Fleury Michon Leads Three Premier Dividend Stocks On Euronext Paris

As global markets navigate through a mixed landscape of economic signals, France's CAC 40 Index has shown resilience with modest gains, reflecting cautious optimism among investors. In this context, dividend stocks like Fleury Michon offer appealing prospects for those seeking steady income streams amidst prevailing market uncertainties.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 6.25% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.77% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.38% | ★★★★★★ |

Fleury Michon (ENXTPA:ALFLE) | 5.42% | ★★★★★☆ |

Métropole Télévision (ENXTPA:MMT) | 9.57% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 3.83% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.18% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.93% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.16% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.27% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

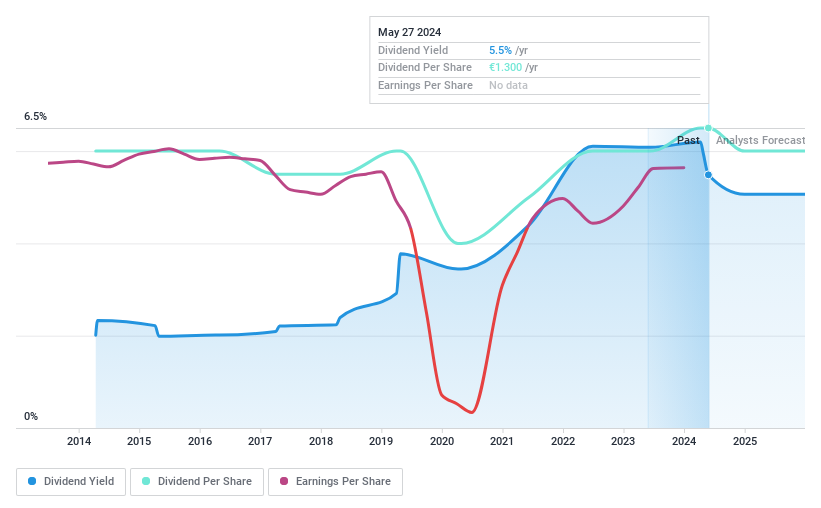

Fleury Michon

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fleury Michon SA, with a market cap of €100.12 million, operates in the production and international sale of food products primarily in France.

Operations: Fleury Michon SA generates €709.60 million from its Division GMS France and €83.92 million from its International Division in revenue.

Dividend Yield: 5.4%

Fleury Michon SA demonstrated a robust financial performance in 2023, with sales increasing to €836.2 million and net income significantly rising to €10.3 million. Despite this growth, the company's dividend track record remains unstable and payments have been volatile over the past decade. However, dividends are well-supported by earnings and cash flows, with a low payout ratio of 36% and a cash payout ratio of 12.8%, respectively. The dividend yield stands at a competitive 5.42%, positioning it well within the top tier of French dividend stocks.

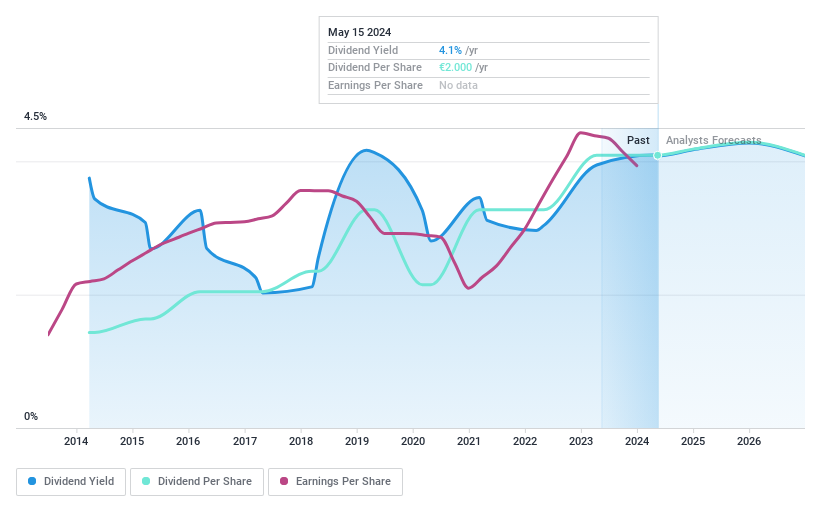

Infotel

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Infotel SA, with a market capitalization of €339.68 million, is engaged in designing, developing, marketing, and maintaining software solutions focused on security, performance, and management across the globe.

Operations: Infotel SA generates revenue primarily through its Services segment, which brought in €296.02 million, and its Software segment, contributing €11.53 million.

Dividend Yield: 4.1%

Infotel SA trades at 28.8% below estimated fair value, suggesting potential undervaluation relative to peers. Despite a dividend yield of 4.08%, lower than the top French dividend payers at 5.22%, its dividends are supported by a payout ratio of 76.2% and cash flows with a cash payout ratio of 63.7%. However, its dividend history shows volatility over the past decade, indicating some instability in payments despite recent growth in earnings forecasted at an annual rate of 10.93%.

Navigate through the intricacies of Infotel with our comprehensive dividend report here.

Upon reviewing our latest valuation report, Infotel's share price might be too pessimistic.

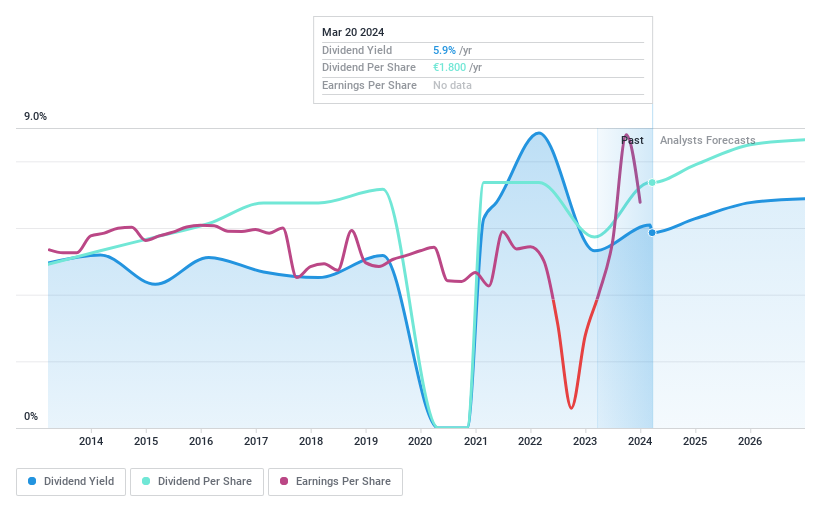

SCOR

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SCOR SE operates globally, offering life and non-life reinsurance products across regions including Europe, the Middle East, Africa, the Americas, Latin America, and Asia Pacific, with a market capitalization of approximately €4.57 billion.

Operations: SCOR SE generates revenue primarily through its life reinsurance segment, SCOR L&H, which contributed €8.45 billion, and its non-life reinsurance segment, SCOR P&C, with €7.04 billion in revenues.

Dividend Yield: 7.1%

SCOR SE's dividend sustainability is bolstered by a low payout ratio of 39.7% and a cash payout ratio of 24.2%, indicating strong coverage by both earnings and cash flows. Despite this, the company has experienced volatility in its dividend payments over the past decade, reflecting some instability. Recently, SCOR SE announced an increased dividend payment of €1.80 per share for 2023, effective from May 23, 2024, demonstrating a commitment to maintaining shareholder returns amidst executive changes and strategic appointments aimed at reinforcing its market position.

Turning Ideas Into Actions

Unlock our comprehensive list of 32 Top Euronext Paris Dividend Stocks by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ALFLE ENXTPA:INF and ENXTPA:SCR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance