FTSE 100 Live: Pound hits lowest rate of 2023 against the dollar, London house prices dip

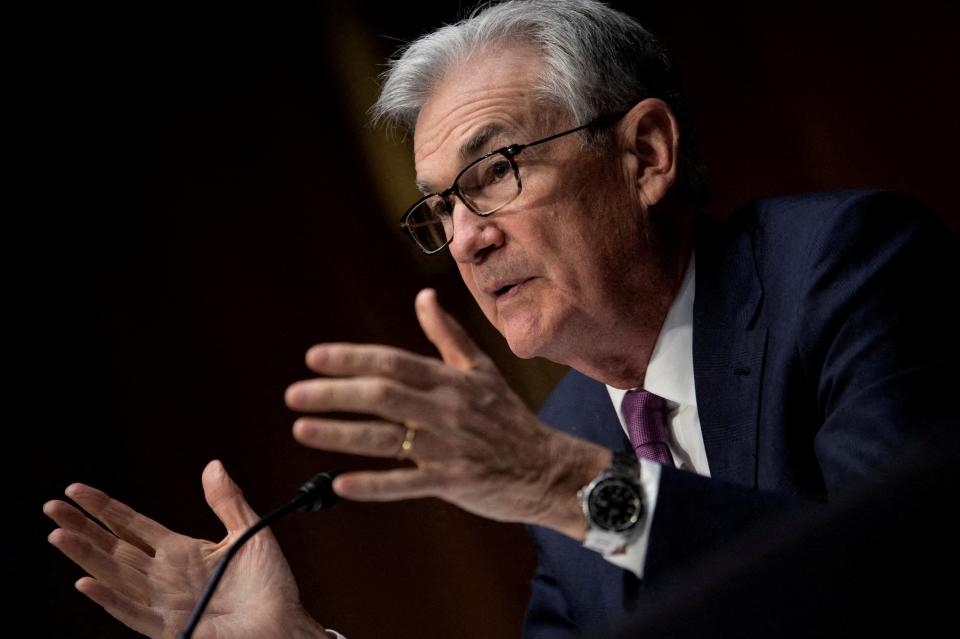

The pound fell below $1.19 for the first time this year, following comments from US Federal Reserve chair Jerome Powell.

Powell told Congress that the Fed would likely raise interest rates to a level higher than previously thought, after inflation came in higher than expected.

The testimony strengthened the value of the dollar, leading the pound’s exchange rate against the currency to dip just below $1.19. It hovered slightly above that level in early January, which had been the lowest exchange rate of the year.

Elsewhere, unchanged annual house price growth of 2.1% today pointed to continued resilience in the UK property market.

Mortgage lender Halifax also reported a monthly price increase of 1.1%, up from 0.2% in January and after the fall of 1.3% December.

It said lower mortgage rates, improving consumer confidence and a robust labour market had stabilised prices after a difficult end to 2022.

Greggs, Foxtons and Reach were also among the companies reporting results today.

FTSE 100 Live Tuesday

House market steady after February price growth

Foxtons says mini-Budget impact still being felt

Greggs eyes ‘significantly more than 3,000 UK shops

Business leaders call for UK version of Joe Biden’s Inflation Reduction Act

18:10 , Daniel O'Boyle

A poll of UK business leaders has found the vast majority would support a British version of US President Joe Biden’s Inflation Reduction Act, which subsidises domestic investment in green technologies.

In total, 78.9% of the 859 Institute of Directors (IoD) members who were polled backed the idea. Most of those in favour said they supported the plan because it would help tackle climate change, while a significant minority of those in support said it would “level the playing field with the EU and the US”.

Of those who opposed the plan, around two thirds said there were better uses of taxpayer resources than green subsidies, while the remainder said it was a “protectionist policy”.

Hospitality bosses urge Chancellor to reform rates, planning and licensing in 2023 budget

18:01 , Daniel O'Boyle

The bosses of 155 UK hospitality businesses have signed a letter to Chancellor Jeremy Hunt, calling on him to bring in reforms to planning, licensing and business rates, among other changes they said would “unshackle” the sector.

The letter - signed by companies including Wetherspoons, IHG, the Restaurant Group and Mitchells & Butlers -said that inflation, and particularly high energy costs, has prevented the sector from truly recovering from the Covid-19 pandemic.

“While trade remains relatively stable, our businesses simultaneously face rising costs that erode margins and force prices up, and debt repayments that stifle investment,” the letter said. “Yet hospitality can instead be part of the solution to inflation.”

Legal and General, Hiscox and Galliford reporting tomorrow

17:27 , Daniel O'Boyle

A busy week of financial results will continue tomorrow, with Legal and General, Admiral, Hiscox and Galliford Try among those reporting results.

Also reporting will be cybersecurity firm Darktrace, which ordered an external report into its finances in a bid to fend off a short-seller report questioning the validity of its statements to shareholders last month.

The EU is also set to release GDP figures for Q4 of 2022.

FTSE closes at 7919

16:53 , Daniel O'Boyle

The FTSE 100 closed at 7919.48 today, after morning gains were erased by fears of further US interest rate hikes.

The index of top London-listed companies was up for most of the day, peaking at 7959.30 in the early afternoon.

However, US Federal Reserve chair Jerome Powell’s comments on potential future interest rate rises sent shares down in London as well as New York, with the FTSE finishing the day at 7919.48.

Fed chair: US interest rates ‘likely to be higher’ than previously thought

15:53 , Daniel O’Boyle

US shares dipped after Federal Reserve chair Jerome Powell said that interest rates in the country may rise higher than previously expected.

Powell - testifying before Congress - noted that higher-than-expected rates of inflation mean that there is more the central bank must still do to bring prices down.

Following the speech, shares in US companies dipped. The S&P 500 is down 0.8% to 4016.57, while the Dow Jones is down 0.5% to 33256.55 and the Nasdaq is also down by 0.5%, to 11616.74.

The FTSE 100 was also down, falling from 7951.10 when US markets opened to hit 7911.90, before rebounding to 7924.28.

The dollar gained against all major currencies, including the pound, which now buys less than $1.19.

US stocks set to inch up ahead of Fed chair testimony

13:44 , Daniel O'Boyle

US stock futures are trading slightly up on yesterday’s close, as markets await Federal Reserve chair Jerome Powell’s testimony before congress today.

Dow Jones futures are up by 13 points to 33464, while S&P 500 futures are up 4.25 points to 4056.75. Nasdaq futures are up 30 points to 12353.50.

Powell will face questions from US legislators on how the Fed is handling inflation, which may provide guidance on how far the body will go in raising interest rates.

Cazoo appoints new COO

13:37 , Daniel O'Boyle

Online car retailed Cazoo has appointed a new COO, and said it is on track to hit its revised 2023 targets after announcing a restructuring process that including a number of layoffs.

Jonathan Dunkley will become Cazoo’s chief operating officer from the end of March, having previously been a strategic advisor. He will replace Paul Whitehead, who is set to become CEO as current chief executive Alex Chesterman will focus on his duties as executive chairman.

Cazoo said it is still on course to sell between 40,000 and 50,000 cars in the UK this year, and still expects to be able to last until the second half of 2024 before more investment would be needed.

The restructuring process was announced in January, when Cazoo announced these targets, and is set to complete by the end of the month.

“Strong results year-to-date are driven by the swift and decisive management action to progress with restructuring of the group,” Chesterman said.

Flutter pays $4m SEC settlement over legacy Russian lobbying payments

12:42 , Daniel O'Boyle

Betting giant Flutter has paid an $4 million settlement to the US Securities and Exchange Commission (SEC) related to payments for gifts to Russian government officials.

The matter dealt with lobbying efforts on behalf of PokerStars and its parent company The Stars Group (TSG), which Flutter acquired in 2020, to legalise online poker in Russia.

The SEC said the PokerStars business made payments to consultants, including “reimbursement for New Year’s gifts to individuals including Russian government officials, which relevant company policies prohibited” and did not disclose these payments properly.

The events in question occurred between 2015 and 2020, ending days after the Stars Group came under Flutter’s control.

A Flutter spokesperson noted that the settlement was about issues that occurred under prior management.

“This is a legacy issue, related to a period prior to Flutter’s ownership of TSG,” the spokesperson said. “As highlighted by the SEC, following our acquisition of TSG we made significant changes to implement a framework of controls in line with Flutter’s existing standards.

“We are pleased that this matter has now been concluded.”

The SEC said that, “without admitting or denying the findings”, Flutter will also cease and desist from further violations.

London-listed Flutter is currently pursuing an additional listing of its shares in the US, a move that it said could be the first step towards a primary US listing

Hotel laundry boss sees room for further hospitality recovery

11:48 , Daniel O'Boyle

Linens company Johnson Service Group said that, while the UK hospitality sector rebounded from Covid-19 in 2022, there’s still room to grow to reach pre-pandemic levels of activity.

The business - which provides linen services to the hotel, restaurant, catering and hospitality sectors - revealed revenue was up by 42.1% to £385.7 million in 2022, as its customers recovered from the impact of the Covid-19 pandemic.

However, CEO Peter Egan said there was still room for the hospitality sector to grow.

“It seems like a long time ago but we had the Omicron impact in early 2022,” he said. “Once we got past Omicron, it has been strong, but not quite 2019.”

A budget boost for our pension funds is needed

11:24 , Simon English

If you believe what you read, London is running out of local investors. There have plenty of money, they just don’t want to spend it on our equities.

Foreign investors are taking their cue from that, which is why you have large companies looking to float in New York and why the London stock market is undervalued.

Amongst the crowd that thinks deregulation is the answer to anything, all this is a sign that something Must Be Done.

Greggs CEO: No plans to raise sausage roll prices further

10:52 , Simon Hunt

Greggs boss Roisin Currie has told the Standard that Greggs are not planning any further price rises for its best-selling sausage roll.

However, she added that she could not rule out rises later in the year as a result of “uncertainty and complexity in the market.

The business reported sales of £1.5 billion in 2022 and aims to have “significantly more than 3,000 UK shops”..

Premier Foods shares lift 9%, Wincanton slides 24%

10:15 , Graeme Evans

Premier Foods today sweetened profit guidance in another boost for the FTSE 250-listed owner of household brands including Mr Kipling, Bisto and Ambrosia.

Shares surged 9% to their highest level in almost a year as an unscheduled update revealed continued sales momentum and market share gains for its grocery division.

The home cooking trends mean Premier should finish its April financial year with quarterly revenues growth of at least 10%, leading to top-of-the-range annual profits of £135 million.

The stock today lifted 10.4p to 125.4p, having been 92p in October.

Premier Foods was joined at the top of the FTSE 250 by Wood Group as the energy consulting and engineering business disclosed a fourth takeover tilt from US private equity giant Apollo.

Aberdeen-based Wood is “minded to reject” the proposal, which was pitched at 237p a share or £1.64 billion compared with 230p previously. It said: “The board will continue to engage with its shareholders and intends to engage further, on a limited basis, with Apollo.”

Shares rose 22.4p to 217.8p as the wider FTSE 250 continued its recent resilient performance by adding 53.33 points to 20,117.44.

In the FTSE 100 index, which improved 12.93 points 7942.72, the US-focused plant hire business Ashtead surged 3% or 180p to 5926p after it upgraded full-year guidance on the back of a 29% jump in third quarter profits.

On a weaker note, shares in Spirent Communications tumbled 14% in the FTSE 250 as the 5G testing firm said it expected a challenging first half of the year due to customers taking longer to reach investment decisions. Shares lost 29.45p to 181.6p.

Wincanton shares were jolted by the loss of a contract with HMRC to support inland border facilities. This and the impact of challenging conditions mean the logistics firm expects 2024 profits materially below City forecasts, sending shares down 24% or 74.5p to 231p.

Greggs workers in line for £17 million bonus payout after boost to profits

09:28 , Simon Hunt

Thousands of workers at Greggs are in line to share a £16.6 bonus payout after the Newcastle-based bakery saw a boost in profits.

Greggs boss Roisin Currie told the Standard workers would receive an average of £700 each, with the bonus being paid at the end of March. All employees with at least six months’s service would be eligible for the award, with bigger payouts for staff who had worked at the firm for more than six years.

Sales jumped 23% to £1.5 billion in 2022, Greggs said today, while pre-tax profits crept up slightly to £148 million as cash-strapped brits flocked to its stores in search of affordable menu options amid sky-high inflation.

The sausage roll maker said its growth was helped along by increased opening hours across hundreds of stores, as well as a boost in sales of chicken goujons and an increase in online orders, with active users of its app topping one million for the first time. The bakery has ramped up its production capacity in London with the opening of a new pizza-making plant in Enfield.

Top shareholder Axel Springer withdraws representative from PurpleBricks board

08:56 , Daniel O'Boyle

PurpleBricks’ largest shareholder Axel Springer has withdrawn its representative from the struggling online estate agent’s board while the business pursues a sale.

PurpleBricks has struggled in recent years, with shares down more than 98% from their 2017 peak, and put itself up for sale last month - as well as announcing another round of layoffs - following a profit warning.

The PurpleBricks board said at the time that its brand still carried a significant amount of value because of its name recognition, and that it may be more likely to reach its potential “under an alternative ownership structure”.

Now, its largest shareholder - German media giant Axel Springer, which owns a 26.5% stake - said it would withdraw its representative on the PurpleBricks board, due to “the regulatory and governance expectations around equality of information between shareholders during an offer period”.

The board member, Ait Voncke, said he supports the sale process.

“Axel Springer is fully supportive of the strategic review and formal sale process being undertaken by the Purplebricks board,” Voncke said. “We are confident this review and process will benefit stakeholders and support the long term growth of the business.”

Revolution bars shares drop 9% as it slides into the red

08:53 , Simon Hunt

Shares in Revolution Bars sunk 9% to 8p today after the firm fell into the red and its boss warned of a slowdown in demand from younger patrons.

The chain, which operates across a number of student towns including Leeds, Durham and Nottingham, posted a pre-tax loss of £100k, reversing profits of £4.3 million last year as it bemoaned “continuous and varied external headwinds” and a “downturn in consumer confidence.”

CEO Rob Pitcher said: “The consumer is finding things very tricky with the cost-of-living crisis and we’re not immune to that.

“The older demographic seem to be less impacted [but] younger people are having a tougher time. The performance of our brand reflects that.”

Revolution said its acquisition of Peach Pubs in October last year was helping mitigate the downturn, as the chain is aimed at over-45s.

FTSE 100 drifts, Premier Foods and Wood lead FTSE 250

08:41 , Graeme Evans

Ashtead shares lead the FTSE 100 index after the US-focused plant hire business upgraded profit guidance on the back of a strong third quarter performance

Shares rose 2% or 142p to 5888p in a session when London’s top flight drifted 2.52 points to 7927.27.

In the FTSE 250 index, shares in Premier Foods were 9% or 10.8p higher at 125.8p after the Bisto and Mr Kipling owner upgraded profit guidance.

Wood Group surged 13% or 26p to 220.1p as it revealed another bid approach from Apollo, while retirement income business Just Group jumped 9% or 7.8p to 89.7p in the wake of full-year results.

The FTSE 250 index stood 3.49 points higher at 20,067.60, but Spirent Communications lost 11% or 24.2p to 186.8p due to cautious guidance on the 2023 outlook.

STV records best month in 19 years , but revenue set to drop in Q1 2023

08:36 , Daniel O'Boyle

Scottish broadcasting business STV ended 2022 on a high, recording its best month for viewing share in 19 years, but revenue is set to drop by double digits to start 2023 as Holyrood’s Covid ad campaigns ended.

STV’s revenue was down by 5% year-on-year, to £137.5 million, but pre-tax profit was up by 11% to £22.2 million thanks to lower costs.

The broadcaster - which is the ITV network franchisee for Central and Northern Scotland - said it had its best month since 2003 in November of last year, thanks to the World Cup and I’m a Celebrity… Get Me Out of Here.

Viewership of the World Cup was especially high, with rates higher in Scotland than in the UK as a whole, despite both Wales and England qualifying for the tournament.

However, ad revenue for the first three months of 2023 is set to decline by 15%, which STV said was expected due to the Scottish government paying for a number of Covid-related ads in Q1 of 2022. When government campaigns are removed, revenue is set to be flat.

Wood receives new Apollo takeover approach

08:10 , Graeme Evans

Wood Group, the FTSE 250-listed consulting and engineering business, has received a fourth takeover approach from US private equity giant Apollo.

The Aberdeen-based company said it is “minded to reject” the latest proposal, which is pitched at 237p a share or £1.64 billion compared with 230p previously.

Wood said: “The board will continue to engage with its shareholders and intends to engage further, on a limited basis, with Apollo.”

Shares rose 22.4p to 217.8p today.

The company is focused on the core markets of energy and materials after bolstering its balance sheet through September’s disposal of its built environment division.

Reach to focus investment on US after cutting costs following “challenging” 2022

07:59 , Daniel O'Boyle

Daily Mirror publisher Reach will focus its 2023 investment on the US market and social media, after announcing a cost-cutting plan that included 200 layoffs earlier this year.

Reach, which publishes the Daily Mirror, Daily Express and Daily Star - as well as a number of regional titles - announced a cost-reduction plan in January following a profit warning.

This plan, focused on “more efficient procurement throughout the print supply chain, the simplification of central support functions and the removal of editorial duplication”, included 200 layoffs. Reach said it hoped the plan would lead to savings of 5-6% of operating costs, up to £30 million.

However, the business also hopes to invest in the US and in targeting millennials, having developed a “playbook” for reaching new audiences.

Reach said its focus in 2023 would be on building an American audience, noting that with 9% of online views coming from the US it lagged behind some of its UK competitors in this space. It said it also aims to build a younger audience with the launch of “social-first” brand Curiously.

Operating profit was down by 27.4% in 2022, as print revenue dropped, digital revenue was flat and costs rose rapidly - due mostly to a 60% rise in the cost of newsprint.

Focus on Federal Reserve testimony, FTSE 100 seen higher

07:47 , Graeme Evans

China’s disappointing GDP target weighed on the mining-heavy London market yesterday, with the FTSE 100 index down 0.2% compared with gains elsewhere in Europe.

Wall Street indices finished close to their opening mark but had been much higher. The late retreat came as investors revised their positions ahead of Federal Reserve chair Jerome Powell’s testimony to the Senate Banking Committee at 3pm UK time today.

Michael Hewson, chief market analyst at CMC Markets, said: “The key focus will be on how Powell sees the US labour market, and whether the Federal Reserve thinks that economic conditions have improved or deteriorated since the last Fed meeting.

“Markets will also be paying attention to whether Powell continues to peddle the same narrative of disinflation, which was a hallmark of his last press conference.

“If he acknowledges that inflation could be much stickier than the Fed thought over a month ago, that could prompt a pullback in US equity markets.”

CMC expects the FTSE 100 index to open 13 points higher at 7943.

Foxtons says impact of mini-Budget still being felt in its ‘sales pipeline'

07:46 , Michael Hunter

Foxtons, the estate agency chain synonymous with the London property market, said the impact of the mini-Budget is still being felt, with its sales pipeline “reduced” by the turmoil that followed the short-lived measures.

It expected these effects to last “through the majority of 2023.” But it was optimistic for improvement, adding: “ Mortgage rates have started to reduce in recent weeks and buyer activity is picking up, which may result in a more favourable sales market in the latter part of the year.”

For 2022, profit before tax more than doubled to almost £12 million, from revenue of £140.3 million, up 11%. Its sales arm generated revenue of 1% to £43.2 million.

In the lettings market, it said a tend for low volumes and high prices continued into 2023, after revenue from this part of its business rose 17% to £87 million for last year.

Premier Foods ups profits guidance

07:29 , Graeme Evans

Premier Foods, whose brands include Mr Kipling, Ambrosia and Bisto, today sweetened its profits guidance after better-than-expected trading in recent weeks.

The St Albans-based company now expects revenue growth in the final quarter of its financial year to be at least 10% ahead of the prior year.

The grocery business led the way, with broad based growth and further market share gains, while Premier also reported an improving trend for its sweet treats division.

Adjusted profits for the year to 1 April are forecast to be around £135 million, which equates to growth of approximately 10% compared to the previous year.

Average house price up in February, London dips

07:22 , Graeme Evans

The typical UK property cost £285,476 in February after lender Halifax said annual house price growth stayed at 2.1% for a third month.

The year-on-year increase follows a rise of 1.1% in February, compared with 0.2% in January and a decline of 1.3% in December.

Halifax Mortgages director Kim Kinnaird said: “Recent reductions in mortgage rates, improving consumer confidence, and a continuing resilience in the labour market are arguably helping to stabilise prices following the falls seen in November and December.

“Still, with the cost of a home down on a quarterly basis, the underlying activity continues to indicate a general downward trend.”

Average house prices in London are now £526,842, a 0.9% fall from January’s £530,416.

Halifax said London may be affected by its large proportion of flats – prices for which have broadly stagnated. Despite this slowdown, homes in London still cost over £240,000 more than the UK national average.

Greggs eyes ‘significantly more than 3,000 UK shops’ after sales soar past £1.5 billion

07:12 , Simon Hunt

Sausage roll vendor Greggs has said there is a “clear opportunity” to have “significantly more than 3,000 UK shops” as a surge in sales helps fuel its expansion.

The Newcastle-based firm opened a record 186 new shops in 2022 and is targeting another 150 openings in 2023, including in retail parks and train stations.

Sales soared 23% to £1.5 billion, while pre-tax profits crept up slightly to £148 million.

Greggs boss Roisin Currie said: “Although consumer incomes remain under pressure, Greggs continues to offer exceptional value to people looking for great tasting, high-quality food and drink on-the-go.

"We have an exciting, ambitious plan for the years ahead and, by continuing to nurture what makes Greggs special, I believe we are extremely well-placed to realise the opportunity to become a significantly larger, multi-channel business."

Recap: Yesterday’s top stories

06:30 , Simon Hunt

Good morning. Here’s a look at some of our top stories from yesterday.

Software giant WANdisco said it was considering a US listing, dealing a fresh blow to the hopes of the London market to attract top tech companies.

EG Group, the company owned by the billionaire Issa brothers, has sold off $1.5 billion worth of property in a bid to help pay down its debts.

The boss of the CBI, Tony Danker, has stepped aside from his role amid an investigation into allegations of misconduct involving a female employee.

The crisis at Home REIT has escalated as two of its major tenants are set to enter liquidation.

Today we’re expecting results from:

Foxtons

Reach

Just Group

Fresnillo

Greggs

H&T Group

Ashtead

DotDogital

Revolution Bars

STV Group

Yahoo Finance

Yahoo Finance