aged under 20 years are living with T2D in the United States, with 5,300 new cases diagnosed each year.

AstraZeneca generated $1.89 billion from Farxiga sales in the first quarter of 2024, up 45% year over year, reflecting accelerated volume growth compared with the overall SGLT2 inhibitor class in general.

Farxiga is also being evaluated in other label expansion studies. Late-stage studies are ongoing on Farxiga for myocardial infarction. AstraZeneca is also conducting a fixed-dose combination study of an experimental anti-cancer drug (zibotentan) with Farxiga in patients with CKD and high proteinuria.

Farxiga faces stiff competition from Jardiance, another blockbuster oral SGLT2 inhibitor, which is marketed by pharma giant Eli Lilly LLY. The Lilly drug, which poses a major threat to Farxiga, is already approved in the United States to improve glycemic control in individuals aged 10 years and older with T2D. Apart from T2D, Lilly’s Jardiance is also approved to treat HF and CKD indications.

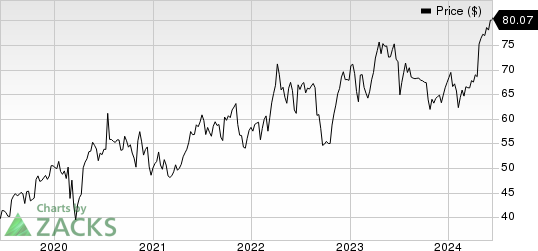

AstraZeneca PLC Price

AstraZeneca PLC price | AstraZeneca PLC Quote

Zacks Rank & Key Picks

AstraZeneca currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector are Arcutis Biotherapeutics ARQT and Heron Therapeutics HRTX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Arcutis Biotherapeutics’ 2024 loss per share have narrowed from $2.49 to $1.60. During the same period, the loss estimates per share for 2025 have narrowed from $1.77 to $1.14. Year to date, shares of Arcutis have surged 150.8%.

Earnings of Arcutis Biotherapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. Arcutis delivered a four-quarter average earnings surprise of 14.93%.

In the past 60 days, estimates for Heron Therapeutics’ 2024 loss per share have narrowed from 22 cents to 10 cents. During the same period, estimates for 2025 have improved from a loss of 9 cents to earnings of 1 cent. Year to date, HRTX’s shares have appreciated 115.3%.

Earnings of Heron Therapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. HRTX delivered a four-quarter average earnings surprise of 30.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Heron Therapeutics, Inc. (HRTX) : Free Stock Analysis Report

Arcutis Biotherapeutics, Inc. (ARQT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance