Finance and HR Software Stocks Q1 In Review: Global Business Travel (NYSE:GBTG) Vs Peers

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the finance and hr software stocks, including Global Business Travel (NYSE:GBTG) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 15 finance and HR software stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 1.3%. while next quarter's revenue guidance was in line with consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and finance and HR software stocks have had a rough stretch, with share prices down 8% on average since the previous earnings results.

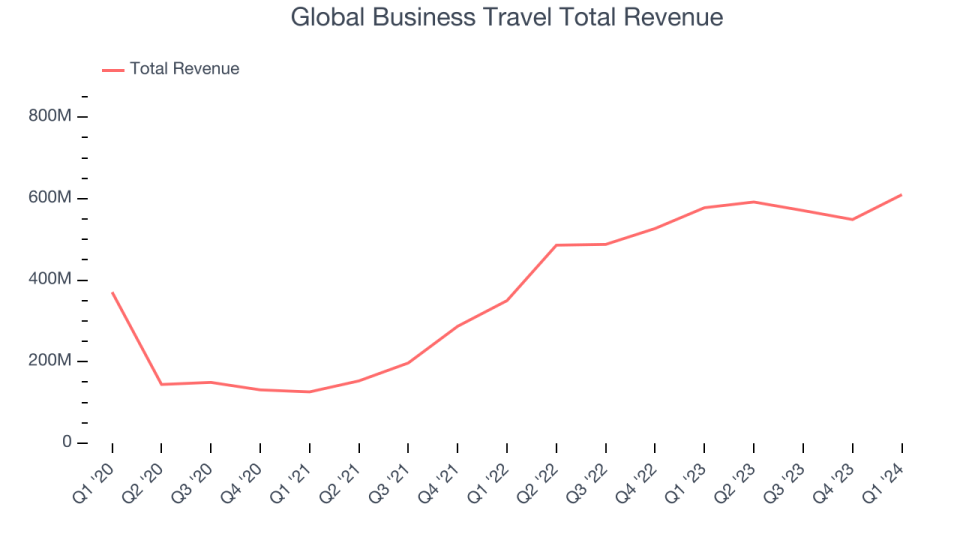

Weakest Q1: Global Business Travel (NYSE:GBTG)

Holding close ties to American Express, Global Business Travel (NYSE:GBTG) is a comprehensive travel and expense management services provider to corporations worldwide.

Global Business Travel reported revenues of $610 million, up 5.5% year on year, falling short of analysts' expectations by 2.3%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations.

Paul Abbott, Amex GBT’s Chief Executive Officer, stated: “In the first quarter, we delivered strong financial results with share gains, significant margin expansion and meaningful Adjusted EBITDA growth to reach the highest first quarter Adjusted EBITDA in our company's history. This puts us well on track to deliver against our full-year guidance. Our recently announced agreement to acquire CWT accelerates our ability to deliver long-term growth and value creation for shareholders. "

Global Business Travel delivered the weakest performance against analyst estimates and weakest full-year guidance update of the whole group. The stock is down 5.2% since the results and currently trades at $5.9.

Read our full report on Global Business Travel here, it's free.

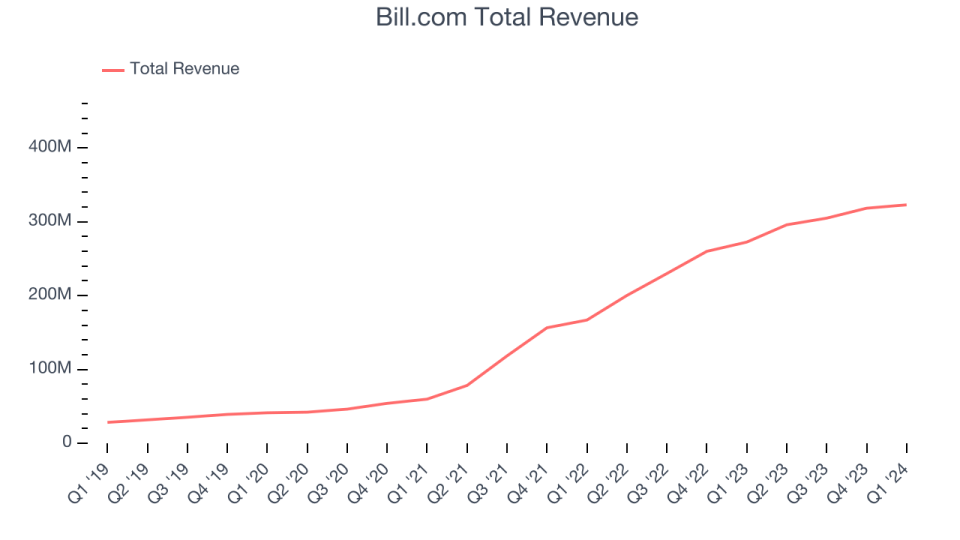

Best Q1: Bill.com (NYSE:BILL)

Started by René Lacerte in 2006 after selling his previous payroll and accounting software company PayCycle to Intuit, Bill.com (NYSE:BILL) is a software as a service platform that aims to make payments and billing processes easier for small and medium-sized businesses.

Bill.com reported revenues of $323 million, up 18.5% year on year, outperforming analysts' expectations by 5.6%. It was a very strong quarter for the company, with an impressive beat of analysts' billings estimates and a solid beat of analysts' revenue estimates.

The stock is down 17.1% since the results and currently trades at $52.49.

Is now the time to buy Bill.com? Access our full analysis of the earnings results here, it's free.

Paychex (NASDAQ:PAYX)

One of the oldest service providers in the industry, Paychex (NASDAQ:PAYX) offers its customers payroll and HR software solutions.

Paychex reported revenues of $1.44 billion, up 4.2% year on year, falling short of analysts' expectations by 1.2%. It was a weak quarter for the company, with a miss of analysts' revenue estimates.

The stock is up 2% since the results and currently trades at $124.

Read our full analysis of Paychex's results here.

Marqeta (NASDAQ:MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Marqeta reported revenues of $118 million, down 45.7% year on year, in line with analysts' expectations. It was a very strong quarter for the company, with a meaningful improvement in its gross margin.

Marqeta had the slowest revenue growth among its peers. The stock is down 7.7% since the results and currently trades at $5.38.

Read our full, actionable report on Marqeta here, it's free.

Dayforce (NYSE:DAY)

Founded in 1992 as Ceridian, an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Dayforce (NYSE:DAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Dayforce reported revenues of $431.5 million, up 16.4% year on year, surpassing analysts' expectations by 1.3%. It was a solid quarter for the company, with accelerating customer growth and a significant improvement in its gross margin.

The company added 182 customers to reach a total of 6,575. The stock is down 8.5% since the results and currently trades at $56.18.

Read our full, actionable report on Dayforce here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance