Franco-Nevada (FNV) Q3 Earnings Beat Estimates, Decline Y/Y

Franco-Nevada Corporation FNV reported adjusted earnings of 83 cents per share in third-quarter 2022, beating the Zacks Consensus Estimate of 82 cents per share. The bottom line declined 5% year over year dragged down by lower metal prices.

The company generated revenues of $304 million in the reported quarter, down 4% year over year. Higher revenues from Energy assets driven by realized oil and gas prices were offset by lower revenues from Precious Metal and Iron Ore assets owing to lower metal prices. During the September-end quarter, 67.9% of revenues were sourced from Precious Metal assets (54.7% gold, 10% silver and 3.2% platinum group metals).

The company sold 120,542 Gold Equivalent Ounces (GEOs) from precious metal assets in the reported quarter, down 6% from the prior-year quarter. FNV sold a total of 176,408 GEOs (including Energy), which was down 1% from the prior-year quarter.

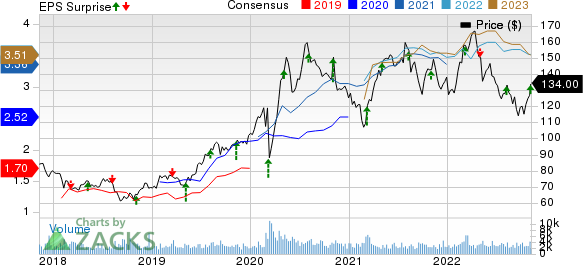

FrancoNevada Corporation Price, Consensus and EPS Surprise

FrancoNevada Corporation price-consensus-eps-surprise-chart | FrancoNevada Corporation Quote

During the reported quarter, adjusted EBITDA was down 5% year over year to $257 million.

Financial Position

The company had $1.06 billion cash in hand at the end of the third quarter of 2022, up from $539 million reported as of the end of 2021. It recorded an operating cash flow of $720 million in the first nine-month period of 2022, up from $676 million in the prior-year period.

Franco-Nevada is debt-free and uses the free cash flow to expand its portfolio and pay out dividends. FNV now has available capital of $2 billion.

Other Updates

On Oct 27, 2022, FNV acquired a 2% net smelter return royalty (“NSR”) on Argonaut Gold Inc.’s (“Argonaut”) construction-stage Magino gold project located in Ontario, Canada, for $52.5 million. The construction of the project is approximately 70% complete, with the first gold pour expected in April 2023.

On Oct 6, 2022, the company acquired a 2% NSR on all of Westhaven Gold Corp.’s claims across the Spences Bridge Gold Belt in Southern British Columbia, Canada, for $6 million and an existing 2.5% NSR from Westhaven on adjoining properties currently owned by Talisker Resources Ltd. for a purchase price of $0.75 million.

On Jul 18, 2022, FNV acquired a gold stream with reference to production from the Tocantinzinho project, owned by G Mining Ventures Corp. which is located in Pará State, Brazil (the “Stream”).

Price Performance

Image Source: Zacks Investment Research

Franco-Nevada’s shares have lost 8.1% in the past year compared with the industry’s fall of 11%.

Zacks Rank & Stocks to Consider

Franco-Nevada currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space include Albemarle Corporation ALB, Commercial Metals Company CMC and Reliance Steel & Aluminum Co. RS.

Albemarle, currently carrying a Zacks Rank #2 (Buy), has a projected earnings growth rate of 430.9% for the current year. The Zacks Consensus Estimate for ALB's current-year earnings has been revised 5.8% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 24.2%, on average. ALB has gained around 10% in a year.

Commercial Metals currently carries a Zacks Rank #2. The Zacks Consensus Estimate for CMC's current-year earnings has been revised 3.8% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 19.7%, on average. CMC has gained around 34% in a year.

Reliance Steel, currently carrying a Zacks Rank #2, has a projected earnings growth rate of 29.7% for the current year. The Zacks Consensus Estimate for RS's current-year earnings has been revised 0.1% upward in the past 60 days.

Reliance Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 13.6%, on average. RS has gained around 25% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

FrancoNevada Corporation (FNV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance