First Mover Americas: Bitcoin Price Eyes Record This Week

This article originally appeared in First Mover, CoinDesk's daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

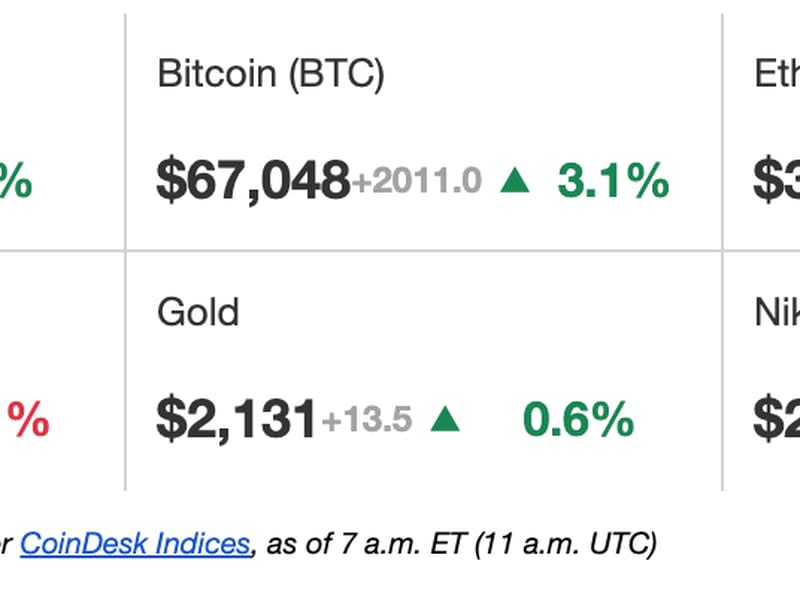

Latest Prices

Top Stories

Bitcoin (BTC) will reach an all-time high before the week ends, according to Markus Thielen, head of research at 10x. “Price action during the weekend is always important to follow and while attempts have been made to [liquidate] leveraged long positions, there are no sellers,” said Thielen in a note titled, "Everybody Will Be Astonished by Bitcoin’s Price Action This Week." The cryptocurrency reached a record in euro terms on Monday and was trading at around $66,839 at press time on Tuesday, less than 3% shy of its all-time dollar peak of $69,000, touched in November 2021. The broader CoinDesk 20 Index (CD20) was higher by 4.7%. According to Laurent Kssis, a crypto ETP specialist at CEC Capital, another rally could be on the way. Buying pressure looks strong from retail investors, who consider the recent spot bitcoin exchange-traded fund (ETF) inflows to be a key momentum phase. “Inflows are still very supportive and not quite yet over, which may and could continue to push the price upwards in the crypto currency markets," he said.

Deutsche Boerse, the operator of Germany’s largest stock exchange, has started a crypto spot trading platform for institutional clients, the company said in a statement on Tuesday. DBDX offers a fully regulated ecosystem for trading, settlement and custody of crypto assets, the firm said. Initially, trading on DBDX will operate on a request-for-quote (RFQ) basis, followed by multilateral trading. Deutsche Boerse will operate the trading venue, and Crypto Finance will provide settlement and custody services.

Baanx, a cryptocurrency payments specialist authorized by the U.K.’s Financial Conduct Authority (FCA), has raised $20 million in Series A funding round, the company said on Tuesday. The investment, which included Ledger, Tezos Foundation, Chiron and British Business Bank, brings the crypto payment enabler’s total funding to over $30 million. London-based Baanx, which runs the Ledger card product, recently signed a three-year partnership with Mastercard for the U.K. and Europe. Large legacy payments companies such as Mastercard and Visa have been quietly exploring things like payments on Ethereum, stablecoins and the Web3 world of non-custodial wallets – areas where Baanx provides seamless connectivity.

Chart of the Day

The chart shows all addresses currently holding layer-2 scaling solution Optimism's OP token are "in the money." In other words, all holders are sitting on unrealized gains.

An address is said to be in the money when a token's going market rate is higher than the address' average coin acquisition cost.

OP rose to a record high of $4.51 early Tuesday.

Source: IntoTheBlock

- Omkar Godbole

Yahoo Finance

Yahoo Finance