Ferroglobe (GSM) to Report Q3 Earnings: What's in Store?

Ferroglobe GSM is scheduled to report third-quarter fiscal 2022 results on Nov 15, after market close.

Q3 Estimates

The Zacks Consensus Estimate for the GSM’s third-quarter revenues is pegged at $695 million, suggesting growth of 62% from the year-ago quarter. The same for earnings per share is pegged at 68 cents, indicating a turnaround performance from the loss of 36 cents reported in the prior-year quarter. The Zacks Consensus Estimate for the company’s third-quarter earnings has remained unchanged in the past 30 days.

Q2 Performance

In the last reported quarter, Ferroglobe delivered year-over-year improvement in both adjusted earnings per share and revenues, with both attaining record levels. The company beat the Zacks Consensus Estimate on both metrics. GSM’s earnings have surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering a positive earnings surprise of 10.2%, on average.

Ferroglobe PLC Price and EPS Surprise

Ferroglobe PLC price-eps-surprise | Ferroglobe PLC Quote

Key Factors to Note

The company’s efforts to bolster its overall competitiveness by refocusing the product portfolio towards higher value-added products and continuously improving its cost position and production efficiency have been driving results for the past few consecutive quarters. Its net debt is also at the lowest since the company’s formation, which is expected to have boosted its earnings as well.

GSM’s third-quarter 2022 results are likely to reflect the impact of higher volumes supported by strong demand. However, lower prices might have had an offsetting impact. The costs of several key inputs such as electrodes, paste and coal have been adversely impacted by inflationary pressures through the course of the quarter. General operating costs are also anticipated to have been high in the quarter. However, this is likely to have been partially offset by an energy cost benefit in France.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Ferroglobe this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, but that is not the case here.

You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Ferroglobe is 0.00%.

Zacks Rank: GSM currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

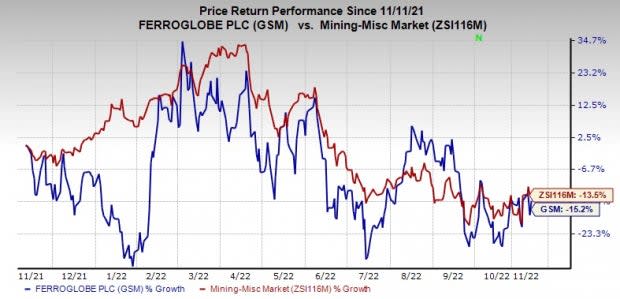

Share Price Performance

Image Source: Zacks Investment Research

Ferroglobe’s shares have lost 15.2% over the past year, compared with the industry’s decline of 13.5%.

Stocks Poised to Beat Estimates

Here are some stocks, which, according to, our model, have the right combination of elements to post an earnings beat in their upcoming releases

.

MAG Silver MAG, expected to release earnings on Nov 21, has an Earnings ESP of +18.18% and carries a Zacks Rank #3. The Zacks Consensus Estimate for MAG’s third quarter 2022 revenues is pegged at $35 million.

The Zacks Consensus Estimate for MAG Silver’s third-quarter earnings has been revised 27% downward in the past 60 days. The consensus estimate for MAG’s earnings for the quarter is currently pegged at 11 cents, suggesting a turnaround performance from the loss of 2 cents per share reported in the prior-year comparable quarter.

Ross Stores ROST currently has an Earnings ESP of +3.13% and a Zacks Rank of 3. The Zacks Consensus Estimate for ROST’s quarterly revenues is pegged at $4.4 billion, which suggests a decline of 4.7% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Ross Stores’ earnings has moved down by a penny to 80 cents per share in the past seven days. The consensus estimate indicates a 26.6% decline from the year-ago quarter. ROSS is expected to report results on Nov 17.

Burlington Stores BURL, expected to report results on Nov 22, currently has an Earnings ESP of +2.46% and a Zacks Rank of 2. The Zacks Consensus Estimate for Burlington Stores’ quarterly revenues is pegged at $2.1 billion, which suggests a decline of 10.9% from the figure reported in the prior-year quarter.

The consensus mark for BURL’s quarterly earnings has been unchanged in the past 30 days at 51 cents per share. The consensus estimate suggests 62.5% decline from the year-ago quarter’s reported number.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Ferroglobe PLC (GSM) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

MAG Silver Corporation (MAG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance