FTSE 100 Live: Pound below $1.20, Ericsson layoffs, US inflation

A closely-watched consumer confidence benchmark today posted its highest reading since April as hopes build over the outlook for the UK economy.

GfK posted a better-than-expected score of minus 38, representing the biggest monthly improvement in nearly two years but still much weaker than before the pandemic.

In today’s corporate results, British Airways owner International Airlines Group reported a profit of 1.2 billion euros (£1bn) for 2022 and said it expected a surplus of between 1.8 billion and 2.3 billion euros (£1.6bn-£2bn) in the current year.

FTSE 100 Live Friday

IAG targets 2023 growth after return to profit

Profits crash at Jupiter Fund Management

Rally continues for Rolls-Royce shares

US stocks start week down again amid rate hike fears

16:47 , Daniel O'Boyle

US stocks declined further today amid concerns that higher-than-expected inflation would lead to more interest rate hikes.

The S&P 500 was down by 1.2% to 3964, the lowest figure since 19 January. The Dow Jones was down by 1% to 32816, its lowest since 19 December.

The tech-focused Nasdaq’s fall has been even sharper. It is currently down 1.7% to 11389.

FTSE finishes tough week at 7889

16:35 , Daniel O'Boyle

The FTSE 100 closed at 7888.66 today, rounding out a tough week for London stocks.

Thugh shares rebounded slightly when markets opened, they fell sharply after higher-than-expected US Personal Consumption Expenditures Index inflation made investors wary of further interest rate hikes.

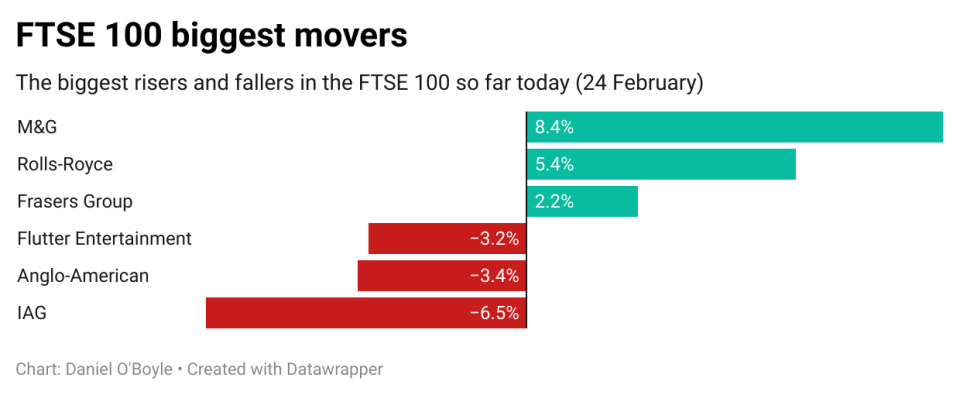

Investment manager M&G was the day’s top riser, while British Airways owner IAG was the biggest faller.

Layoffs cloud UK fintech prospects

16:22 , Simon Hunt

The UK’s long-term dominance of the European fintech sector has been thrown into doubt after a study found that a greater number of London-based firms have been hit by layoffs compared with their EU counterparts.

At least a dozen UK fintechs have let go of staff over the past 12 months, an analysis by the UK Trade and Business Commission found, against only half a dozen firms headquartered in the EU.

While London-based Revolut is set to hire at least 1700 staff over the next year, many of its peers have been less fortuitous, with the likes of Railsbank, Zilch Zego and TrueLayer all shedding at least 10% of staff.

The figures come amid further questions about the challenges facing London’s financial services post-Brexit.

US PCE inflation ahead of expectations

15:12 , Daniel O'Boyle

The US Personal Consumption Expenditures Index has shown inflation in the country to be ahead of expectations.

The index found prices in January were up by 0.6% from December, and 4.7% from January 2022.

Economists expected a month-on-month increase in prices of 0.4% and year-on-year increases of 4.9%, down from 5.0% in December.

While the Consumer Price Index uses data reported by consumers, the Personal Consumption Expenditures Price Index is based on data reported by businesses and is the preferred measure of the Federal Reserve for inflation targets. As a result, the higher-than-expected figure may mean that further interest rate rises are on the way in the US.

The main PCE figure excludes food and fuel. If these are included, prices were up by 5.4%.

Transport union cancels strike action as members accept pay deal

14:33 , Daniel O'Boyle

Members of the Transport Salaried Staffs Association (TSSA) have voted to accept offers by train companies in the long-running dispute over pay, job security and conditions, the union announced.

TSSA said its 3,000 members voted overwhelmingly in favour of deals which include a two-year pay rise worth 9 per cent.

The union said it had won an improved deal on pay, as well as commitments on job security and full consultation over any possible changes to terms and conditions following months of industrial unrest.

Telecoms giant Ericsson to lay off 8,500 staff

13:27 , Simon Hunt

Telecoms giant Ericsson is to lay off 8,500 staff in a bid to slash costs.

The firm notified staff of the measures in an internal company memo this week, according to reports by the Reuters news agency.

CEO Borje Ekholm said in the memo that “the way headcount reductions will be managed will differ depending on local country practice.”

Ericsson has 105,500 staff worldwide, implying a cutback of around 8% of jobs.

The firm has around 1400 staff in the UK according to its most recent annual report filed with Companies House, meaning over 100 UK workers could lose their jobs of the 8% cut is implemented in Britain.

Pound falls below $1.20

13:08 , Daniel O'Boyle

The value of the pound has dipped below $1.20, approaching a new low for the year.

One pound currently buys $1.1972.

The dollar rose against all major currencies today, ahead of the Bureau of Economic Analysis reporting Personal Consumption Expenditure figures - a key component in the Federal Reserve’s interest rate decisions - at 1:30 pm GMT.

The pound hit $1.19 on both 3 and 5 January, which remains its lowest level for the year.

M&G the top riser, IAG and Flutter among the fallers

12:58 , Daniel O'Boyle

Investment manager M&G has been the top riser of the day among FTSE 100 companies, with its shares up by more than 8%.

Other top risers include Rolls Royce - which has cntinued to trade strongly after a jump of more than 20% yesterday - and retail giant Frasers Group.

On the other end of the table, IAG shares have dipped by more than 6% despite the business returning to profit in 2022, while mining busness Anglo-American and Paddy Power owner Flutter also fell.

Oxford Street candy stores play ‘whack a mole’ to defy council crackdown

12:39 , Daniel O'Boyle

Oxford Street candy store operators have defied a council crackdown with the number of the “eyesores” returning to record levels in recent weeks, figures reveal today.

There are currently 29 US-style candy and souvenir outlets on Europe’s busiest shopping street, equal to the previous peak in 2020, according to analysts Local Data Company.

They had been reduced to 21 after Westminster council trading standard officers and police launched a series of raids.

The gender pension gap is about more than the size of savings

11:30 , Daniel O'Boyle

The gender pension gap – the gulf in difference between how well-prepared men and women are for retirement – is a serious cause for concern.

The latest Women and Retirement Report found that the average UK male aged 65 to 74 holds over £250,000 in pension assets, compared to less than £150,000 for the average woman. Most obviously, this means women are less likely to be able to enjoy a long, comfortable retirement. They might have to work longer and still live off less – they are likely to experience a poorer quality of life post-work.

One of the devastating consequences of the smaller pension pots women typically have is they can be left feeling reliant on others, including a partner they might not otherwise want to be with, due to the much-needed financial support they can provide during their retirement.

Leeds leads on mortgages

10:43 , Simon English

LEEDS Building Society flew the flag for mutuality today, breaking records for mortgage lending and member numbers.

With big banks under pressure for reporting the highest profits since 2007 while keeping savings rates low, building societies have shown their worth.

Leeds lent £5 billion in home loans in 2022, the highest ever, which it says “helped put home ownership within reach of more people”.

The Leeds has been around since 1875 and now has more members than ever – 839,000 people who effectively own the business. It is the fifth biggest building society – Nationwide is the number one.

Leeds says it has suspended all mortgage arrears fees until “at least” the start of 2024 to help struggling customers figure out their finances.

Chief executive Richard Fearon said: "Our continued support for the housing market enabled us to surpass all previous lending records. We continued to offer strong support for customers less well served by the wider market despite the extremely volatile conditions we were operating in. Approximately one in three of all our mortgages went to first time buyers - helped by our decision to withdraw from lending on second homes to bolster our support for those yet to get on the property ladder.”

Fearon claims the society paid savers an interest rate that was 0.5% higher than the rest of the market.

Banks deny profiteering.

Rolls shares up another 5% as FTSE 100 rises, BP higher

10:26 , Graeme Evans

Rolls-Royce shares have risen another 5% following the turnaround optimism of new chief executive Tufan Erginbilgic in yesterday’s better-than-expected annual results.

Fresh from last night’s rise of 24% to an 18-month high, the engines giant put on another 6p to 139.2p as analysts revised their estimates for 2023 and beyond.

Other big blue-chip risers included renewable energy giant SSE, which added 17.5p to 1788.5p after analysts at Goldman Sachs enhanced their “buy” recommendation with a new price target of 2343p.

A rise in Brent crude futures to near $83 a barrel supported BP and Shell as their shares lifted 7.7p to 554.7p and 32p to 2514p respectively. The FTSE 100 index was 27.82 points higher at 7935.54, but lower over the week after closing at 8004 last Friday.

Domino’s Pizza shares remained under pressure after analysts at Liberum warned investors over the threat of fast-growing Greggs.

Reiterating its long-held “sell” rating, the City firm said it viewed Greggs as an increasing headache for Domino’s after the bakery chain extended its hours into the evening peak and stepped up store expansion.

Liberum’s note also referred to this week’s disappointing update by Domino’s Pizza Enterprises, whose outlets in Australia, France, Germany and Japan make it the fast food chain’s largest franchise holder outside the United States.

The UK company is due to report results on 9 March, but Liberum thinks that the City’s forecasts for this year are still too high. It has a target price of 230p, which compares with today’s level of 284p after a fresh decline of 3.8p took this week’s fall to around 8%.

The pressure on Domino’s shares came in a robust session for the FTSE 250 index, which followed yesterday’s 0.6% gain with a rise of 44.63 points to 19,835.12. Stocks on the risers board included Aston Martin Lagonda, which cheered 2% or 4.3p to 194.8p.

Kin & Carta shares nosedive after profit warning

10:04 , Daniel O'Boyle

Shares in digital transformation consultancy Kin & Carta plummeted this morning after it released a profit warning.

The business now expects revenue to grow by between 8% and 12% for the year to 31 July, after first-half revenue came to £98.8 million. The business had previously expected growth of 21-27%.

The company had also expected operating profit margins to improve to around 13%, but now expects these to be level with prior years, when it was just below 10%.

Shares in Kin & Carta are down by more than 53p this morning to 132.9p.

Funds wobble, profits crash at Jupiter

09:54 , Simon English

The extent of the task facing new Jupiter chief Matthew Beesley was made plain today when he reported a crash in assets and profits.

Beesley has been CEO of the storied fund management group since last October and has to battle some troubling performance stats and wider scepticism that active fund management can add value to investors.

Schroders, the City institution founded in 1804, has its own, similar problems.

For the year to December Jupiter funds fell 17% to £50 billion, a result of poor stock picking and clients pulling money away. Profits crashed 68% to £58 billion.

Beesley told the Standard: “It goes without saying but I will say it anyway -- it has been a difficult year.”

He insists a turnaround has already begun, thanks to his plans to “curate” the products on offer and improve relations with clients.

He says that “outflows” are slowing and that “fragile investor sentiment” is improving.

ASA International CEO to step down after 16 years

09:22 , Daniel O'Boyle

Dirk Brouwer, co-founder and chief executive of microfinance business ASA International, will step down in June.

Karin Kersten, currently Executive Director for corporate development, has been chosen as his replacement.

“After having run ASA International, for the most part together with Shafiq, for more than 15 years, I am very pleased that we have found in Karin a formidable successor to take over the baton as the first female CEO of our company,” Brouwer said. “Karin and I have worked closely together over the last one-and-a-half years, and I am very confident that she will be able to successfully lead the Company going forward in an increasingly more digital world.”

Brouwer set up the business in 2007 and has led it since then. He will leave the CEO post in June but will become deputy chairman and special advisor to Kersten.

“In this capacity the board fully expects Mr. Brouwer to continue to make a significant contribution to the strategic and operational development of the business for the foreseeable future,” ASA said.

Rolls rally continues, Jupiter shares jump 11% in FTSE 250

08:45 , Graeme Evans

Rolls-Royce shares are up another 2% or 3.3p to 136.2p, having surged 24% on Thursday following bullish results-day comments by new chief executive Tufan Erginbilgic.

Renewable energy provider SSE is among today’s other big blue-chip risers, adding 25.5p to 1786.5p after analysts at Goldman Sachs enhanced their “buy” recommendation with a new price target of 2343p.

A rise in Brent crude futures to $83 a barrel also supported BP as its shares lifted 6.9p to 553.9p. The FTSE 100 index was 25.30 points higher at 7933.02, with IAG the biggest faller as the airline group’s shares declined 2% or 3.4p to 162p.

The FTSE 250 added 25.18 points to 19,815. 67, aided by Jupiter Fund Management’s results-day surge of 11% or 14.9p to 149p.

CVS aims to expand beyond UK after H1 profit grows

08:33 , Daniel O'Boyle

Vet group CVS is setting its sights on expansion beyond the UK, after further revenue growth in the six months to 31 December.

Revenue was up 8.2% to £296.3 million, while operating profit increased by 19.7% to £31.5 million.

CEO Richard Fairman said the business was well-placed to invest in the future, including in entering more markets.

“We are looking actively at markets outside the UK,” he said. “We have some presence in the Netherlands and a small presence in Ireland but are looking to grow internationally.

“The veterinary market is opening up to corporate consolidation. There are markets like Germany, France where there’s been some corporate consolidation, but it’s mostly just starting. What we are looking at is high quality practices and strong management teams.”

Besides mainland Europe, Fairman said CVS would look to other English-speaking countries. He also added that any expansion would be done either by acquiring a large group of vets or a portfolio of assets that has room to grow.

IAG outlook fails to lift shares

08:21 , Graeme Evans

IAG shares are 3% or 4.5p lower at 160.95p, despite its profit forecast for 2023 being in line with the City’s consensus.

Analysts at Liberum said: “Management sees the bulk of the improvement over 2022 coming in the first half, suggesting a suitably cautious outlook for the second half where the comparatives have more of the recovery benefit already.”

As a long-haul operator, IAG has been one of the last names in the sector to gain momentum following the pandemic. It’s now facing another hurdle in terms of the cost-of-living crisis.

Hargreaves Lansdown analysts Sophie Lund-Yates added: “So far it seems pent up demand for travel is keeping things propped up, but there is a limit to how long this can continue.”

Despite today’s weakness, the shares are up by around a quarter this year. Liberum has a “buy” recommendation, believing there’s scope for the FTSE 100 stock to reach 220p.

US markets fragile ahead of PCE reading, FTSE 100 seen higher

07:50 , Graeme Evans

Wall Street finished a volatile session in positive territory last night, but the S&P 500 index is still heading for its worst week since December as worries mount that fresh interest rate rises will tip the US economy into recession.

Traders will now be looking to the release of the Federal Reserve’s preferred measure of inflation for clues about the scale of the next move by policymakers.

Ahead of this afternoon’s price index for personal consumption expenditures, CMC Markets expects London’s FTSE 100 index to open 33 points higher at 7940.

Its chief market analyst Michael Hewson said: “Given the strength of recent economic data, today’s January numbers may call time on the trend of lower prices, with expectations that the PCE core deflator could fall only modestly from 4.4% to 4.3%.

“What the markets won’t want to see is prices start to edge up again given how fragile US stock markets are currently looking, despite yesterday’s rebound by the S&P 500.”

Consumer confidence shows improvement

07:38 , Graeme Evans

GfK’s consumer confidence monitor today recorded a better-than-expected score of minus 38, up from minus 45 the previous month.

However, the reading is still severely depressed and the mood as well as the economy remain a long way off pre-lockdown levels.

GfK’s client strategy director Joe Staton said households were a little more optimistic about the state of their personal finances and the general economic situation.

He added: “A little consumer resilience might be what we need to soften any downturn in 2023. However, many challenges remain and this may be nothing more than a bubble of hope – and bubbles always burst.”

Wise founder Kristo Kaarmann ups stake in business to near 50%

07:23 , Simon Hunt

The founder of payments transfer business Wise, Kristo Kaarmann, has increased his share of the voting rights in the company as he tightens his control to near 50%.

Kristo Kaarmann now holds 48.2% of the voting rights, up from 47.1%, regulatory filings show.

He owns an 18.2% stake in the share capital of the business worth £1.1 billion, according to Bloomberg data.

BA owner returns to profit after lifting of Covid travel restrictions

07:20 , Jonathan Prynn

British Airways owner IAG has swung back to the black after the lifting of Covid travel restrictions with a profit of Euros415 million (£366 million) compared with a loss of more than Euross3.5 billion in 2021

. The company, which also owns Spanish airline Iberia and Irish carrier Aer Lingus, expects to make an operating profit of between Euros1.8 billion and Euros2.3 billion in the current year.

Trustpilot selects outgoing Future CEO Byng-Thorne as new chair

07:19 , Daniel O'Boyle

Outgoing Future CEO Zillah Byng-Thorne will become the new chair of online reviews business Trustpilot.

Byng-Thorne replaces Tim Weller, who will remain on the Trustpilot board but will not stand for reelection as chair. As chair, Weller helped lead Trustpilot through its 2021 IPO. However, its shares slumped in 2022 and currently trade at less than half the level of the initial IPO price.

“I am pleased to succeed Tim as chair of the company,” Byng-Thorne said. “Trustpilot has an important part to play in promoting trust in the online economy, and I look forward to continuing my work with the board and the management team to ensure that we make further progress against our strategy and towards achieving our mission and purpose.”

Future revealed in January that Byng-Thorne would exit as CEO, and announced earlier this week that former Daily Mail executive Jon Steinberg would replace her.

Cineworld to emerge from chapter 11 bankruptcy

07:13 , Simon Hunt

Beleaguered picturehouse chain Cineworld is expected to emerge from chapter 11 bankruptcy inside the first half of this year, the firm said today, as it charts a course for its survival.

The business said it had received non-binding proposals from a number of interested parties for some or all of its businesses.

None of the proposals include an all-cash bid for the entire business, Cineworld said, adding it was unlikely that the equity interests of shareholders would be recovered by the move.

“Although any sale transaction resulting from the Marketing Process, among other things, may delay emergence beyond the first half of 2023, the Company remains committed to emerging from the Chapter 11 cases as expeditiously as possible,” Cineworld said.

IAG returns to profit, upbeat on 2023 outlook

07:12 , Graeme Evans

British Airways and Iberia owner IAG hailed 2022 as a year of strong recovery, with operating profits of 1.2 billion (£1 billion) due to sustained leisure demand and markets reopening. The figure compares with a loss of almost 3 billion euros in 2021.

Chief executive Luis Gallego is looking for a surplus of between 1.8 billion and 2.3 billion euros (£1.6bn-£2bn) in the current year. This reflects full year capacity of about 98% of the 2019 level, with the current quarter at near 96%.

Gallego said: “At this point of the year we continue to see robust forward-bookings, while also remaining conscious of global macro-economic uncertainties.

“We are transforming our businesses, with the intention of returning IAG to pre-Covid levels of profit within the next few years, through major initiatives to improve customer experience and operational performance.”

Reacap: Yesterday’s top stories

06:44 , Simon Hunt

Good morning. Here’s a summary of our top stories from yesterday.

The boss of Rolls-Royce said it is “capable of much more” as he launched a strategic review into the company and reported a jump in profit.

WPP offered hope today that the economy could be in for a “soft landing” as clients resumed spending and profits zipped past £1 billion. The ad giant founded by Sir Martin Sorrell saw revenues in 2022 up nearly 13% to £14.4 billion.

BAE Systems said it expects continued growth in 2023 and beyond as countries across the world up their defence budgets in response to Russia’s invasion of Ukraine.

Today we’re expecting:

IAG results

Jupiter Fund Management results

CVS Vet results

Yahoo Finance

Yahoo Finance