Four charts showing why interest rates are on hold for now - and why they'll rise soon

Interest rates could be on the way up far sooner than has been predicted – and they could be far higher, too.

The Bank of England says rates would need to rise “earlier” and by a “somewhat greater extent” than they thought at its last review in November.

While members of the Monetary Policy Committee voted unanimously to keep rates on hold at 0.5% for now, several experts – including past members – are predicting several rises to come during 2018.

MORE: How the Bank of England decides whether to put up interest rates

Andrew Sentance, former member of the MPC and now senior economic adviser at PwC, said: “It is no surprise to see interest rates being kept on hold this month. But it is still likely that we will see at least one quarter-point rise in 2018 and possibly two or three.

What’s behind the speculation?

Interest rates have been at historically low levels for years as the Bank sought to support the economy in the fallout from the global financial crash.

But, now the world economy is growing, even a politically unstable and nervous Britain is benefiting.

The share of people without a job is at its lowest level for over 40 years, and businesses are finding it hard to recruit people. The bank says: “Our economy is probably growing about as fast as it can without overheating. And inflation is above our 2% target.”

Here are four charts that explain the reasoning behind the Bank’s position.

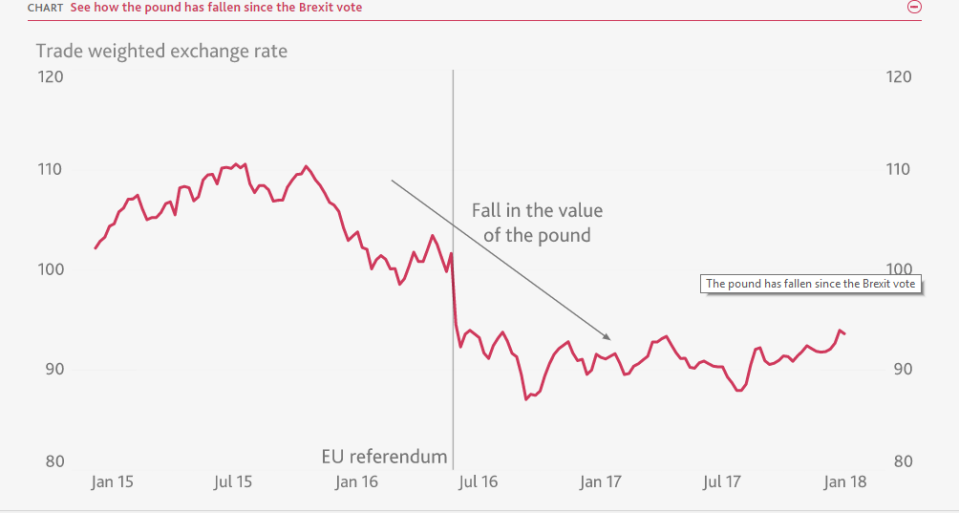

Brexit and sterling:

The pound began falling after the Brexit referendum vote, meaning that things businesses get from abroad cost more.

Those costs are inevitably passed on to consumers.

“The fall in the pound happened around 18 months ago,” says the bank. “Its effect on inflation doesn’t last forever. And in the next few months inflation is going to start to fall back gradually towards our target.”

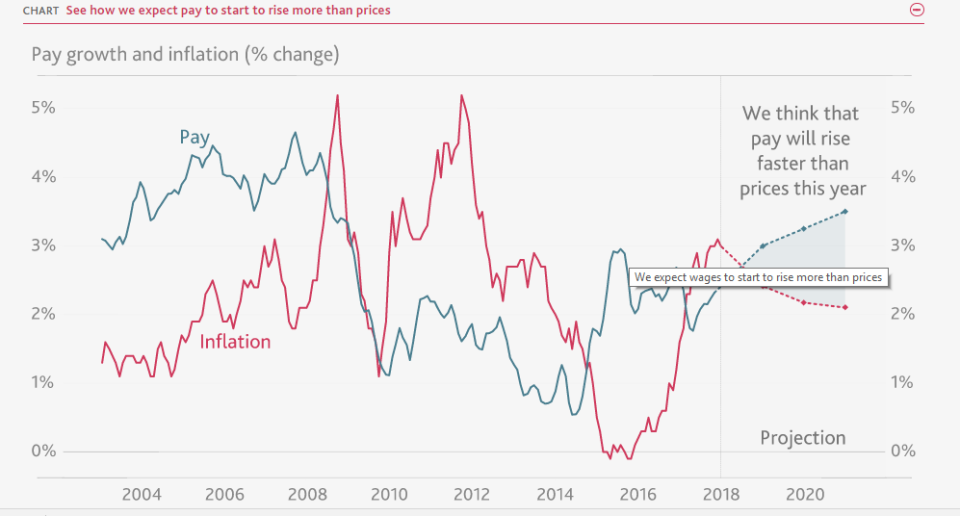

Wages vs inflation:

The bank believes the squeeze on living standards is beginning to ease. For the past 18 months, inflation has outstripped wage rises across the majority of sectors, meaning households have had to budget very carefully where to spend any spare cash.

MORE: Council tax bills to rise by almost £100 – where does your money go?

With fewer people than since 1975 out of work, and with vacancies rising, the bank believes companies are having to compete harder than ever to attract workers – and one way to do that is to pay more.

“We expect bigger pay rises over the next few years.”

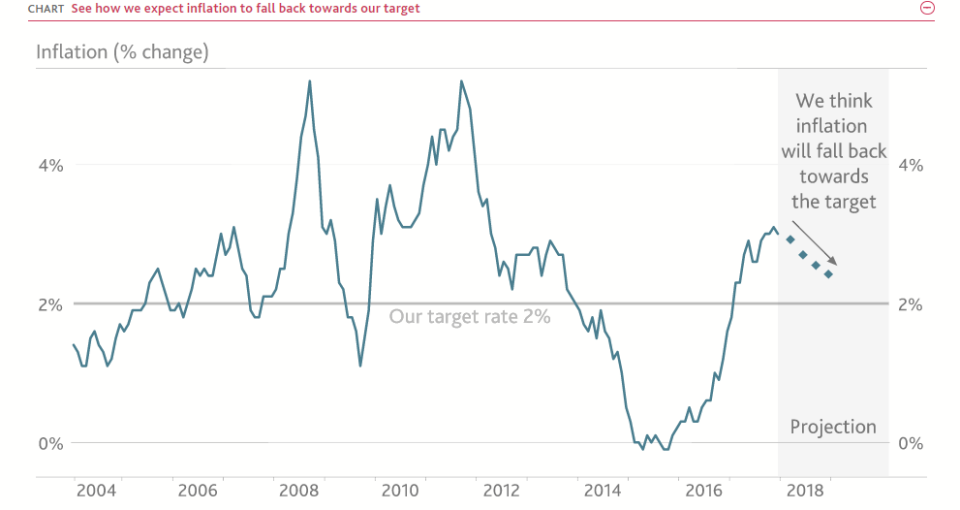

Inflation target:

The official inflation target is 2% but inflation has been running higher than that for the past year.

The balancing act for the bank is to set interest rates at the correct level to keep growth in the economy at a sustainable level.

Set them too low, then growth in the economy will be too fast, and inflation will stay above the target.

Set too high or raised to rapidly, then growth will be too slow, and inflation will fall below the target.

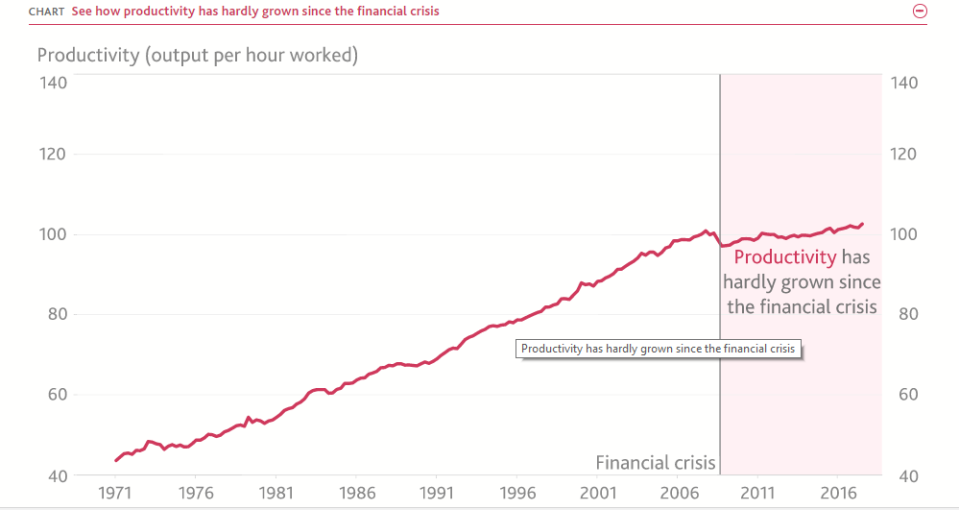

Productivity:

With a record number of people in work, there isn’t much more economic growth that can come from unemployed people finding work.

MORE: Brexit bills: The goods with the biggest price hikes since the EU referendum

Instead, says the bank, it will mostly need to come from higher productivity – getting more out of the people in work.

“We think that productivity will probably grow relatively slowly in coming years, too,” says the bank.

“We think that for inflation to settle back at the 2% target, the economy probably needs to grow at around 1½% in coming years.”

Yahoo Finance

Yahoo Finance