Ferguson PLC's Dividend Analysis

Exploring the Dividend Performance and Sustainability of Ferguson PLC

Ferguson PLC (NYSE:FERG) recently announced a dividend of $0.79 per share, set to be payable on July 31, 2024, with the ex-dividend date on June 14, 2024. As investors anticipate this upcoming payment, it's essential to delve into the company's dividend history, yield, and growth rates. This analysis utilizes comprehensive data from GuruFocus to evaluate the performance and sustainability of Ferguson PLC's dividends.

Company Overview

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

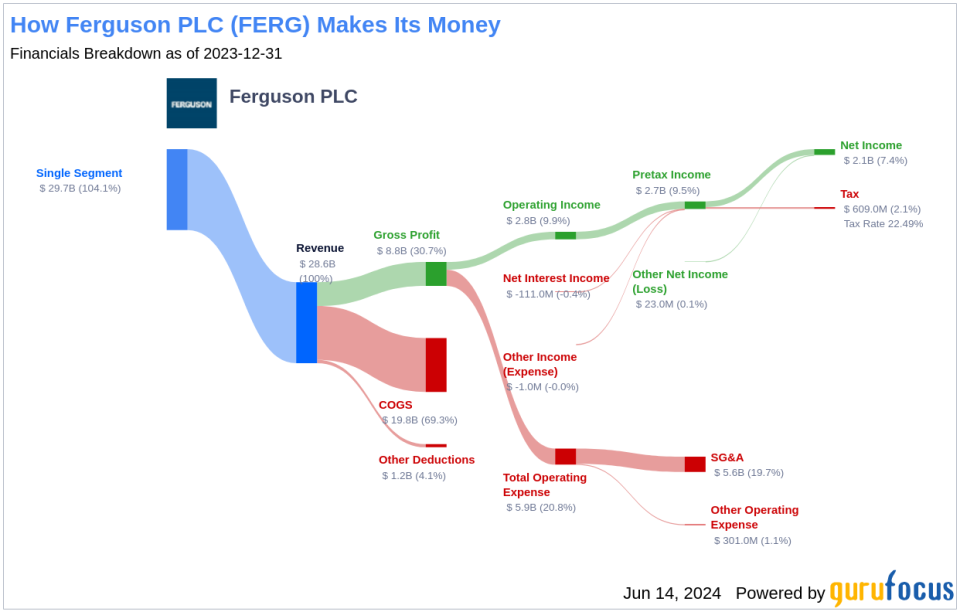

Ferguson PLC distributes plumbing and HVAC products primarily to repair, maintenance and improvement, new construction, and civil infrastructure markets. It serves over 1 million customers and sources products from 37,000 suppliers. Ferguson engages customers through approximately 1,700 North American branches, over the phone, online, and in residential showrooms. In fiscal 2023, Ferguson derived 95% of its nearly $30 billion of sales in the United States. According to Modern Distribution Management, Ferguson is the largest industrial and construction distributor in North America. The firm sold its UK business in 2021 and is now solely focused on the North American market.

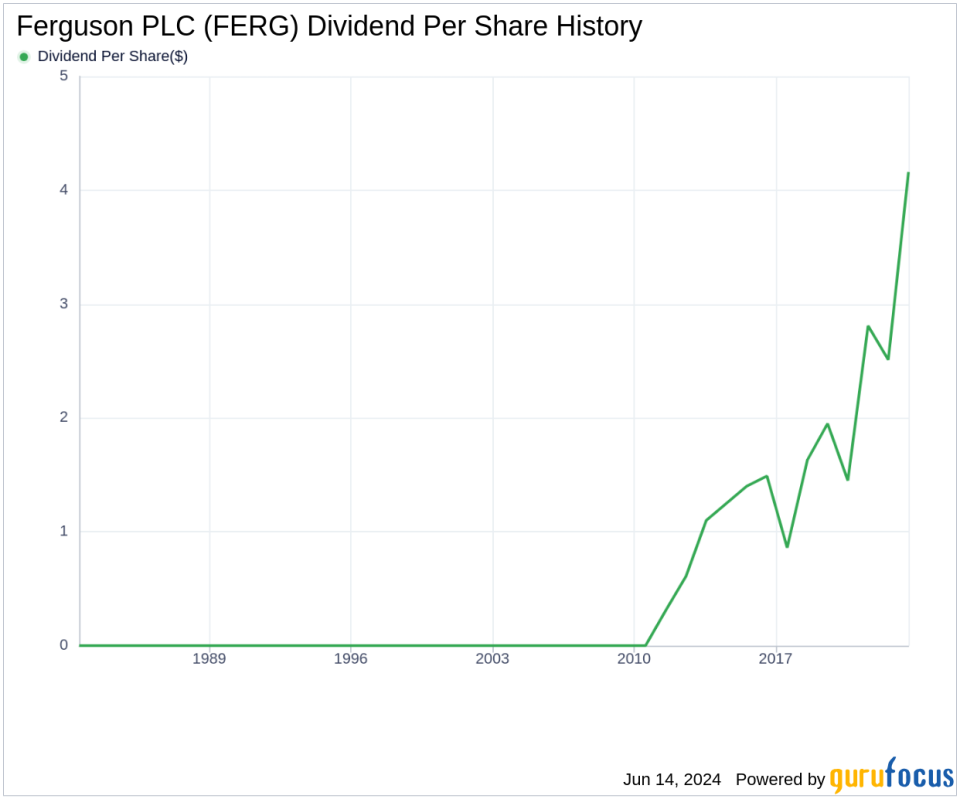

Reviewing Ferguson PLC's Dividend History

Ferguson PLC has consistently paid dividends since 2011, with distributions occurring on a quarterly basis. Below is a chart illustrating the annual Dividends Per Share to track historical trends.

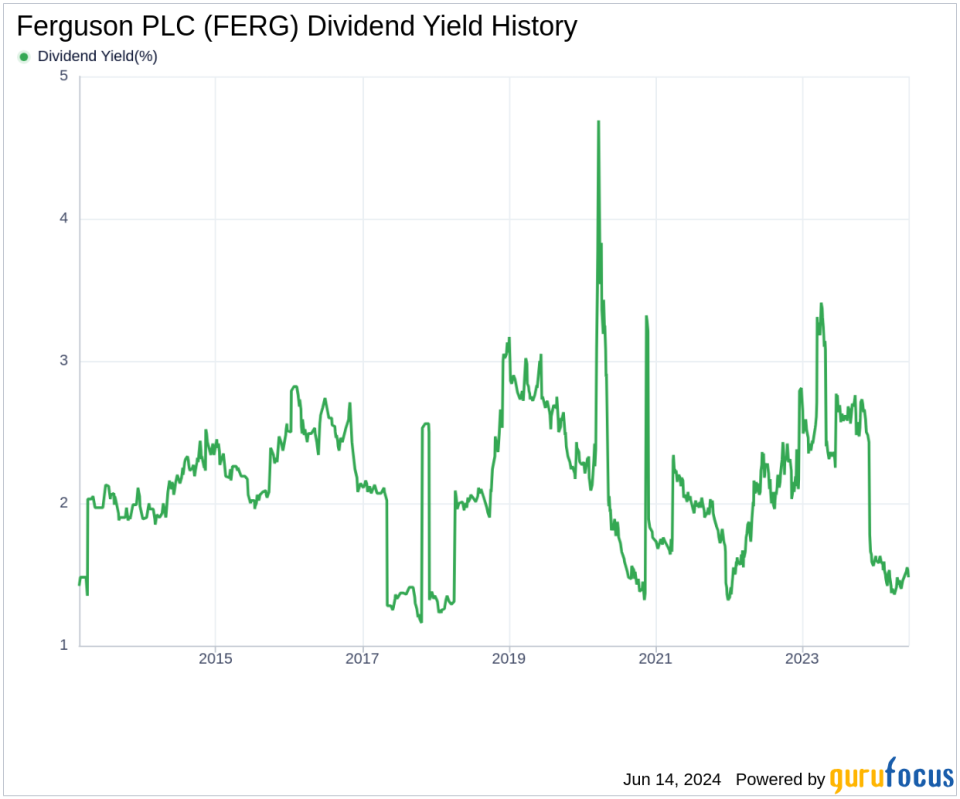

Analyzing Dividend Yield and Growth

Ferguson PLC currently boasts a 12-month trailing dividend yield of 1.50% and a forward dividend yield of 1.53%, indicating an expected increase in dividend payments over the next year. Over the past three years, the annual dividend growth rate was an impressive 42.10%, though it moderated to 19.00% over a five-year period. The decade-long growth rate stands at a solid 11.80%. Based on these metrics, the 5-year yield on cost for Ferguson PLC stock is approximately 3.58%.

Evaluating Dividend Sustainability

To assess the sustainability of Ferguson PLC's dividends, it's crucial to examine the dividend payout ratio, which currently stands at 0.32. This ratio indicates that the company retains a substantial portion of its earnings for future growth and stability. Additionally, Ferguson PLC's profitability rank is an impressive 8 out of 10, reflecting robust earnings capabilities. The consistent positive net income over the past decade further supports the company's strong profitability.

Future Growth Prospects

Ferguson PLC's growth rank of 8 out of 10 indicates a promising growth trajectory. Key metrics such as revenue per share and growth rates suggest a robust revenue model, with an average annual increase of 17.70% over the past three years. Additionally, the company's earnings have grown by about 25.00% annually during the same period. The 5-year EBITDA growth rate of 22.90% further underscores Ferguson PLC's capacity for sustained profitability and dividend payments.

Conclusion

Ferguson PLC's consistent dividend payments, robust growth rates, and strong financial health make it an attractive option for dividend investors. The company's strategic focus on the North American market and its ability to maintain a healthy payout ratio while investing in growth initiatives provide a solid foundation for future dividend sustainability. For those interested in exploring more high-dividend yield opportunities, GuruFocus Premium offers a comprehensive High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance