FTSE 100 Live: Bitcoin slides 2%, London records slowest rate of house price growth

London recorded the slowest rate of annual house price growth at +5.2% over the last year to the end of November, data from the Halifax UK Housing Market Review has found, while prices began to take a dip in the fourth quarter.

The impact of higher interest rates and surging living costs is today revealed in retail sales and consumer confidence figures.

The Office for National Statistics said retail sales volumes are estimated to have fallen 0.4% in November following a rise of 0.9% the previous month.

FTSE 100 Live Friday

Retail sales down in Black Friday month

Recession jitters continue to hit shares

Games Workshop unveils Amazon TV rights deal

Bitcoin slides 2% as Binance auditor pulls out

Friday 16 December 2022 14:41 , Simon Hunt

The price of Bitcoin has slid 2% in the past 24 hours after French accountancy firm Mazars suspended audit work with the world’s largest crypto firm, Binance.

A Binance spokesperson said: "Mazars has indicated that they will temporarily pause their work with all of their crypto clients globally, which include Crypto.com, KuCoin, and Binance.

“Unfortunately, this means that we will not be able to work with Mazars for the moment."

Binance’s own coin, BNB, slid 5.3%.

London records slowest rate of house price growth as prices dip in fourth quarter

Friday 16 December 2022 14:14 , Simon Hunt

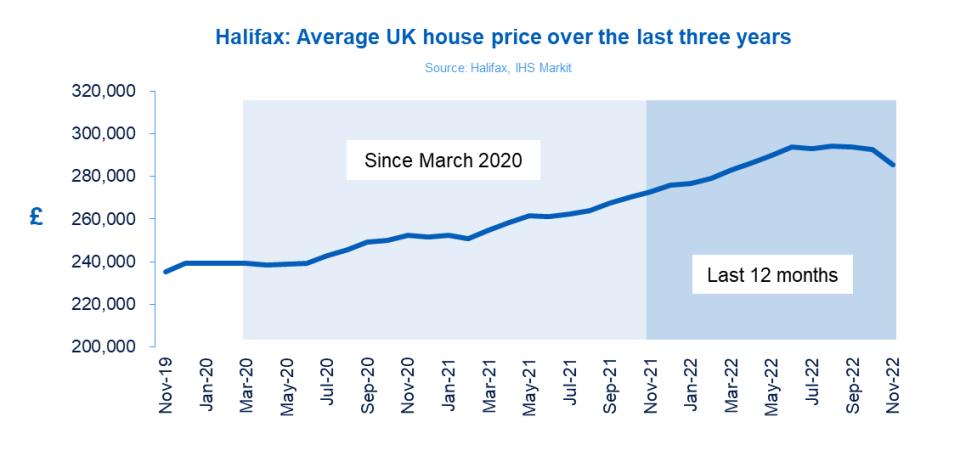

London recorded the slowest rate of annual house price growth at +5.2% over the last year to the end of November, data from the Halifax UK Housing Market Review has found, while prices began to take a dip in the fourth quarter.

House prices flattened off from mid-year, and fell near the end of the year, as the increasing cost of living put more pressure on household finances and rising interest rates pushed up mortgage costs.

Andrew Asaam, Homes Director, Halifax, said: “It was a tale of two halves for the UK housing market in 2022. The year kicked off with average house prices continuing to rise at pace, still supported by low interest rates and strong demand from buyers. This meant the typical property had added more than £17,500 to its value by June.

“Following such rapid house price growth, and the growing economic headwinds, a slowdown was almost inevitable. We saw this play out with a flattening of house prices over the summer, before the -2.3% decrease recorded in November.”

FTSE 100 down 90 points: lunchtime update

Friday 16 December 2022 12:38 , Simon Hunt

Five hours into today’s trading session in London, the FTSE 100 is down 90 points to 7,336.

Almost all stocks are down today, with real estate stocks leading the losses.

Here’s a look at some of the biggest moves of the day so far:

BT units merge as part of shake-up under new chief exec

Friday 16 December 2022 11:25 , Simon Hunt

The shake-up of BT under chief executive Philip Jansen continued today with the merger of two of its largest units.

The Global and Enterprise arms will become one organisation called BT Business with the aim of better serving corporate customers. The EE mobile phone brand is targeted at retail customers.

Late in November BT negotiated the end of strikes by workers by paying staff a £1500 pay rise.

Earlier this week BT cut the charges on its Openreach arm to clients such as Sky and TalkTalk as it seeks new customers in the battle with Virgin Media and CityFibre.

Today’s deal is seen as part of the drive by Jansen to modernise a business that in the past has been seen as sluggish and bureaucratic.

BT Business will be led by Bas Burger, the present CEO of BT Global. The new arm will have revenue of £8.5 billion a year. No job cuts were mentioned but plainly cannot be ruled out.Rob Shuter, the CEO of BT Enterprise, will leave BT in a few months.

Cost savings of £100 million a year are predicted by 2025. BT wants to slash costs by £3 billion a year overall and believes it now has the support of unions to get there.

Jansen said: “By combining the two units, BT Business will bring the Group’s combined assets, products, capabilities and brand to the service of all of our 1.2 million business customers who will benefit from faster innovation and delivery. Bas is an excellent leader and I’m confident he will build on the plans already under way and drive the combined business back to growth.”

BT shares were flat today at 114p.

City comment: a tale of two pubs

Friday 16 December 2022 10:55 , Simon Hunt

A tale of two City pubs. One on Tuesday lunchtime at Bank, deserted, cold and desolate after the rail strike laid waste to almost 200 bookings. The second a few hundred yards away by the Barbican last night, heaving, noisy and festive as only a non-strike day Thursday in December can be. So which is telling the real story about London’s economy?

Well they both are. There is no doubt that the RMT shutdowns are effective and particularly damaging to central London,But dig below the surface and a more complex story emerges.

Despite the squeeze on spending there is no doubt that those who can spend this December will find a way. The urge to enjoy this Christmas is understandably strong after two Covid ravaged years. Restaurant bookings are being transferred not trashed altogether, some even being pushed in January. I have even heard of employers laying on fleets of taxis to get their staff in for festive knees up rather than just canning it.

Today’s better than expected PMI reading for the services sector also provides some reason for hope. It rose back to the 50 mark that indicates no growth - but no contraction either - last month.

The grinding cycle of strikes - particularly transport shutdown - will undoutedly shave a fraction off GDP, but probably only a fraction. In my empty pub on Tuesday, sad though it was, bar staff were already looking forward to the sell out bookings all next week.

FTSE 100 rate fears continue, National Express shares reverse

Friday 16 December 2022 10:03 , Graeme Evans

Warnings from the European Central Bank and US Federal Reserve that monetary policy conditions will need to remain tight in 2023 have sparked a sell-off that continued for London shares today.

The FTSE 100 index weakened another 0.4% or 31.85 points on top of yesterday’s 0.9% decline to stand at 7394.32. The UK-focused FTSE 250 index dropped by more than 1%, down 223.91 points to 18,669.88.

December is typically one of the best months of the year for stock markets, but this year’s rally has failed to materialise as investors unwind gains seen since mid-October.

Richard Hunter, head of markets at Interactive Investor, said recession fears were back at the top of the agenda as central banks continued their policy of interest rate hikes.

He added: “Any thoughts of a Santa rally have all but evaporated, with previous hopes of peak inflation and interest rates being soundly rejected.”

Big fallers in the FTSE 100 included London Stock Exchange and Rentokil Initial after declines of 2%, while outsourcing business Bunzl dropped 84p at 2857p as analysts at Barclays lowered their price target to 2740p.

Shares in components supplier RS Group also fell 14.5p to 915p as it announced the departure of chief executive Lindsley Ruth after seven years in charge. Finance boss Peter Egan will run the former Electrocomponents business until a successor is found.

Coach operator National Express was among the biggest fallers in the FTSE 250 index after broker Liberum downgraded its earnings forecasts for the next two years due to the impact of cost inflation and higher interest rates.

Its price target now stands at 155p, having been at 240p previously. The shares fell 6% or 9.5p to 134.3p, alongside a decline of 6% or 19p to 273.9p for ticket business Trainline.

Bitcoin miner Argo risks being delisted in further signs of crypto industry woes

Friday 16 December 2022 09:51 , Simon Hunt

Further signs of the precarity of the cryptocurrency industry were laid bare today as London-based crypto mining operator Argo said it was at risk of being suspended from the Nasdaq stock exchange.

Argo’s shares, which have plummeted 96% since the start of the year, have now fallen below the minimum bid price required to be compliant with Nasdaq’s listing rules, and face wiped from the exchange in June if they do not recover.

They sunk a further 7.5% on the London Stock Exchange this morning to just 3.3p.

It’s a further blow to beleaguered Argo after it sounded the alarm on its potential collapse on Monday, warning it was “at risk of having insufficient cash to support ongoing business operations within the next month.”

The firm said it hoped to sell off assets and secure additional financing to avoid bankruptcy.

The crypto industry has lost over $1 trillion in value since January.

Games Workshop shares soar as Amazon snaps up Warhammer TV rights

Friday 16 December 2022 09:22 , Michael Hunter

Warhammer, the fantasy figurine game loved by hobbyists, is moving from the tabletop to the television screen after Amazon snapped up rights from Games Workshop to turn it into a drama series.

Shares in the FTSE 250 company soared 1065p to 8365p, up 14% on the news.

The deal covers the latest version -- Warhammer 40000 -- and according to a range of reports, the TV series will star Henry Cavill, who recently lost his role as Superman after nearly a decade in the famous red cape and boots.

Cavill is said to be a Warhammer fan and no stranger to painting its militaristic humans, known as the Imperium of Man, who are locked in battle with a range of enemies, including skeletal robots called Necron and the Aeldari elves.

The latest version of the game is set 40000 years into the future amid a complex war. Terms of the deal were not disclosed.

Hollywood Bowl rolls past pre-pandemic performance

Friday 16 December 2022 09:18 , Simon Hunt

Hollywood Bowl has rolled past its pre-pandemic performance as families rushed backed to its tenpin alleys after an easing of Covid restrictions.

The Hemel Hempstead-based business posted a 68% boost in profits on 2019 levels to £38 million, while sales climbed 49% to £194 million.

The firm opened three new sites in 2022 and plans to open a further ten before the end of 2025.

Hollywood Bowl boss Stephen Burns said: “We are finding spaces becoming available from other operators that aren’t able to cope with the increased cost pressures that everyone else has seen.”

Hollywood Bowl shares climbed 4.4% to 239p.

FTSE 100 weakens, Rank shares fall 8%

Friday 16 December 2022 09:00 , Graeme Evans

Hopes for an improved session have been dashed, with the FTSE 100 index down 0.5% or 36.75 points to 7389.42 as traders continue to worry about the economic outlook.

Fallers include London Stock Exchange and Rentokil Initial after declines of 2%, while outsourcing business Bunzl is off 84p at 2857p after analysts at Barclays lowered their price target to 2740p.

Shares in former Electrocomponents business RS Group also fell, down 20p to 909.5p, as it announced the departure of chief executive Lindsley Ruth for personal reasons. Chief financial officer Peter Egan will run the company until a successor is found.

The FTSE 250 index weakened 1% or 180.78 points to 18,713.01, led by transport-focused National Express and Trainline after declines of 5%. However, Games Workshop shares jumped 13% or 975p to 8275p after it announced an agreement for Amazon to develop film and TV content from Warhammer characters.

In the FTSE All-Share, shares in gambling group Rank fell 8% or 6.8p to 73.5p after it said the return to growth at its Grosvenor casinos was taking longer than expected due to the current economic conditions.

Consumer confidence near record low

Friday 16 December 2022 08:03 , Graeme Evans

Consumer confidence improved for the third month in a row in December, but the reading of minus 42 is still near to the record low of minus 49 recorded in September.

GfK said it was the first time in the survey’s 50-year history that the index has been at minus 40 or worse for eight months or more in a row.

The reading for people’s personal financial situation over the next 12 months remains at minus 29 and the major purchase index is at minus 34, albeit an improvement of four points on the previous month.

Joe Staton, GfK’s client services director, said: “Real wages are falling as inflation continues to bite hard, further straining the discretionary budget of many households as we enter the last few shopping days before Christmas.”

Rank Group warns on profit as gamblers spend less in Grovesnor casinos

Friday 16 December 2022 07:54 , Michael Hunter

Gamblers have not returned to Rank Group casinos in the numbers expected, prompting a profit warning from the FTSE 250 company.

Famed for its high-rolling Grovesnor casinos, the staple of the West End said trading in the second quarter was “weaker than expected”. Weekly net gaming revenue of £5.8 million was “only marginally ahead” of the first quarter.

The company added; “We had expected Grosvenor venues to have continued to improve throughout Q2 and then into the second half of the year, but this improvement has not yet materialised, driven by lower customer spend per visit.”

That meant it now forecast like-for-like operating profit of between £10 million and £20 million for the year to June 30 2023, with the “main variable being the performance of Grovesnor”. Underlying operating profit for the full year which ended on June 30 2022 was just over £40 million.

Visits to its Mecca bingo chain took a hit from the cold snap and as punters stayed at home to watch the World Cup.

Fulham Shore profits shrink as CEO vows to conserve cash

Friday 16 December 2022 07:52 , Simon Hunt

Half-year profits at Franco Manca and The Real Greek owner The Fulham Shore shrunk over 80% to just £300,000 today, its results show, despite a 26% jump in revenues to almost £50 million as it dealt with soaring labour and food inflation.

Fulham Shore executive chairman David Page said: “The Board remains mindful that we continue to operate against an unstable political and economic backdrop, which in turn has impacted consumer confidence and driven up our costs as well as facing significant challenges from the ongoing transportation disruption.

“Reflecting on this, our aims over the coming 12 months are to conserve cash for our shareholders, to proceed cautiously, and take advantage of ever-decreasing rents.”

Markets steady despite alarm over rate rise outlook

Friday 16 December 2022 07:51 , Graeme Evans

Fears over how far rate setters will go in tightening monetary policy last night left the FTSE 100 index 0.9% lower and caused the S&P 500 to finish down 2.5%.

The sell-off was triggered by the hawkish stance of Federal Reserve policymakers on Wednesday and yesterday’s guidance from the European Central Bank that interest rates are likely to raise rates by another 1% by the spring.

The Bank of England also confirmed a further 0.5% increase, taking its base rate to a post-2008 high of 3.5%.

This week’s central bank announcements have added to fears that much higher rates will send the global economy into a period of stagflation. However, European markets look set for a steadier session today after CMC Markets forecast a rise of 22 points to 7448 for the FTSE 100 index.

Retail sales down in Black Friday month

Friday 16 December 2022 07:35 , Graeme Evans

Retail sales volumes fell by 0.4% in November, having risen by 0.9% in October in a bounce back from the impact of the additional bank holiday for the Queen’s funeral.

The November calculations by the Office for National Statistics include Black Friday, although it notes that for many retailers their promotional activity lasted throughout the month.

Sales volumes for online retailers fell by 2.8% in November, continuing a downward trend seen since early 2021.

Department stores sales volumes rose by 1.7% over the month, while household goods stores lifted 4.4%. Clothing sales volumes rose by 2.1%, mainly because of growth in footwear stores, but remained 2% below their February 2020 levels.

The ONS also reported that food store sales volumes rose by 0.9%, with anecdotal evidence from retailers suggesting that customers stocked up early for Christmas.

City analysts had been expecting November growth of 0.3%, although that was before today’s revision in October’s volumes from 0.6% to 0.9%.

Yahoo Finance

Yahoo Finance