Fed’s Favored Inflation Gauge Slows, Supporting Case for Cut

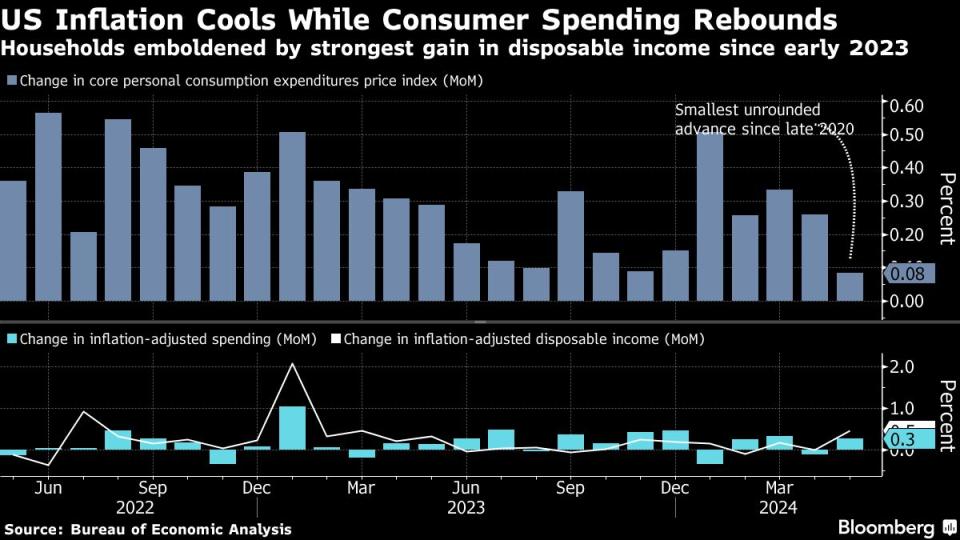

(Bloomberg) -- The Federal Reserve’s preferred measure of underlying US inflation decelerated in May, bolstering the case for lower interest rates later this year.

Most Read from Bloomberg

Supreme Court Overturns Chevron Rule in Blow to Agency Power

‘I Was Afraid of This’: Biden Debate Debacle Rocks US Allies

At the same time, household spending rebounded after a pullback in April, and incomes showed solid growth, offering some hope that price pressures can be tamed without lasting damage to consumers.

The so-called core personal consumption expenditures price index, which strips out volatile food and energy items, increased 0.1% from the prior month, according to Bureau of Economic Analysis data out Friday. That marked the smallest advance in six months. On a two-decimal basis, it was up just 0.08%, the least since late 2020.

Inflation-adjusted consumer spending growth was driven by goods and fueled in part by the jump in incomes. The combination of slower price increases and robust spending offers some relief for Fed officials after an array of reports earlier this week pointed to a loss of economic momentum.

“The economy is moving in the right direction, with persistent growth, moderating inflation, and a more normal balance in the job market,” Bill Adams, chief economist at Comerica Bank, said in a note. “This is the kind of good data that will persuade the Fed that inflation is heading back to normal.”

Treasury yields fell after the report as investors priced in a greater chance of rate cuts, while stocks opened higher.

Worse-than-expected inflation data in the first quarter prompted Fed officials to dial back their projections for rate cuts this year. While they will want to see more reports like this one before starting to lower borrowing costs, Friday’s report gives them some hope that inflation is moving toward the right direction.

“The deflation in goods prices and weakness we are starting to see at least gets us a path to a possible September cut,” said KPMG Chief Economist Diane Swonk.

Central bankers pay close attention to services inflation excluding housing and energy, which tends to be more sticky. That metric increased 0.1% in May from the prior month, according to the BEA, the least since October.

Household demand has so far remained resilient even as borrowing costs have taken a toll on some sectors of the economy. The report showed inflation-adjusted outlays for services rose 0.1%, driven by airfares and health care. Spending on merchandise advanced 0.6%, led by computer software and vehicles.

Despite some signs of cooling in the labor market, solid wage growth continues to power consumer spending. Wages and salaries rose 0.7%. On an inflation-adjusted basis, real disposable income jumped 0.5%, the most since January 2023, after a flat reading in April.

What Bloomberg Economics Says...

“Monthly headline and core PCE inflation for May registered their lowest levels yet this year, largely due to declining gasoline prices and a drag from durable goods. We’re skeptical that the disinflation process will prove persistent, however, with slow-moving and sticky core services categories likely to buoy inflation in the second half of the year.”

— Stuart Paul, Eliza Winger and Estelle Ou, economists

For the full note, click here

The saving rate rose to 3.9%, the highest level since the start of the year. Separate data published Friday by the University of Michigan showed consumer sentiment edged lower in June, while inflation expectations moderated.

A monthly government report on employment, due July 5, will offer the latest insight on how income growth is holding up.

--With assistance from Kristy Scheuble, Vince Golle and Steve Matthews.

(Updates with consumer sentiment data in penultimate paragraph.)

Most Read from Bloomberg Businessweek

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

The FBI’s Star Cooperator May Have Been Running New Scams All Along

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

How Glossier Turned a Viral Moment for ‘You’ Perfume Into a Lasting Business

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance