FedEx (FDX) Q1 Earnings Miss Estimates, Revenues Rise Y/Y

FedEx Corporation’s FDX first-quarter fiscal 2023 (ended Aug 31, 2022) earnings (excluding 10 cents from non-recurring items) of $3.44 per share missed the Zacks Consensus Estimate of $3.69. Maintaining last week’s stance, management emphasized that results for the fiscal first quarter were hurt by volume weakness globally.

Quarterly revenues of $23,200 million fell short of the Zacks Consensus Estimate of $23,213.4 million and increased 5.44% from the year-ago fiscal quarter’s reported figure owing to yield improvements, including fuel surcharge increases.

Operating expenses (reported basis) increased 7% to $22.1 billion. Expenses pertaining to salaries and employee benefits inched up 1% in the fiscal first quarter. Purchased transportation expenses increased 2% due to challenging labor market conditions. Fuel expenses surged 81%. Other operating expenses climbed 11%, while rentals expense increased 2%.

Operating income (on a reported basis) decreased 15% from the year-ago fiscal quarter’s reported number to $1.19 billion. Operating income (on an adjusted basis) declined 17.4% from the year-ago fiscal quarter’s reading to $1.23 billion for the reported quarter. Operating margin (adjusted) declined to 5.3% from 6.8% in the year-ago fiscal period. To navigate the weaker-than-expected business environment, FDX is actively cutting costs. In the first quarter, FDX generated cost savings to the tune of approximately $300 million.

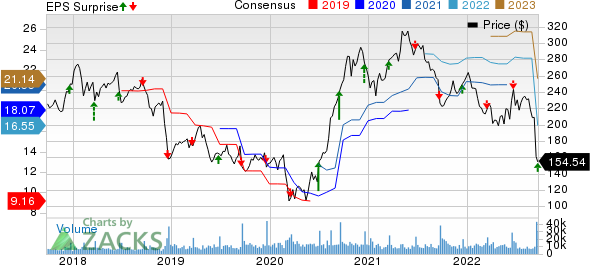

FedEx Corporation Price, Consensus and EPS Surprise

FedEx Corporation price-consensus-eps-surprise-chart | FedEx Corporation Quote

Segmental Performance

Quarterly revenues at FedEx Express (including TNT Express) improved 1% from the prior-year fiscal quarter’s level to $11.13 billion. Within the segment, package revenues increased 2%, while freight revenues were flat with the year-ago fiscal quarter’s reading. Segmental operating income decreased 69% from the year-ago fiscal quarter’s level to $174 million. Reduction in global package and freight volume hurt the operating income for the segment.

FedEx Ground revenues increased 6% year over year to $8.16 billion for the period under consideration owing to increased fuel surcharges, among other factors. Operating income came in at $694 million, up 3% from the year-ago fiscal quarter’s tally. Segmental operating results benefited from growth in FedEx Home Delivery and yield-management actions.

FedEx Freight revenues climbed 21% from the year-ago fiscal quarter’s reported figure to $2.72 billion, driven by higher revenues per shipment. The segment’s operating income surged 67% to $651 million, driven by yield-management actions, including higher fuel surcharges. Average daily shipments declined 5%, while revenue per shipment increased 27%.

Capital expenditures for the quarter decreased 18% from the prior-year fiscal period’s level to $1.28 billion.

Liquidity

FedEx exited first-quarter fiscal 2023 with cash and cash equivalents of $6.85 billion compared with $6.89 billion recorded as of May 31, 2021. Long-term debt (less current portion) was $19.91 billion compared with $20.18 billion recorded at the end of fiscal 2021.

Outlook

Management retained the guidance that it had provided last week while releasing the preliminary results. FDX expects revenues in the $23.5-$24 billion range for the fiscal second quarter. The Zacks Consensus Estimate is currently pegged at $23.7 billion. Earnings per share for the fiscal second quarter (excluding costs related to business optimization initiatives and business realignment activities) are likely to be $2.75 or greater. The Zacks Consensus Estimate is currently pegged at $4.02. FDX anticipates capital spending of $6.3 billion in fiscal 2023.

FDX, currently carrying a Zacks Rank #5(Strong Sell), reaffirmed its plan to repurchase $1.5 billion of its common stock in fiscal 2023. FedEx expects to repurchase shares worth $1 billion during the fiscal second quarter. In the same period, FDX expects to generate approximately $700 million of savings.

Cost-Saving Actions for Fiscal 2023

FedEx expects to generate cost savings in the $2.2-$2.7 billion range in fiscal 2023. The cost-cut actions will consist of:

$1.5-$1.7 billion at FedEx Express (including reducing flight frequencies and temporarily parking aircraft)

$350-$500 million at the Ground unit (including closing select sort operations, suspending certain Sunday operations and other linehaul expense actions)

$350-$500 million for shared and allocated overhead expenses,

Shipping Rate Hike Announced

To bolster the top line despite the weak demand for package deliveries globally, FedEx announced an increase in package rates. To this end, FedEx Express, FedEx Ground and FedEx Home Delivery rates will increase by an average of 6.9% from Jan 2, 2023, onward. Rates at its Freight unit will increase by an average of 6.9-7.9%, depending on a customer’s transportation rate scale.

Stocks to Consider

Some better-ranked stocks in the Zacks Transportation sector are Triton International TRTN and C.H. Robinson CHRW.

Triton is being aided by the gradual increase in trade volumes and container demand. TRTN expects container demand to remain strong throughout 2022. Measures to reward its shareholders through dividends and buybacks instill confidence in the stock.

Triton has an expected earnings growth rate of 22.4% for the current year. TRTN’s bottom line outpaced the Zacks Consensus Estimate in each of the last four quarters, the average being 7.5%. TRTN currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

C.H. Robinson is being aided by an improving freight scenario in the United States. Efforts to control costs also bode well. Measures to reward its shareholders instill confidence in the stock.

CHRW has a pleasant earnings track record. The bottom line surpassed the Zacks Consensus Estimate in three of the trailing four quarters (missing the mark in the remaining one). The average beat is 24.2%. The stock has witnessed the Zacks Consensus Estimate for 2022 earnings being revised 17.3% upward over the past 60 days. C.H. Robinson currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FedEx Corporation (FDX) : Free Stock Analysis Report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

Triton International Limited (TRTN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance