First-Half Wrap: The AI Boom, Robust Earnings, Auto Sales on Tap

And just like that, the end of next week marks the finish of the first half. What a wild ride it has been on the macro front. 2023 ended with a string of better-than-expected inflation reports, much to the delight of Chairman Jerome Powell and the Federal Reserve. The tables turned, however, when the calendar flipped to 2024.

At one point early in the first quarter, nearly seven quarter-point rate cuts were priced into the fed funds futures market, a time when the U.S. 10-year Treasury note yield was trading near 4%. Three consecutive troubling CPI reports sent the bond bulls scurrying as the year pressed on, though. The rates market seems to have found its footing after the last pair of CPI prints.

Big bull trends in big tech

In the stock market, despite many calls for a broadening out of the rally, the mega-cap artificial intelligence theme reasserted its dominance following small caps' surge over the back half of fourth-quarter 2023. Shares of Nvidia (NASDAQ:NVDA) rose big, then split 10-for-1 and jumped once again. Other semiconductor stocks took part in the boom. Taiwan Semiconductor (NYSE:TSM), ASML (NASDAQ:ASML) and 2023 IPO Arm Holdings (NASDAQ:ARM) provided a global bull market in the chip space.

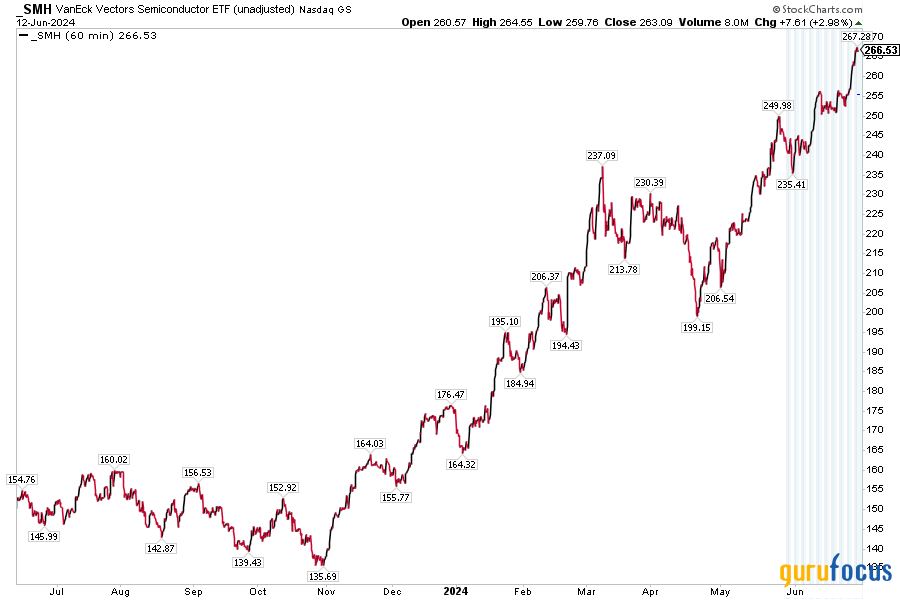

Then, after yet another Nvidia blowout quarterly earnings report, the sometimes-overlooked AI picks-and-shovels company, Broadcom (NASDAQ:AVGO), followed its rival's suit, issuing a gangbuster first-quarter profit report and announcing a 10-to-1 split. In all, the VanEck Semiconductor ETF (NASDAQ:SMH) rallied nearly 100% from its October 2023 nadir through late June.

SMH Semiconductor ETF nearly doubles from Its October 2023 low amid the AI euphoria

Source: Stockcharts.com

Earnings growth looks firm

Bigger picture, corporate earnings growth outperformed during the first half. More than $250 of S&P 500 earnings per share is now the forecast over the next 12 months, with about $244 of current-year per-share operating profits and $277 of out-year EPS, according to FactSet.[1] Traders have just three weeks to prep for the beginning of the second-quarter earnings season when the big banks kick things off on Friday, July 12.

Where's the volatility?

While it has been an action-packed first half, what's been conspicuously absent from the financial front page has been volatility. The VIX Index had just a lone spike above 20 during a short window in April when equities pared early year gains.[2] At least we got some excitement and wild price action in the meme stocks for a fleeting moment.

Low volatility in equities seemed to carry over into the currency markets as the U.S. Dollar Index ranged from 102 to about 106 despite macro uncertainty around growth and inflation across many developed economies.[3]

Interim data ahead: Auto sales and production figures for June

Be on the lookout for clues on the macro from individual companies in the coming days. Before the Independence Day holiday in the states, monthly sales and production results from the world's biggest automakers hit the tape.

The first major set of interim data comes from Toyota Motor (NYSE:TM), Honda Motor (NYSE:HMC), Subaru Corp (TSSE:7270), and Mazda Motor (TSE:7261). While there are no widely followed consensus expectations for the numbers, there's optimism in the industry considering that U.S. auto sales have been inching up, according to WARD's Automotive.[4]

The second half begins with more monthly sales reports from the likes of Tata Motors (TTM), Li Auto (NASDAQ:LI) and Hero MotoCorp (BOM:500182) from the Chinese and Indian markets. For China's electric vehicle companies, specifically, tensions appear to only be rising as both the U.S. and European politicians threaten and impose new tariffs.[5] It comes as the U.S. election season heats up. If there's one thing both Democrats and Republicans agree on, it's a tough stance on China trade relations. We will find out what the rhetoric is at the first presidential debate Thursday next week.

Hopes for solid monthly results from U.S. auto companies

But it's hard to stand in front of the freight train that is the American consumer. Ahead of the holiday, interim updates from the likes of General Motors (NYSE:GM) and Tesla (NASDAQ:TSLA) cross the wires and Ford (NYSE:F) posts its June numbers on July 5, according to Wall Street Horizon's data.

With the start of summer today, the shine has been on GM since late May. The stock revved to a 52-week high last week as the Detroit automaker announced a reduced outlook for 2024 EV production at an industry conference. Chief Financial Officer Paul Jacobsen provided color on stronger-than-expected vehicle pricing this year, helping to lift GM shares.[6] Before the presentation, the company announced a new $6 billion share repurchase authorization and hiked its quarterly dividend.[7]

AI spotlight: Nvidia shareholder meeting

Before all that, the spotlight will be on what else but Nvidia on June 26. That's when the $3 trillion market cap chip designer hosts its annual shareholder meeting. While there are no imminent signs of big news to come from the event, the AI capex arms race is bigger than ever after a slew of developers' events in the past month (from Alphabet (NASDAQ:GOOG), Microsoft (MFSFT) and Apple (NASDAQ:AAPL), among others). And with Elon Musk's pay package punditry finally out of the way, Nvidia's shareholder gathering might be the final major Magnificent Seven event to make headlines.

The bottom line

As the first half wraps up, investors have plenty to be happy about. Both U.S. and foreign stocks are solidly positive amid AI euphoria. Other industries, such as automakers, can point to encouraging data points too. Earnings season is already within sight, but investors and portfolio managers will have plenty of interim reports to parse through before then.

1 Earnings Insight, FactSet John Butters, June 7, 2024, https://advantage.factset.com2 Volatility Index, StockCharts, June 14, 2024, https://schrts.co3 US Dollar, Stock Charts, June 17, 2024, https://schrts.co4 Car Sales Very Strong, Apollo Academy, Torsten Slk, June 10, 2024, https://www.apolloacademy.comy-strong/5 Europe to Hit China With EV Tariffs That Its Own Automakers Oppose, The Wall Street Journal, William Boston, Kim Mackrael, June 12, 2024, https://www.wsj.com6 GM lowers EV production targets amid slow demand, says EVs will show 'variable profit', Detroit Free Press, Jamie L. LaReau, June 11, 2024, https://www.freep.com7 GM Board Approves New $6 Billion Stock Buyback, The Wall Street Journal, Mike Colias, Dean Seal, June 11, 2024, https://www.wsj.com

Copyright 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance