FedEx Up Post Q4 Earnings Beat: What's Next for FDX Investors?

Shares of FedEx Corporation FDX performed very impressively on the bourse on Jun 26, ending the trading session at $296.19, up 15.5% from Jun 25’s closing price. The massive northward movement was owing to the better-than-expected earnings per share reported by the package delivery company. Apart from the earnings beat, management issued a favorable earnings forecast for fiscal 2025. This, too, pleased investors leading to the double-digit stock price appreciation.

Highlights of Q4 Earnings

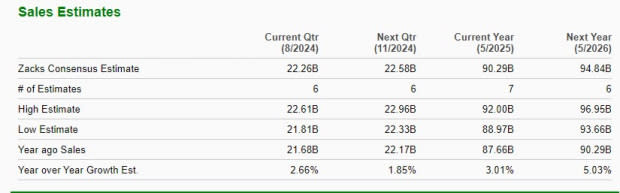

FedEx's fourth-quarter fiscal 2024 earnings per share (excluding 53 cents from non-recurring items) of $5.41 beat the Zacks Consensus Estimate of $5.34 and improved 9.5% year over year. Results were aided by cost savings owing to the DRIVE initiative. Revenues of $22.109 billion fell marginally short of the Zacks Consensus Estimate of $22.115 billion but grew 0.8% from the year-ago quarter.

Management expects a low-to-mid single-digit revenue growth (in percentage terms) year over year for fiscal 2025. The firm expects earnings per share between $18.25 to $20.25 before the MTM retirement plans accounting adjustments and $20 to $22 after excluding costs related to business optimization initiatives. The Zacks Consensus Estimate for fiscal 2025 is currently pegged at $20.26 per share.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Strong Price Performance So Far

The FedEx stock’s upsurge is not limited to Jun 26. Shares of FDX have performed handsomely since the beginning of 2024, gaining 17.1% year to date. Shares of rival United Parcel Service UPS declined 12.1%, mainly due to top-line woes and high labor costs. The industry, which houses both FDX and UPS, declined 9.8% year to date.

Image Source: Zacks Investment Research

FDX Rides on DRIVE Initiatives

Given the post-COVID adjustments in business, FedEx is realigning its costs under a companywide initiative called DRIVE. The comprehensive program, launched in fiscal 2023, aims to boost the company’s long-term profitability. These initiatives are expected to result in annual cost savings of $2.2 billion in fiscal 2025.

Related benefits are already driving bottom-line expansion and liquidity. The DRIVE-induced cost savings in fiscal 2024 was $1.8 billion. As part of the DRIVE initiative, FDX aims to consolidate its delivery companies, Express, Ground, Services and others, into a unified Federal Express Corporation, operating under the FedEx brand. The company is assessing the role of the Freight unit in its portfolio.

Shareholder-Friendly Approach Bodes Well

Despite challenges, FedEx continues paying dividends and buying back its shares. Strong cash flow generation is allowing FDX to remain committed to returning value to its shareholders. In fiscal 2024, it has generated $4.1 billion in adjusted free cash flow, up $500 million from fiscal 2023 levels.

In fiscal 2024, FedEx returned approximately $3.8 billion to its stockholders ($2.5 billion of stock repurchases and $1.3 billion of dividend payments). For fiscal 2025, FedEx anticipates repurchasing $2.5 billion of its common stock, including $1 billion in the fiscal first quarter. FDX intends to make dividend payments worth $1.3 billion in fiscal 2025.

In June, FedEx’s board of directors approved a dividend hike of 10%, thereby raising its quarterly cash dividend to $1.38 ($5.52 annualized). FDX is not the only player from the Zacks Transportation sector to have hiked quarterly dividends in 2024. Recently, Delta Air Lines DAL announced a 50% quarterly dividend hike to 15 cents per share.

Not All Roses, Some Brickbats as Well

Despite the tailwinds, FDX does have its share of challenges. Geopolitical uncertainty and higher inflation continue to hurt consumer sentiment and growth expectations, particularly in Asia and Europe. The resultant weakness in package volumes drove FedEx's revenues down 3% year over year in fiscal 2024. The Express unit, FDX's largest segment, saw segmental revenues decline by 4 %, while FedEx Freight revenues were reduced by 6%.

Moreover, the valuation picture is not favorable. FDX is trading at a premium with a forward 12-month Price/Earnings of 14.53X compared with the Zacks Transportation - Air Freight and Cargo industry’s 14.24X, reflecting a stretched valuation. FDX is also currently trading above its 12.48X five-year median.

Image Source: Zacks Investment Research

Conclusion

Although FDX shares have performed well recently, we believe investors should wait for a better entry point and monitor the company’s developments closely. Given the headwinds facing the stock, we advise investors to refrain from rushing to buy FDX now. For those who already own the stock, stay invested for solid long-term prospects. The stock’s Zacks Rank #3 (Hold) supports our thesis.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance