Volatile French Markets Attempt to Digest Le Pen’s Reassurances

(Bloomberg) -- French stocks gained and bonds posted small moves as traders weighed assurances from far-right leader Marine Le Pen that she’d work with President Emmanuel Macron should she prevail in national elections.

Most Read from Bloomberg

Flesh-Eating Bacteria That Can Kill in Two Days Spreads in Japan

S&P 500 Hits 30th Record of 2024 as Megacaps Rally: Markets Wrap

These Are the World’s Most Expensive Cities for Expats in 2024

How the US Mopped Up a Third of Global Capital Flows Since Covid

France’s CAC 40 benchmark advanced 0.9% as of 5:04 p.m. in Paris. The main European stock measure swung between gains and losses as Citigroup Inc. downgraded the region’s equities, citing “heightened political risks” among other reasons. Yields on French government bonds rose again on Monday, while the spread over their German peers remained broadly steady.

Concern about political volatility after Macron called a snap vote for later this month spurred a flight to haven assets last week, wiping out $258 billion from the market capitalization of the country’s stocks. On Monday, traders initially seized on Le Pen’s comments that she won’t try to push Macron out, but sentiment remains fragile before the first round of voting on June 30.

“Investors should stay out of it at the moment,” said Evelyne Gomez-Liechti, rates strategist at Mizuho International. While “there can be some short-term small consolidation,” there’s still huge uncertainty given a lack of clarity over the economic policies of Le Pen’s National Rally, she said.

Europe’s Volatility Likely to Spread to Wall Street, IG Warns

Last week’s losses saw France slip behind the UK as the biggest equity market in Europe. The slump erased all of the CAC 40 benchmark’s gains for 2024 — a sharp reversal from scaling record highs a month ago. An index of euro-denominated junk bonds — almost a fifth of which comprises French companies — widened sharply to its highest spread over benchmarks since early April.

Big Trades in French Bank Bonds Surge on Snap Election Risks

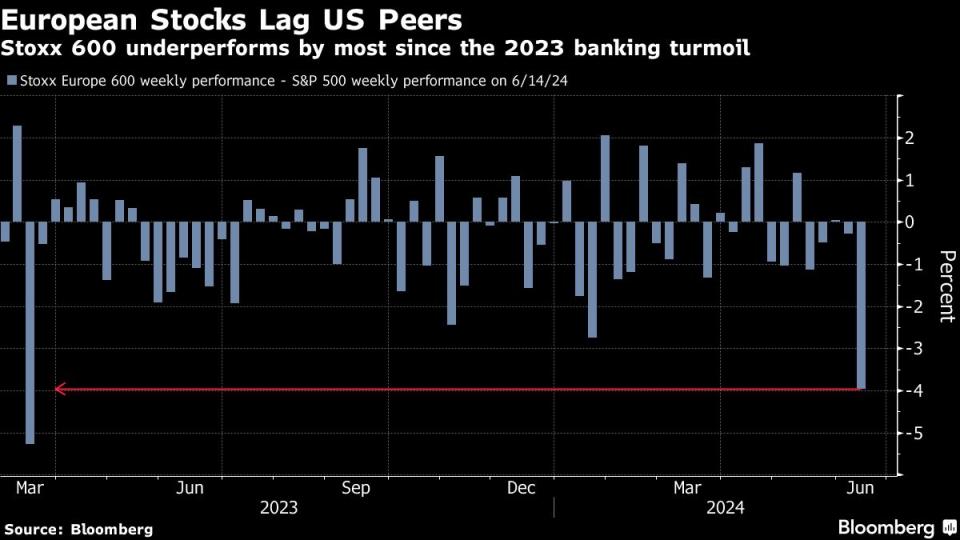

The retreat last week also spread into broader European equity markets, with the benchmark Stoxx Europe 600 Index suffering its worst week since October. The gauge traded up 0.1% after climbing as much as 0.7% earlier.

Not ‘Disorderly’

A raft of officials and strategists suggested the declines were overdone.

“What we’re seeing in the markets is, of course, a repricing,” European Central Bank Chief Economist Philip Lane said on Monday at an event organized by Reuters in London. “It’s not, you know, the world of disorderly market dynamics.”

According to Liberum’s Joachim Klement and Susana Cruz, concerns about a right-wing prime minister are overblown and markets will calm after the vote.

While a gauge of redenomination risk — the risk that France leaves the eurozone — jumped last week, it remains well below the levels seen in 2017 when then-presidential candidate Le Pen advocated leaving the European Union. The party has since softened its stance toward European Union membership.

Frédérique Carrier, head of investment strategy at RBC Wealth Management, noted that populist politicians have a history of moving closer to the center once they reach power and Le Pen’s comments had fueled hopes for that outcome in France.

Still, “foreign investors are nervous about the heightened political risk that the situation in France brings,” she said.

That nervousness is further blurring the lines in Europe’s traditional debt hierarchy, putting French bonds on a par with those once at the heart of the region’s debt crisis.

Portuguese debt now yields less than comparable French debt, while the gap between Spanish and French 10-year yields has dwindled to just 11 basis points, the least since 2008 on a closing basis.

It’s an extension of a long-term trend that’s been playing out for years, with investors increasingly demanding more compensation given the country’s bloated debt pile. The European Commission is expected to initiate its Excessive Deficit Procedure against France this week, an action designed to force member states to get poor public finances in line with EU rules.

--With assistance from Julien Ponthus, Allegra Catelli, Abhinav Ramnarayan, James Hirai and Anchalee Worrachate.

(Updates prices throughout, additional context from paragraph 10.)

Most Read from Bloomberg Businessweek

Google DeepMind Shifts From Research Lab to AI Product Factory

Trump’s Planned Tariffs Would Tax US Households, Economists Warn

It Will Take More Than US Bargaining Power to Cut Drug Costs

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance