Forex Daily Recap – USD/INR Dropped over RBI Payout to the Government

USD/INR

Indian rupee pair was -0.71% down on Tuesday following RBI Payout to the government. Notably, the Central Bank approved the transfer of higher-than-expected dividend to the Indian government. Last week, Indian Finance Minister Nirmala Sitharaman had come up some stimulus plans to boost the economy. Hence, the market had remained under fear, expecting a miss of the fiscal target this time.

Nevertheless, RBI’s payout of around $24.62 billion was almost more than double the previous $9.51 billion. Such a decisive move by the RBI has significantly helped the government mitigate risks. In the interim, the bond yields had shot to a three-week high on the back of weak global economic conditions.

On the technical side, the pair had rebounded to the south side after testing the 72.312 resistance handle. Anyhow, a 1-month-old slanting ascending support ensured to prevent the USD/INR bears from taking further down moves. Nonetheless, the pair continued to stay in the upper vicinity of the Bollinger Bands, sustaining a strong positive trend. Meantime, the oversold Relative Strength Index (RSI) has already started playing its role in dragging down the pair.

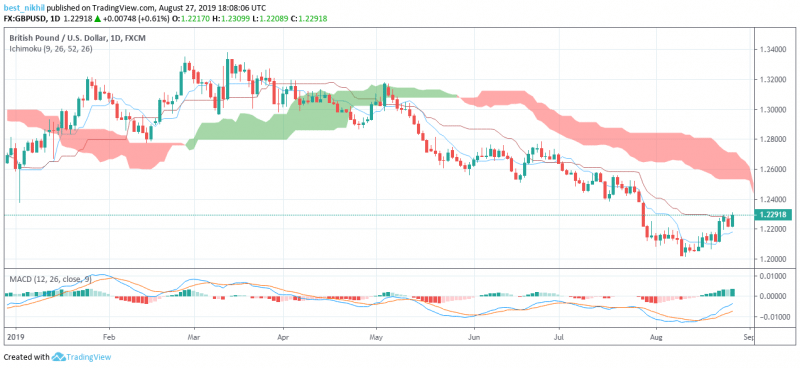

GBP/USD

Today, Cable bulls were resiliently moving to the upside, aiming the overhead red Ichimoku Clouds. In the middle of the day, Opposition Leader Jeremy Corbyn backed the no-confidence vote delay decision of the cross-party. At the same time, Corbyn has prioritized to use legislation to stop a no-deal Brexit by the end of the week. Interim, Brexit Party Leader Nigel Farage warned UK PM, asking to perform a “clean break Brexit” on Oct 31. Farage added that any Brexit fudge would provoke for a general election in the autumn.

Needless to say, the GBP/USD pair soared over the Brexit optimism, rising above the base line and conversion line of the Ichimoku Clouds. Also, though the MACD technical indicator contained multiple green histograms pointing north, the MACD and signal lines remained below the zero line.

USD/MXN

Healthy 20.1204 resistance level was putting a lid over the pair’s daily gains last day. Today, the USD/MXN pair was 0.63% up over adverse Mexican July Trade and Unemployment data. The market had expected the July Trade Balance to report 460 million this lower than the previous 2.56 billion.

However, the actual data stood even below the estimates, recording -1.12 billion this time. Notably, the Unemployment rate came up in-line with the market hopes of around 3.7%. Meanwhile, underlying Parabolic SAR and a robust 1-month-old slanting support kept cheering the bulls.

AUD/USD

The Aussie pair was -0.27% down on Tuesday despite RBA’s Debelle’s findings of the country’s shock absorbing economy. Debelle noted that Australia’s net foreign liabilities as a percentage of the national GDP have remarkably lowered to the lowest mark. And, also most of the debt remained in AUD, making the currency a shock absorber.

“Australia has clearly been a major beneficiary of that system. The current threats to the system are a significant risk to both Australia and the world,” Debelle said.

On the technical side, the pair continued to maintain a range bound approach, trading below the Ichimoku Clouds.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini S&P 500 Index (ES) Futures Technical Analysis – August 27, 2019 Forecast

Soybeans, Corn, Recovers Ground on Improved Crop Rate and Trade War

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – August 27, 2019 Forecast

US Stock Market Overview – Stocks Close Mixed, US Yields Continue to Invert

Natural Gas Price Forecast – natural gas markets continue to find sellers above

Yahoo Finance

Yahoo Finance