Fluor (FLR) Wins EPCM Contract for Iluka's Eneabba Project

Fluor Corporation FLR has secured an engineering, procurement and construction management (“EPCM”) contract for the Iluka Resources Limited’s Eneabba project. Although the value of the project has not been disclosed, Fluor will book the reimbursable contract value in the second quarter of 2022.

Fluor’s Mining & Metals business unit will perform the work under the contract that includes completion of the front-end engineering design and execution of the EPCM services to this fully-integrated rare earths refinery in Eneabba, Western Australia.

Construction under this contract is expected to begin in 2022, and the first production is slated for 2025. The finalized refinery will produce light and heavy rare earth oxides, including neodymium, praseodymium, dysprosium and terbium, which are key to global electrification.

Contract Wins & Solid Backlog Level Unlock Opportunities

Fluor’s diversity remains a key strength that helps it mitigate the cyclicality of markets in which it operates. The company’s strategy of maintaining a good business portfolio mix permits it to focus on the more stable business markets and capitalize on developing the cyclical markets at suitable times.

The company exited first-quarter 2022 with a healthy ending backlog of $19.3 billion and a total backlog of $19.25 billion. Management expects bookings to be solid during the rest of 2022 and help it achieve a $2.50-$2.90 per share gross margin by 2024.

For 2022, Fluor expects an adjusted EPS of $1.15-$1.40 from continuing operations. In 2022, it assumes increased opportunities for new awards across all segments and continued progress of the cost optimization program. The company projects a 10% increase in revenues, $50 million in adjusted G&A expense per quarter, and a tax rate of 28%. The company anticipates average full-year margins of 5% in Energy Solutions, 3.5-4.5% in Urban Solutions and 4% in Mission Solutions.

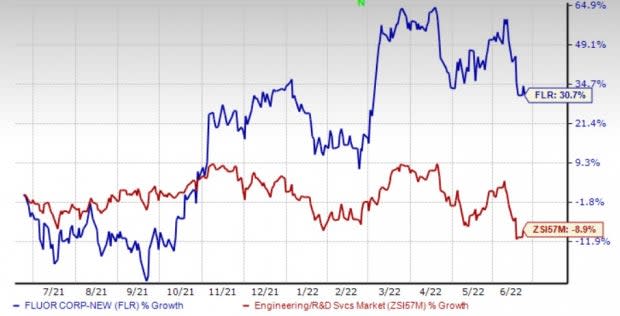

Image Source: Zacks Investment Research

The shares of the company have advanced 30.7% over the past year against the Zacks Engineering - R and D Services industry’s 8.9% decline.

Zacks Rank

Fluor currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

3 Top-Ranked Construction Stocks to Buy

AECOM ACM — carrying a Zacks Rank #2 (Buy) — is a leading solutions provider for supporting professional, technical and management solutions for diverse industries across end markets like transportation, facilities, government and in environmental, energy and water businesses.

AECOM’s expected earnings growth rate for 2022 is 21.6%. The consensus mark for its 2022 earnings has moved up to $3.43 per share from $3.40 in the past 60 days.

Sterling Construction Co., Inc. STRL, a Zacks Rank #2 company, has been benefiting from broad-based growth across the E-Infrastructure, Building and Transportation solutions segments.

The consensus mark for Sterling’s 2022 earnings rose to $2.88 per share from $2.80 in the past 60 days. This suggests 34% year-over-year growth.

KBR, Inc. KBR, a Zacks Rank #2 company, is a global engineering, construction and services firm, supporting the market segments of global energy and international government services.

KBR has seen an upward estimate revision from $2.54 to $2.61 per share for the 2022 bottom line in the past 60 days. This suggests 7.9% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance