Full House Resorts Inc (FLL) Reports Significant Revenue Growth Amidst Expansion Efforts

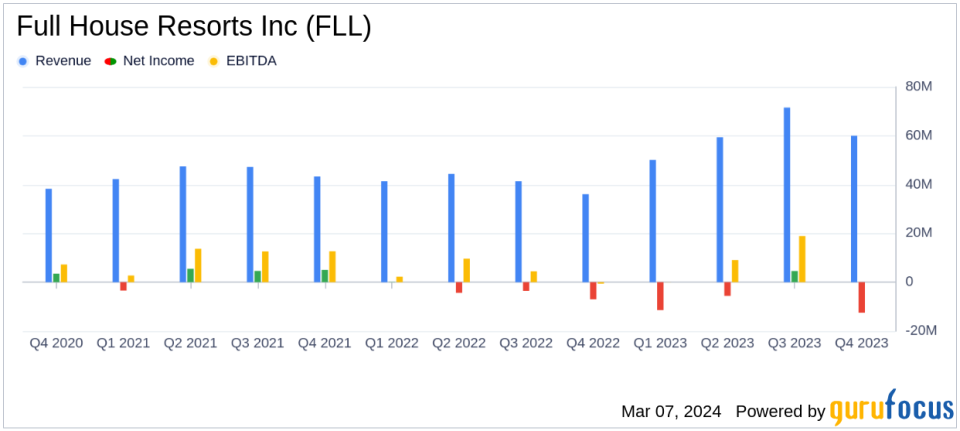

Revenue Growth: Q4 revenues surged by 66.4% to $60.0 million, while annual revenues increased by 47.6%.

Net Loss: Q4 net loss widened to $12.5 million, impacted by preopening and development costs, and depreciation charges.

Adjusted EBITDA: Q4 Adjusted EBITDA rose by 87.4% to $7.3 million, reflecting the contribution of new properties.

Liquidity: As of December 31, 2023, Full House Resorts had $73.8 million in cash and cash equivalents.

Debt Profile: The company reported $450.0 million in outstanding senior secured notes due 2028 and $27.0 million under its revolving credit facility.

Operational Milestones: The phased opening of Chamonix Casino Hotel and the record-setting performance of American Place in Illinois.

On March 5, 2024, Full House Resorts Inc (NASDAQ:FLL) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, which owns, operates, and develops casinos and related hospitality and entertainment facilities across the United States, reported significant growth in revenues, driven by the opening of new properties and the ramp-up of operations at existing ones.

Financial Performance and Challenges

Full House Resorts saw a substantial increase in revenues, with a 66.4% jump to $60.0 million in the fourth quarter of 2023, primarily due to the opening of American Place in February 2023. The full-year revenues also grew by 47.6%, reaching $241.1 million. However, the company faced a net loss of $12.5 million in the fourth quarter, which included $3.1 million of preopening and development costs, primarily related to the phased opening of Chamonix, and significant depreciation and amortization charges related to the temporary American Place facility. The net loss for the full year was $24.9 million, with preopening and development costs amounting to $15.7 million.

Adjusted EBITDA, a key metric for assessing a company's operational performance, rose by 87.4% to $7.3 million in the fourth quarter and by 51.1% to $48.6 million for the full year. This growth reflects the positive impact of the new properties and the $5.8 million of accelerated revenue from sports wagering agreements.

Strategic Developments and Outlook

President and CEO Daniel R. Lee highlighted the company's transition into a new phase with the opening of two new casinos in 2023. The Chamonix Casino Hotel in Colorado began its phased opening on December 27, 2023, and American Place in Illinois has been setting new revenue records. The company has received approvals to operate American Place in its temporary configuration until August 2027, which provides additional time before the opening of the permanent facility.

Lee also noted that the company has reached an inflection point with the bulk of capital expenditures for these projects behind them. This positions Full House Resorts to generate significant free cash flow in the coming years, benefiting from tax-loss carryforwards and accelerated depreciation for tax purposes.

Our Company recently reached an inflection point," said Mr. Lee. "In 2023, our total cash interest expense was approximately $38.4 million and Adjusted EBITDA, as noted, was $48.6 million, despite construction disruptions in Colorado and the gradual ramp-up of operations at American Place."

Liquidity and Capital Resources

As of the end of 2023, Full House Resorts maintained a strong liquidity position with $73.8 million in cash and cash equivalents. The company's debt profile included $450.0 million in outstanding senior secured notes due in 2028, which became callable at specified premiums in February 2024, and $27.0 million outstanding under its revolving credit facility.

The company's financial strategy and operational milestones, such as the phased opening of Chamonix and the performance of American Place, underscore its potential for future growth and cash flow generation. Full House Resorts' expansion efforts in strategic locations and the management's focus on operational efficiency are pivotal in driving the company's value proposition in the competitive travel and leisure industry.

For more detailed information and to listen to the conference call discussing these results, investors can visit Full House Resorts' website or access the replay using the provided passcode.

Value investors and potential GuruFocus.com members interested in the travel and leisure sector may find Full House Resorts Inc (NASDAQ:FLL) a compelling study as it navigates through its expansion phase and leverages its strategic assets to enhance shareholder value.

Explore the complete 8-K earnings release (here) from Full House Resorts Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance