Is this FTSE 100 behemoth about to make investors rich all over again?

FTSE 100 behemoth AstraZeneca (LSE:AZN) is on the verge of becoming a £200bn company. It’s already the largest stock on the index and the most valuable British stock overall, having recently overtaken US-listed and perhaps lesser-known, Linde.

AstraZeneca is also among the most successful UK stocks over the past five years — the stock is up 100% over the period. However, it could be about to make us all rich again with the company planning to nearly double revenue over the next six years.

Ambitious plans

AstraZeneca is a titan in the pharmaceutical, biotech, and oncology sectors. But it’s lagging several of its international peers in terms of headline numbers and market cap.

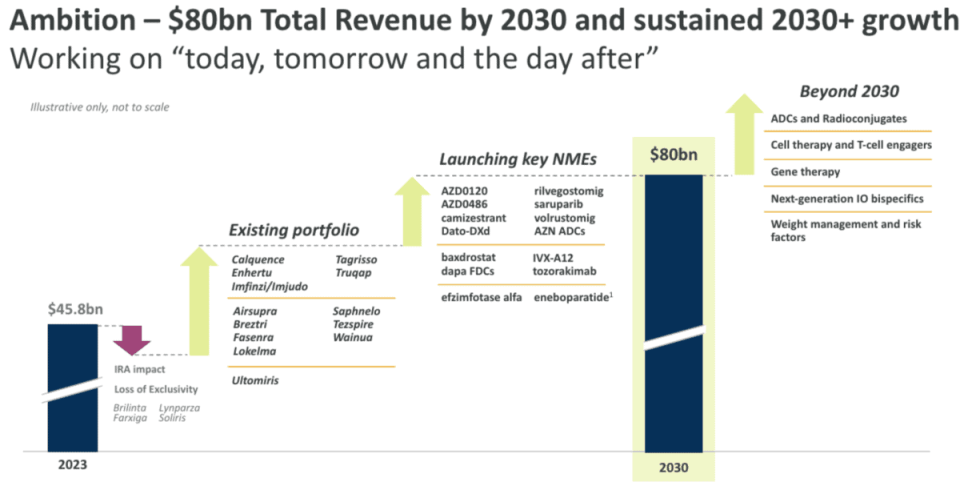

However, in May, management set a bold new target. The company wants to achieve $80bn in revenue by 2030, a significant leap from the $45.8bn reported in 2023.

This leap will be driven by the introduction of 20 new medicines, many still in development, over the next six years, and a renewed commitment to invest in disruptive innovation and new technologies “that will shape the future of medicine“.

CEO Pascal Soriot highlighted that AstraZeneca’s 20 new medicines could each deliver more than $5bn annually in peak-year revenues.

Is it possible?

These are ambitious targets even by the standards of big pharma. But maybe it’s not as hard as it sounds.

It essentially means that AstraZeneca will need to grow revenue by just short of 10% annually over the next six years. We don’t always see this kind of growth from big-cap stocks, but it’s certainly achievable, and management clearly has confidence in the pipeline.

The below chart adds a little depth to the target, highlighting which drugs will no longer be exclusive to AstraZeneca, which existing drugs will push towards peak revenue, and which new molecular entities (NMEs) will be launched.

Oncology is a major part of the company’s plans, with revenue from this segment potentially exceeding $50bn by the end of the decade. In addition to new drugs, and the increasing number of cancer diagnoses, AstraZeneca is looking to open new markets, pushing closer to the lucrative Chinese market with a $1.5bn factory in Singapore.

The bottom line

Since AstraZeneca unveiled its ambitious plans, the share price has remained largely flat and analysts haven’t universally upgraded their price targets. The share price target represents a 10% premium to the current position. That’s good news, but there are much wider discounts on the FTSE 100.

When it comes to pharma, there are always risks related to the huge cost of developing drugs, and the high rate of failure. That’s a risk AstraZeneca shareholders will have to deal with even if it does have a broad portfolio of new drugs.

However, at 19.4 times forward earnings, I think AstraZeneca could be a steal. Earnings are expected to grow at 12.3% over the next three to five years, with the forward price-to-earnings for 2027 being just 15 times.

Meanwhile, the price-to-earnings to growth (PEG) ratio sits at 1.59. This doesn’t scream ‘buy’, but the PEG ratio is very much medium-term focused, and investing in pharma is a long-term game in my opinion. I think AstraZeneca could make shareholders richer over the coming years.

The post Is this FTSE 100 behemoth about to make investors rich all over again? appeared first on The Motley Fool UK.

More reading

James Fox has positions in AstraZeneca PLC. The Motley Fool UK has recommended AstraZeneca Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance