FTSE 100 Live 11 June: Index closes down 1% amid surprise unemployment rise, high wage growth

Raspberry Pi’s stock market debut and the City response to unemployment and earnings figures are in today’s spotlight.

The Cambridge-based tech firm made a strong start to conditional dealings after being given an initial valuation of £541 million.

Meanwhile, hopes of a summer cut in interest rates have been maintained despite today’s latest evidence of strong wage growth.

FTSE 100 Live Tuesday

Wage growth clouds rates outlook

Raspberry Pi stock market debut

FirstGroup profits top £200m

FTSE closes down 1%

Tuesday 11 June 2024 16:37 , Daniel O'Boyle

The FTSE 100 closed down 1% today at 8,147.81, its lowest level since the start of May.

The index started the day ahead but slid as the day went on.

London’s top flight is now down by more than 3% in the last month.

Top risers included Hikma Pharmaceuticals and Convatec. Big fallers included Standard Chartered and Antofagasta.

Back to flat: GDP growth set to hit zero as the economy struggles to expand

Tuesday 11 June 2024 15:34 , Daniel O'Boyle

The struggle to keep the economy moving will be back into the City spotlight tomorrow, when official UK GDP numbers for April look set to show that it is stuck on the flatline.

Square Mile experts are predicting that month-on-month growth will be absent, with the size of the UK’s gross domestic product unchanged in April from March. Over the year, it is forecast to have expanded by 0.6%, down from rate of 0.7% the month before.

Readings like that will come as a reminder of the stubbornly sluggish showing that has blighted the British economy.

Severn Trent boss paid more than £3m despite rise in pollution incidents

Tuesday 11 June 2024 15:03 , Daniel O'Boyle

The boss of embattled water company Severn Trent received a £3.18 million pay packet for the last financial year, despite a spike in pollution incidents and flooding from its sewers during the same period.

Chief executive Liv Garfield’s pay deal for the year to March 31 included a salary of £799,000, plus £584,000 in annual bonuses. The rest was made up of long-term bonuses, pension and benefit payments, according to Severn Trent’s annual report published on Tuesday.

Her pay packet was down slightly from £3.21 million for the previous financial year, which she recently defended.

Sir Patrick Vallance: Local authorities should pool pension funds to boost startup investment

Tuesday 11 June 2024 14:27 , Daniel O'Boyle

The UK’s former chief scientific adviser has called on local authorities to pool their pension funds in order to more effectively deploy investment into higher-risk, fast-growth tech startups.

Sir Patrick Vallance, known for his appearances on televised government briefings during the coronavirus pandemic, said larger funds would help fund managers better understand and manage risks when making venture investment.

Share of first-time buyers with dependants has doubled since 2009 says Santander

Tuesday 11 June 2024 12:59 , Daniel O'Boyle

Around one in five first-time buyers have at least one dependant, in signs that more people getting on to the property ladder already have families, according to a major bank.

Some 20% of first-time buyers in 2023 had at least one dependant, up from 10% in 2009, figures from Santander show.

According to the bank’s customer data from the first quarter of 2024, a fifth of people taking their first step on the property ladder are over the age of 40.

FTSE 100 lower amid French bond sell-off

Tuesday 11 June 2024 12:56 , Daniel O'Boyle

The FTSE 100 tumbled as the France’s politicial uncertainty-sparked bond sell-off extended into a second day.

The FTSE is now at its lowest since the start of May, down almost 1% for the day at 8150.

Yields on longer-dated French bonds have risen by as much as 10 basis points today, and more than 30 basis points in two days.

Credit scores ‘could receive a boost as General Election approaches’

Tuesday 11 June 2024 12:47 , Daniel O'Boyle

The nation’s credit scores could receive a boost as the General Election approaches, according to a financial firm.

Being on the electoral register may potentially have a positive impact on someone’s credit rating, with the data helping lenders to confirm names and addresses.

But a survey for money insights provider Intuit Credit Karma found that two-thirds (66%) of people were unaware that being registered to vote may help improve a credit score, rising to 84% of 18 to 24 year-olds.

Follow the Tory manifesto launch live

Tuesday 11 June 2024 12:17 , Daniel O'Boyle

Rishi Sunak has pledged a further cut to national insurance as he unveils the Conservative Party’s election manifesto.

The Tories' manifesto commits to a further 2p national insurance reduction, to 6%, as part of a drive to eliminate the employee rate altogether.

Follow all of the pledges - on tax, business, pensions and more, with our politics live blog.

New home approvals in London lowest since 2012

Tuesday 11 June 2024 12:13 , Daniel O'Boyle

Hopes of an easing in London’s housing crisis were dealt a blow today by figures showing a dramatic slump in planning permissions granted for new homes in the capital during the first quarter of the year.

The latest Housing Pipeline Report from the Home Builders Federation (HBF) revealed that just 7,613 units were approved in London between January and March. This is the lowest quarterly figure since 2012 and represented a 39% drop on the same period last year and a 51% fall compared with the fourth quarter of 2023.

The rolling 12-month total for units approved in London was the lowest since the third quarter of 2015.

Quoted home insurance prices ‘surge by 41.6% on average in a year’

Tuesday 11 June 2024 11:33 , Daniel O'Boyle

The average quoted price of home insurance jumped by 41.6% in the 12 months to April, according to an index.

This is the biggest jump since Consumer Intelligence started tracking prices in 2014.

Premiums are most commonly being quoted at between £150 and £199, Consumer Intelligence said.

Gemfields appoints former De Beers leader to replace its long-serving chairman

Tuesday 11 June 2024 11:12 , Michael Hunter

Gemfields, the London-listed precious stones miner, has appointed a former De Beers co-chairman to run its board.

Bruce Cleaver will take up the chairmanship of the coloured gemstone miner at the start of next month.

He will replace Martin Tolcher, who steps down after 15 years on the board and five in the chair.

Tolcher said: “the time has come for me to step away from the Company in order to bolster Board independence. I am truly delighted to have such a remarkable successor in Bruce”.

Cleaver said: “Gemfields is a unique and extraordinary business, one that has taken a fragmented and fairly informal industry to considerable sophistication.

“The parallels with DeBeers’ origins and how consistent and reliable supply can deliver remarkable industry growth and positive contributions to communities, are clear.”

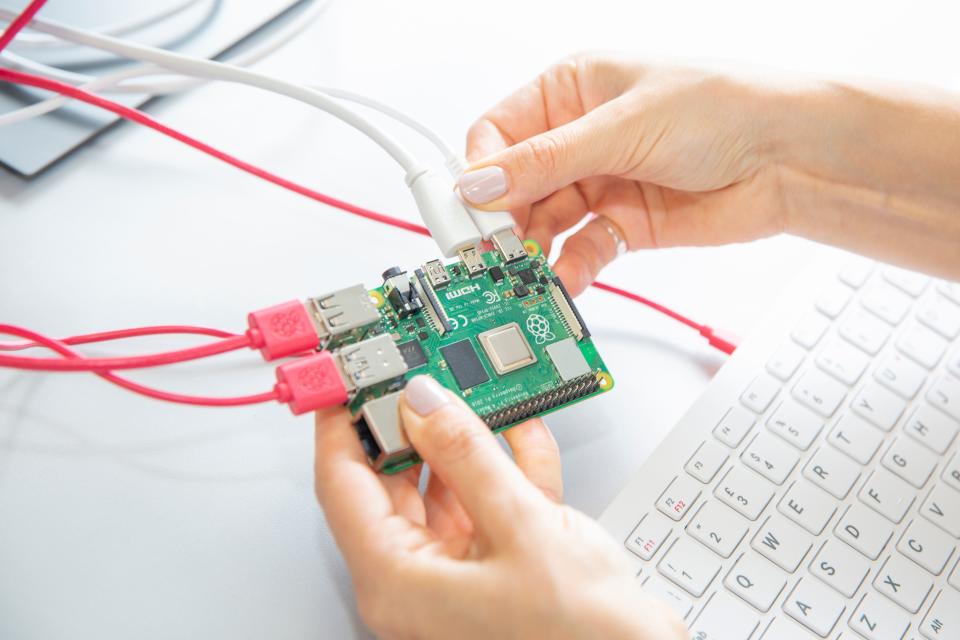

Raspberry Pi shares jump on LSE debut

Tuesday 11 June 2024 10:48 , Simon Hunt

The London Stock Exchange today received a much-needed boost after shares in computer firm Raspberry Pi began trading following its hotly-anticipated IPO.

The Cambridge-based business, which makes small single-board computers, has priced its shares at 280p, at the top of its estimated pricing range, in its flotation.

The company is set to raise £166 million from the listing, with the terms suggesting a valuation of £541.6 million.

But shares in the company soared to just under 390p in the opening minutes of trade, pushing the firm’s valuation up to within touching distance of unicorn status, given to businesses worth more than $1 billion.

Eben Upton, chief executive of Raspberry Pi, said: “The quality of the interactions during the marketing process has underlined our belief that London has the right calibre and sophistication of investor to support growing, ambitious technology businesses such as Raspberry Pi.”

It’s hoped that a successful float could open the floodgates to more major tech IPOs. Several London-based businesses, including fintechs Zilch and Zopa, have announced plans for IPOs but have yet to choose a date or settle on London as their preferred exchange.

Mining weakness hits FTSE 100, Oxford Instruments up 12% in FTSE 250

Tuesday 11 June 2024 10:24 , Graeme Evans

Falls of 2% for Glencore and Rio Tinto provided the biggest downward drag today as the FTSE 100 index weakened 37.82 points to 8190.66.

HSBC also came under pressure after a drop of 3.6p to 690p but housebuilding firms proved to be more resilient after today’s labour market figures.

Persimmon led the way with a gain of 32.5p to 1478.5p, while Rightmove added 5.6p to 559.4p. They were joined by asset manager Intermediate Capital, which jumped 48p to 2294p after UBS analysts upped their price target to 2700p.

The FTSE 250 index improved 62.78 points to 20,508.82, with Oxford Instruments the star performer as shares jumped 12% on the day of its annual results.

The company, which was founded in 1959 as the first technology business to be spun out from University of Oxford, provides services to industry and scientific research communities.

Annual profits rose slightly to £83.3 million, with strong order book growth boosting hopes for further progress in the current year. The shares surged 290p to 2750p as it also announced the acquisition of a Zurich firm in a further boost to its materials analysis techniques.

On AIM, the upturn in fortunes for GB Group shares continued after the digital location and identity business posted results in line with expectations. The stock lifted 7.2p to 353.2p.

Rise in bus travel via £2 fare cap helps First Group take annual operating profit north of £200 million

Tuesday 11 June 2024 10:20 , Michael Hunter

Bus and train operator First Group has reported annual profits above £200 million, helped by rising passenger numbers after the £2 fare cap in England and the popularity of its Lumo electric train line between London and Edinburgh.

The FTSE 250 firm reported adjusting operating profit of £204.3 million in the 53 weeks to March 30, up from £161 million a year earlier. Revenue slipped to £4.72 billion from £4.76 billion.

Revenue at its bus unit rose – crossing above £1 billion, up 12% to £1.01 billion – helped by the simplicity brought by the fare cap, which was extended to the end of the year. Total passenger revenue increased by over £100 million to £769.1 millon, with revenue per mile up by 13%.

FirstGroup boss points to TfL and the Elizabeth Line for signals on rail nationalisation

It also said its Lumo train service between London Kings Cross and Edinburgh has now carried over 2.5 million passengers since its launch in October 2021. It wants to extend some of the services to Glasgow, and has made “formal applications” to do so.

Overall, its rail business lifted the number of passenger journeys to 274 million, up from 263 million.

Market snapshot: FTSE 100 flat, Bitcoin down

Tuesday 11 June 2024 09:47 , Daniel O'Boyle

The FTSE 100’s early gains have been erased, with London’s blue-chip index falling into negative territory.

Take a look at the latest market snapshot

TfL and Elizabeth line could signal the future for nationalised rail, says FirstGroup boss

Tuesday 11 June 2024 09:19 , Michael Hunter

The boss of FirstGroup has pointed to London for signs on how its future might work as the UK’s biggest public transport company faces the potential nationalisation of the railways after the general election.

Graham Sutherland backed the way Transport for London blends public control of its network with services operated by the private sector as First reported a rise in passenger numbers and profits.

““Any concerns around existing national rail contracts could be resolved with a concession-type agreement that TfL runs”, he told the Standard.

“We think that gives public control and holds the private sector to account on service levels and that is a good model. TfL are bidding the Elizabeth Line at the moment on a similar contract. We do think the government could learn something from that.”

The FTSE 250 firm’s shares rose by over 1p to 171p, a gain of 0.7%. It reported adjusting operating profit of £204.3 million in the 53 weeks to March 30, up from £161 million a year earlier.

Cake Box profits grow, but warns of 'challenging' 2025

Tuesday 11 June 2024 08:49 , Daniel O'Boyle

Egg-free baker Cake Box says the upcoming year "is expected to be challenging", as “uncertain macroeconomic conditions” lead Brits to cut back on sweet treats.

However, the franchised chain added that new stores, investment in marketing and a “refresh” of its brand will help boost sales.

Revenue for the year to 31 March rose by 9% to £37.8 million, while profits were up 15% to £6.3 million, as increases in the price of key ingredients like cream and flour slowed. Total turnover at Cake Box stores grew to £78.8 million, as the business opened 20 new shops, bringing its total estate to 225.

Trading so far this year has been in line with expectations. The business said: “Whilst the trading environment for 2025 is expected to be challenging with the continuing uncertain macro-economic conditions, the opening of new stores, investment in marketing, alongside a brand refresh roll out and new website, will help drive demand.”

The shares edged up by 3p to 178.2p this morning, valuing the business at £71.3 million.

Apple Intelligence is ‘promising first step’ for firm’s AI tools, experts say

Tuesday 11 June 2024 08:33 , Daniel O'Boyle

Apple’s new generative AI tools are a “promising first step” for virtual assistants and will enable the firm to “remain competitive” in the emerging AI market, industry experts have said.

On Monday, the iPhone maker offered the first details on how it will begin integrating its new Apple Intelligence generative AI system into the iPhone, iPad and Mac, where it will be able to create language and images, as well as offer guidance and support on everyday tasks, helping with image and video editing, and general file organisation.

Building firms lead FTSE 100, Raspberry Pi shares make strong start

Tuesday 11 June 2024 08:32 , Graeme Evans

Housebuilders dominate today’s FTSE 100 risers board, with Taylor Wimpey, Berkeley, Barratt Developments and Persimmon up by between 1% and 2%.

Tesco and Sainsbury’s are also on the risers board, helping the FTSE 100 index to stand 16.69 points higher at 8245.17.

The five biggest fallers all came from the mining sector, led by Rio Tinto after a decline of 2% or 104p to 5253p.

The FTSE 250 index rose 66.97 points to 20,513.01.

Oxford Instruments, which serves industry and scientific research communities, jumped 7% or 175p to 2635p after announcing an acquisition alongside annual results.

Meanwhile, conditional dealings in Raspberry Pi are off to a strong start after shares jumped from their opening level of 280p to trade at 370p.

Raspberry Pi valued at £541m in London IPO

Tuesday 11 June 2024 07:52 , Graeme Evans

Raspberry Pi has been valued at £541.6 million after shares were priced at 280p before today’s start of conditional dealings in the Cambridge-based tech firm.

The IPO by the maker of high-performance, low-cost general-purpose computing platforms has provided a boost to the London stock market.

Chief executive Eben Upton said today: “The quality of the interactions during the marketing process has underlined our belief that London has the right calibre and sophistication of investor to support growing, ambitious technology businesses such as Raspberry Pi.

“The reaction that we have received is a reflection of the world-class team that we have assembled and the strength of the loyal community with whom we have grown.”

'Sticky wage growth may not stop Bank from cutting rates in August'

Tuesday 11 June 2024 07:36 , Daniel O'Boyle

Ruth Gregory, deputy chief UK economist at Capital Economics, says the continued high wage growth may be a ‘concern’ for the MPC, but may not prevent it from cutting rates this summer.

She said: “The stickiness of wage growth in April will be a lingering concern for the Bank of England. But with employment falling sharply and the unemployment rate climbing, we think wage growth will soon be back on a firm downward path.“

“Overall, the stickiness of wage growth may not stop the Bank from cutting interest rates for the first time in August, as we are forecasting, as long as other indicators such as pay settlements data and next week’s CPI inflation release show decent progress.“

Airports boom after busy half-term

Tuesday 11 June 2024 07:25 , Simon English

THE economy might be steady at best, but airports are booming as people look to get out of the UK, at least on holiday.

Heathrow today said it served a record breaking 81.5m passengers in the 12 months to May.

Meanwhile a bumper half-term holiday week at London Stansted helped boost May’s passenger numbers to a record-breaking 2.7million, the busiest ever May at the airport.

The monthly total was up 6.4% on the same month in 2023, and surpassed the previous busiest ever May in 2019 by 143,000 passengers.

Heathrow said: “Terminal 2 – The Queen’s Terminal celebrates 10 years of operations this summer. Since opening in 2014 it has seen 148m passengers traveling to more than 30 different countries on over a million flights.”

Heathrow CEO Thomas Woldbye said: “Supporting 81m journeys doesn’t just help families to make wonderful holiday memories, importantly it is about the vital trade and business links a hub like Heathrow creates for the UK’s economy.”

James Richardson, London Stansted’s Finance Director, said:

"London Stansted’s fantastic range of destinations, and reliable and efficient airport operation continues to drive strong demand as we welcomed 2.7 million passengers to the airport in May.

“The record-breaking numbers were boosted by a very busy half-term week as hundreds of thousands of Brits headed off on holiday as well as huge numbers of overseas visitors choosing the airport as their gateway to London and the East of England.”

Tuesday 11 June 2024 07:24 , Daniel O'Boyle

Yael Selfin, chief economist at KPMG UK, says the latest jobs figures are “unlikely to shift the dial at the Bank of England”.

Selfin said: ““Wage growth remained elevated in April as the 10% hike in the National Living Wage was enough to temporarily arrest the downward momentum in pay.

“The unemployment rate ticked up to 4.4%. The recent weakening in demand for staff has been attributed to a lack of roles and firms delaying hiring decisions. This is consistent with a broader trend of retaining existing labour, and could signal that firms expect a pickup in activity so that they could utilise their existing staff more.”

“We expect the MPC to stay put at its June meeting and reassess the incoming data flow over the summer before it embarks on cutting interest rates.”

FTSE 100 seen higher after steady US session, Apple shares fall 2%

Tuesday 11 June 2024 07:20 , Graeme Evans

The FTSE 100 index is set for a steady session after Wall Street took a relaxed stance ahead of tomorrow’s inflation reading and Federal Reserve decision.

The S&P 500 index and the Magnificent Seven group of heavyweight stocks both rose by 0.3%, although Apple fell 2% after it unveiled new AI features for the iPhone.

FTSE 100 futures point to a rise of 20 points to 8248, putting back the losses seen yesterday after European markets were rattled by France’s snap election.

The Paris-based CAC40 fell 1.4% yesterday, with the shares of banks including BNP Paribas hit hard by the political uncertainty. The benchmark is seen opening slightly higher today.

Brent Crude stood at $81.52 a barrel this morning, having surged by more than 2% in yesterday’s session.

Will the Bank of England forge its own path?

Tuesday 11 June 2024 07:17 , Daniel O'Boyle

George Sweeney (DipFA), financial advisor at personal finance site Finder.com, says: “The latest figures from the ONS show wage growth excluding bonuses remains level at 6%. This was what some economists were expecting. Although it’s positive for people’s wages and could help us continue to crawl away from the recent recession, this continuing growth doesn’t bode well for the possibility of incoming rate cuts from the Bank of England (BoE).”

“We’ve seen inflation fall back to manageable levels, but the BoE will be looking at all the data available before making a decision on whether to lower the base rate. The key question is going to be how much stock the Monetary Policy Committee put into wage growth data compared to inflation and figures like the unemployment rate.

“The European Central Bank (ECB) cut rates to 3.75% at the end of last week, but the next US inflation reading and Fed Funds rate decision could be more influential for the UK. The jury’s out on whether we’ll follow moves from the EU, the US, or forge our own path forward.”

Wage growth remains high

Tuesday 11 June 2024 07:07 , Daniel O'Boyle

Wage growth in the UK including bonuses was higher than expected at 5.9% for the three months to April, while growth excluding bonuses was unchanged at 6.0%.

Both figures are at levels the Bank of England has indicated are too high to be consistent with its 2% inflation target.

The persistently high figures may encourage the Bank of England to wait until the Autumn to cut interest rates

UK unemployment up to 4.4%

Tuesday 11 June 2024 07:04 , Daniel O'Boyle

Unemployment in the UK rose to 4.4% in the three months to April, in the latest sign that high interest rates are loosening the labour market.

It’s the highest unemployment rate since July 2021.

Unemployment had been expected to hold steady at 4.4%.

Recap: Yesterday's top stories

Tuesday 11 June 2024 06:49 , Simon Hunt

Good morning from the Standard City desk.

European financial markets fell back on Monday as political uncertainty weighed on investor sentiment.

French stocks were particularly weak due to President Emmanuel Macron’s shock decision to call a snap election.

Banks were particularly heavy losers amid a lack of clarity over the future government in the country, denting firms in the sector across the UK and Germany as well.

The Cac 40 in France ended 1.35% lower and the German Dax index was down 0.37% at the close.

The FTSE 100 finished 16.89 points, or 0.20%, lower to end the day at 8,228.48.

Across the Atlantic, the Dow Jones inched lower as traders were cautious ahead of key inflation data and a Federal Reserve interest rate decision later this week.

~

Here’s a summary of our top stories from yesterday:

Leading business group urges new government to unleash London as an “engine of growth” with a package of “quick win” measures including more devolution, relaxing planning rules and ending the tourist tax

Digital ad firm Brave Bison pulls out of £30 million takeover of rival Mission after rejection of its bid

Photo booth group ME Group brings a record number of self-service laundry machines to supermarket car parks and petrol station forecourts

Nationwide members urged to vote “no” to Virgin Money takeover at building society AGM next week by rebel group

Yahoo Finance

Yahoo Finance