France: Electoral Outcome Set to Slow Growth Reforms, Fiscal Consolidation, and EU Policy Agenda

The emerging alternatives of either a hung parliament or an outright victory for the far-right National Rally would in either case diminish the prospect of growth-enhancing and cost-saving reforms, adding pressure on France’s sovereign credit rating (rated by Scope Ratings AA and Outlook Negative).

The first round of early legislative elections resulted in significant gains for the National Rally and for the New Popular Front left-wing alliance, which both favour expansionary fiscal policies. The results also imply that President Emmanuel Macron’s political party and close allies will be unable to build a workable majority in parliament.

The final configuration of the next National Assembly after the second round on 7 July is unclear. The withdrawals of left-wing and centrist candidates aimed at curtailing the gains of the far right reduce the chances of an outright-majority National Rally government, supporting the scenario of a hung parliament.

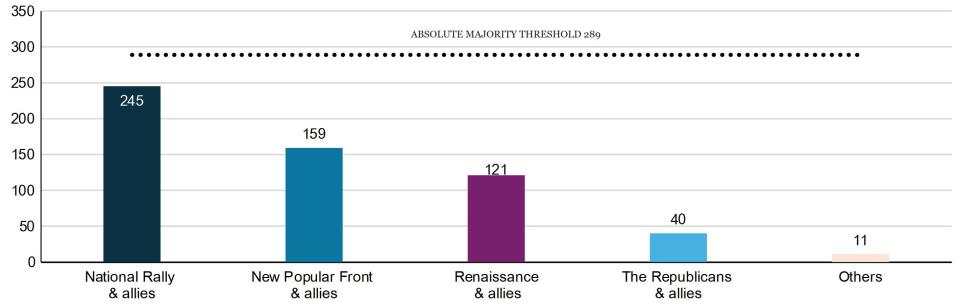

Figure 1: Latest projections point to a hung parliament scenario

Number of seats per major political block in the French National Assembly

Steady Rise in Public Debt Remains France’s Main Economic Challenge

We have highlighted that France’s stretched public finances and high political polarisation already limit the sovereign’s room for policy manoeuvre, which are precisely the risks either parliamentary outcome will likely reinforce.

Expansionary fiscal policy platforms across much of the political spectrum of France thus restrict the prospects of material public-debt reductions in coming years, limiting the country’s ability to withstand future shocks. Whatever the outcome of the second round in the elections, the fiscal trajectory outlined in the 2024 stability programme, with a budget deficit returning below 3% of GDP by 2027, is out of date.

Any new government will have limited fiscal space due to France’s elevated fiscal deficit (5.5% of GDP in 2023) and public debt stock (110.6% of GDP). The consequences of the elections for public finances will depend on the next government’s policy priorities, ability to implement them, and the response of EU institutions as well as market reactions and the magnitude and persistence of any renewed weakening of funding conditions.

Hung Parliament Could Limit Fiscal Slippage but Halt Reform Momentum

The first round shows that France may face a period of political stasis, with potentially neither the National Rally nor the New Popular Front securing an absolute majority after the second round. While this configuration could complicate the 2025 budget-adoption process, it would likely reduce fiscal-slippage risks associated with both groups’ expansionary fiscal policies on which they have campaigned.

The Excessive Deficit Procedure recently launched by the European Commission against France and reactions of capital markets constitute potential guardrails against a more-significant widening of France’s budget deficit. Still, the plausible scenarios for Sunday’s ballot leave a low likelihood that the fiscal deficit will improve materially in coming years.

Political uncertainty also weighs on the growth outlook of France, last forecast by Scope Ratings at 0.8% in 2024 and 1.3% in 2025. Over the near term, heightened economic uncertainty is likely to weigh on business sentiment. In the medium-to-long term, any weak government would likely be unable to achieve significant progress on the structural reforms required to lift growth potential.

EU Funding Conditions and Reform Agenda Could Be Further Affected by French Uncertainties

France’s post-election uncertainties have affected the rest of Europe through a risk-off market environment, as highlighted by earlier rises in funding costs for euro area sovereigns relative to Germany following President Macron’s decision to call early legislative elections. However, spillover across the euro area has to-date remained modest.

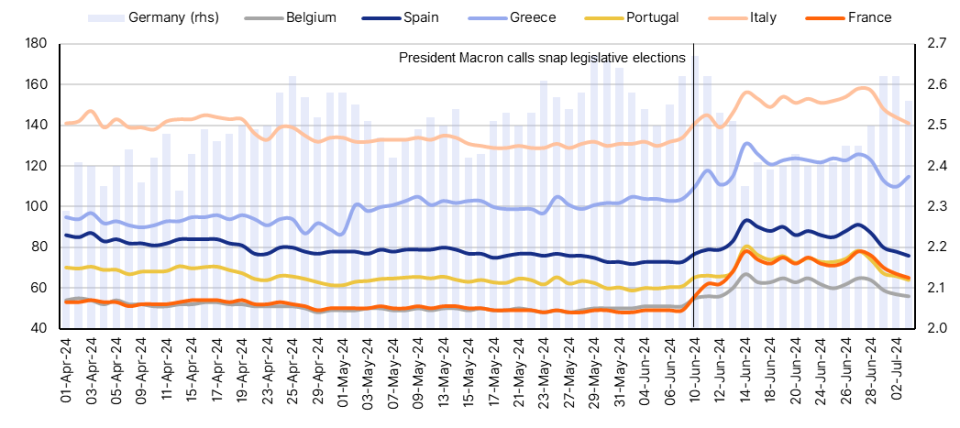

Figure 2: French politics in turmoil but euro-area spill-over modest so far

10-year benchmark bond, yields (%, RHS), spread to the 10-year German Bund (bps, LHS)

Critically, political and policy developments in France are likely to negatively affect the scope and pace of the EU’s reform agenda, including advancements in deepening the Single Market, the Capital Markets Union, and the size and priorities of the next EU budget. The credibility of the EU’s recently adopted fiscal framework could also be tested by the policy priorities of the next French government.

For a look at all of today’s economic events, check out our economic calendar.

Thomas Gillet is Director in Sovereign and Public Sector ratings at Scope Ratings GmbH and primary sovereign analyst on France’s sovereign credit rating. Brian Marly, Senior Analyst at Scope and supporting analyst on France, contributed to drafting this comment.

This article was originally posted on FX Empire

More From FXEMPIRE:

USD/JPY Forecast – US Dollar Continues to See Support Underneath

USD/JPY Forecast – US Dollar Continues to See Strength Against The Yen

G7: Rising Debt Heightens Sovereign Risks Amid Election Uncertainty

AUD/USD Forecast – Australian Dollar Continues to Consolidate

AUD/USD Weekly Price Forecast – Aussie Continues to Chop For The Week

Yahoo Finance

Yahoo Finance