Female-founded companies accounted for 22.8% of 2023 total VC deal value—with one caveat

If you’re a woman in tech, you don’t need data to tell you you’re in the minority. I’m sure there are a lot of women reading this right now, who, like me, have accidentally and unexpectedly found themselves the only woman in a given room. So, what is the optimal use case for data about gender in tech and VC?

“It's important to examine data and trends in order to understand what's truly happening on a larger scale and put personal experiences into perspective,” PitchBook analyst Annemarie Donegan said via email. “It's also critical that men in venture—the majority—understand these numbers and can be part of the solution to bridge the gap.”

PitchBook just released its 2023 US All In Report, tracking how female founders and investors are faring. The data paints a complicated picture, though not an entirely negative one, of the traction that women have gained in the startup ecosystem in the past few years.

On the plus side, though 2023 was a tough year for fundraising, female founders received more capital in 2023 than in 2020, making last year “the third-highest annual level on record,” according to the report. Additionally, companies founded by women accounted for 22.8% of total VC deal value, a record-high with one catch—that number doesn’t include the OpenAI deal.

That’s what gets us to numbers that are a little rougher. Female founders’ total deal count was down by more than 25% last year, no doubt reflecting the overall pullback in the broader environment.

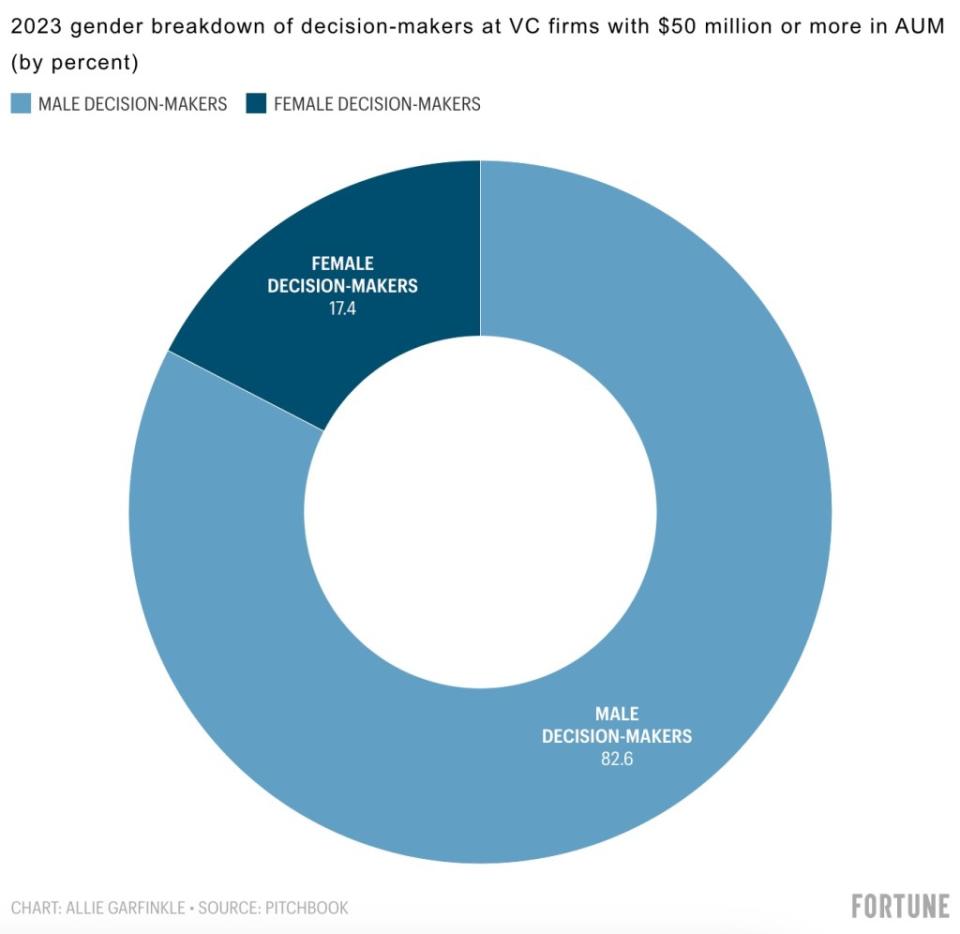

And on the investor side, decision-makers remain disproportionately male. At firms with more than $50 million in assets under management, PitchBook says that 17.4% of decision-makers are women, while 82.6% of decision-makers are men. At smaller firms (defined as those with under $50 million in AUM) the percentage of female decision-makers reaches 18.8%.

When I first started covering tech a few years ago, I read Emily Chang’s Brotopia, and it’s a book I think about a lot, especially the passage that reads: “Getting to fifty-fifty is incredibly complex and nuanced, requiring many detailed solutions that will take decades to fully play out…Most important, stop blaming everybody else for the problem or pretending that it is too hard for us to solve. It’s time to look in the mirror.”

Brotopia was published in 2018, and data shows slow but clear progress since then, and I’m not looking to argue with that progress at all. What I’m actually more interested in is this—have we ever actually looked in the mirror about this? I don’t mean a sidelong, passing glance, I mean a long, hard look. Maybe we have, maybe we haven’t. I genuinely can’t tell, because there’s a difference between saying you take something seriously and actually taking it seriously. There’s a difference between a problem that you consider important, and a problem you consider both urgent and important.

But even if you believe the answer is yes, the tech industry has taken a long, hard look in the mirror, it raises a follow-up question: Who looks in the mirror only once or twice? Like with any good habit, it’s something we have to do again and again.

See you Monday,

Allie Garfinkle

Twitter: @agarfinks

Email: alexandra.garfinkle@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today's newsletter.

This story was originally featured on Fortune.com

Yahoo Finance

Yahoo Finance