Franklin Covey Leads 3 US Growth Companies With Strong Insider Ownership

As the U.S. stock market exhibits mixed signals with sectors like technology showing resilience and consumer stocks facing downturns, investors are keenly observing market dynamics. In such a landscape, companies with high insider ownership can be compelling as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Duolingo (NasdaqGS:DUOL) | 15% | 48% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.8% | 84.4% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Franklin Covey

Simply Wall St Growth Rating: ★★★★☆☆

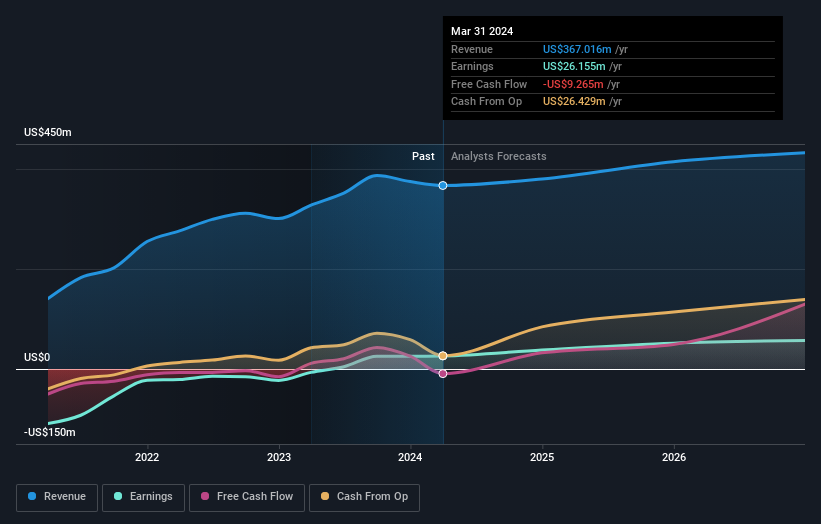

Overview: Franklin Covey Co., operating globally, offers training and consulting services aimed at enhancing execution, sales performance, productivity, customer loyalty, and educational outcomes for both organizations and individuals, with a market capitalization of approximately $456.88 million.

Operations: The company's revenue is segmented into the Education Division generating $70.51 million, Direct Offices within the Enterprise Division contributing $192.38 million, and International Licensees in the Enterprise Division adding $11.56 million.

Insider Ownership: 15.3%

Franklin Covey, a company specializing in organizational consulting and training, demonstrates robust growth potential with its earnings expected to grow by 29.08% annually. Despite recent slight dips in quarterly revenue and net income, the firm's strategic initiatives—including a significant share buyback program authorizing up to US$50 million in repurchases—signal strong confidence from management. High insider ownership aligns leadership interests with shareholder gains, although it trades well below its estimated fair value, suggesting undervaluation.

IMAX

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IMAX Corporation, along with its subsidiaries, functions globally as a technology platform for entertainment and events, boasting a market capitalization of approximately $907.78 million.

Operations: The company generates revenue primarily through two segments: Content Solutions, which brought in $128.61 million, and Technology Products and Services, accounting for $225.79 million.

Insider Ownership: 19.4%

IMAX, a leader in immersive entertainment technology, is expanding globally with recent deals to install advanced IMAX with Laser systems in France and the Philippines, enhancing its international presence. Despite a slight dip in quarterly revenue to US$79.12 million from US$86.95 million and sales falling to US$18.6 million from US$20.06 million, net income rose to US$3.27 million from US$2.45 million year-over-year, reflecting operational resilience. The company's insider transactions haven't shown substantial buying activity recently but continue to demonstrate strategic growth initiatives through global partnerships and technological advancements.

P10

Simply Wall St Growth Rating: ★★★★☆☆

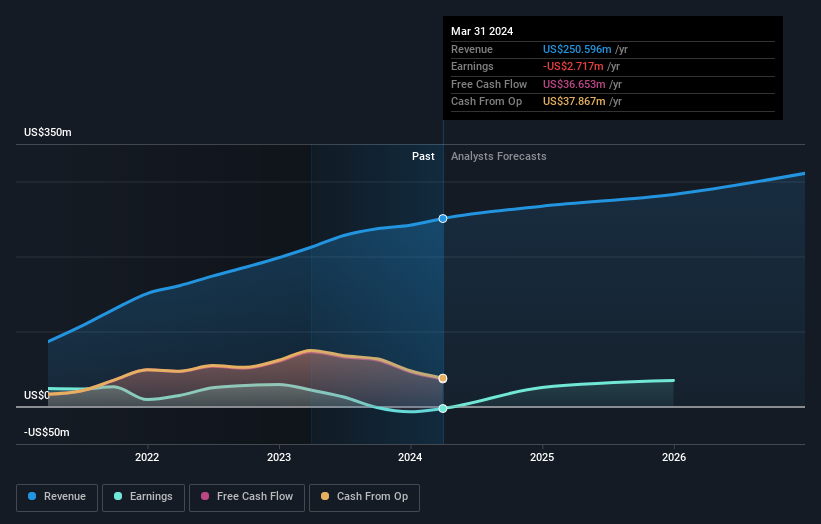

Overview: P10, Inc. operates as a multi-asset class private market solutions provider in the alternative asset management industry in the United States, with a market capitalization of approximately $946 million.

Operations: The firm generates its revenue primarily from asset management, totaling $250.60 million.

Insider Ownership: 34.7%

P10, Inc. demonstrates a mixed growth outlook with its revenue projected to grow at 7.3% annually, slightly below the US market average of 8.6%. Despite this, the company is expected to become profitable within three years, outperforming average market growth predictions. Recent activities include a significant shelf registration and share buybacks totaling US$59.45 million, indicating confidence from management. However, its dividends are not well-covered by earnings and interest payments pose challenges, reflecting some financial strain.

Turning Ideas Into Actions

Unlock our comprehensive list of 184 Fast Growing US Companies With High Insider Ownership by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NYSE:FC NYSE:IMAX and NYSE:PX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance