FTX legal and administrative fees now exceed $500 million

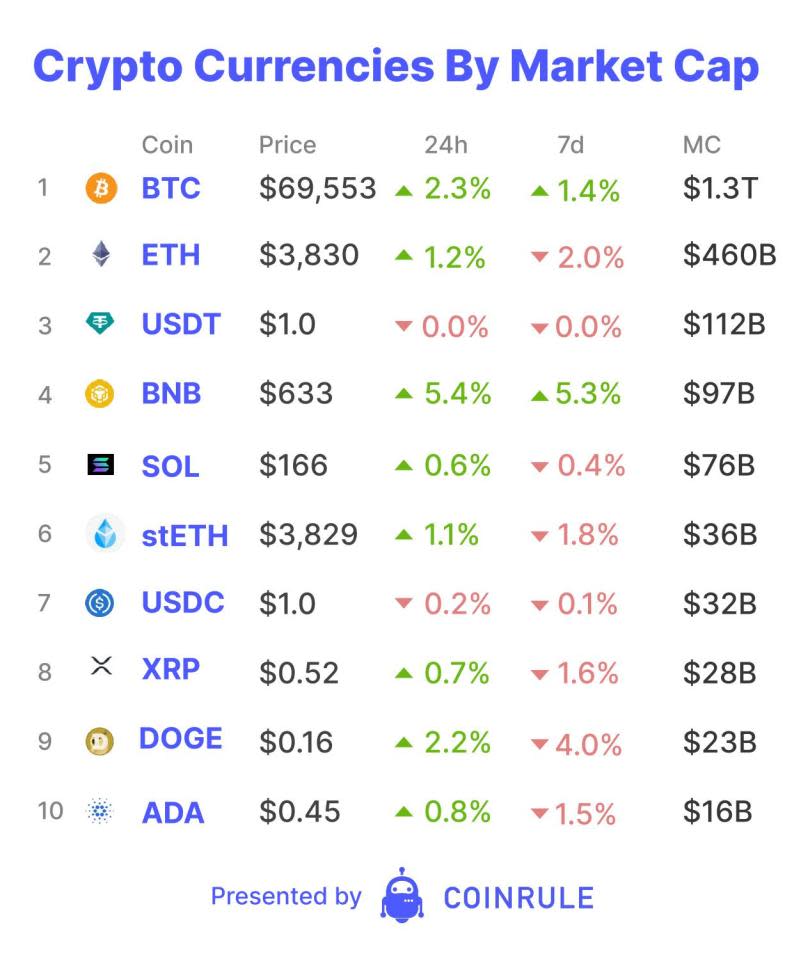

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

Over the past several weeks, FTX creditors learned that 98% of them will receive up to 118% of their lost funds following the exchange’s implosion. Even after the exchange had lost considerable amounts of customers’ funds, the estate still managed to generate this 18% “profit” for the creditors. However, it seems that the firms facilitating FTX’s bankruptcy proceedings are also receiving fair compensation.

One of the main contributors for FTX being able to recover the funds was due to its significant Solana holdings. FTX was an early backer of the Layer 1 blockchain holding 55.8 million Solana at the time of the bankruptcy. This represented approximately 12% of the token’s circulating supply. Crypto hedge funds, such as Galaxy Digital and Pantera Capital, have purchased some of these holdings at auction. The latest auction, concluded on 24th May, raised an additional $2.4 billion. Some creditors, who held significant amounts of Solana at the time of the exchange’s downfall, have argued they should’ve received the tokens as opposed to the USD cash value they were worth at the time of the bankruptcy. This is due to them missing out on the token’s significant appreciation over the past year.

FTX’s risk management may not have been their strong suit. However, they did make an effort to diversify their crypto exposure by also making equity investments. One of them was in Anthropic, an artificial intelligence start-up. Their $500 million investment during 2021 got them 7.8% of the company. Last week, the estate announced that it had successfully liquidated the entire investment, selling the remaining 15 million shares for $450 million. In total, the investment generated $1.3 billion, or $800 million in profit. However, the exchange’s recovery will use a portion of the funds to cover ballooning administrative and legal fees.

According to The Block, approved fees for FTX’s restructuring have now exceeded $500 million. However, firms involved have requested a total amount that exceeds $700 million. One of the primary beneficiaries of the fees is law firm, and FTX’s special counsel, Sullivan and Cromwell. According to court filings, the firm has requested $360 million in fees. For now, $254 million have been approved. John Ray III, FTX’s CEO, has been billing the exchange $1,300 per hour for his services. He has billed over 4,000 hours of work, charging $5.6 million. As these bankruptcy proceedings continue, the fees will keep rising. The question is: how much higher?

The views and opinions expressed in this article are those of the authors and do not represent those of City AM, its affiliates, or employees.

Yahoo Finance

Yahoo Finance