GameStop (NYSE:GME) Misses Q1 Revenue Estimates, But Stock Soars 22.8%

Video game retailer GameStop (NYSE:GME) fell short of analysts' expectations in Q1 CY2024, with revenue down 28.7% year on year to $881.8 million. It made a non-GAAP loss of $0.12 per share, improving from its loss of $0.14 per share in the same quarter last year.

Is now the time to buy GameStop? Find out in our full research report.

GameStop (GME) Q1 CY2024 Highlights:

Revenue: $881.8 million vs analyst estimates of $995.3 million (11.4% miss)

EPS (non-GAAP): -$0.12 vs analyst expectations of -$0.09 (33.3% miss)

Gross Margin (GAAP): 27.7%, up from 23.2% in the same quarter last year

Free Cash Flow was -$114.7 million compared to -$111.8 million in the same quarter last year

Market Capitalization: $16.35 billion

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE:GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

Electronics & Gaming Retailer

After a long day, some of us want to just watch TV, play video games, listen to music, or scroll through our phones; electronics and gaming retailers sell the technology that makes this possible, plus more. Shoppers can find everything from surround-sound speakers to gaming controllers to home appliances in their stores. Competitive prices and helpful store associates that can talk through topics like the latest technology in gaming and installation keep customers coming back. This is a category that has moved rapidly online over the last few decades, so these electronics and gaming retailers have needed to be nimble and aggressive with their e-commerce and omnichannel investments.

Sales Growth

GameStop is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

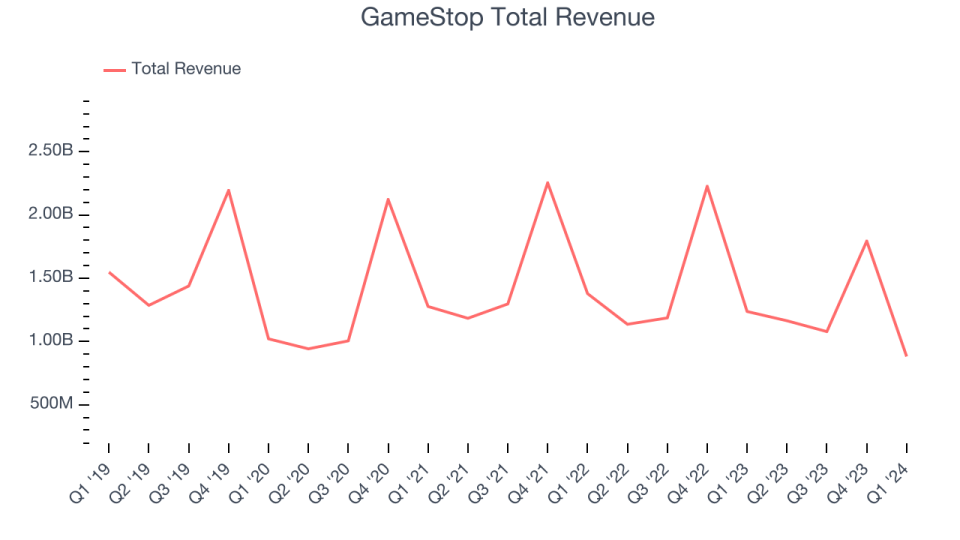

As you can see below, the company's revenue has declined over the last four years, dropping 9.4% annually as its store count and sales at existing, established stores have both shrunk.

This quarter, GameStop missed Wall Street's estimates and reported a rather uninspiring 28.7% year-on-year revenue decline, generating $881.8 million in revenue. Looking ahead, Wall Street expects revenue to decline 3.7% over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

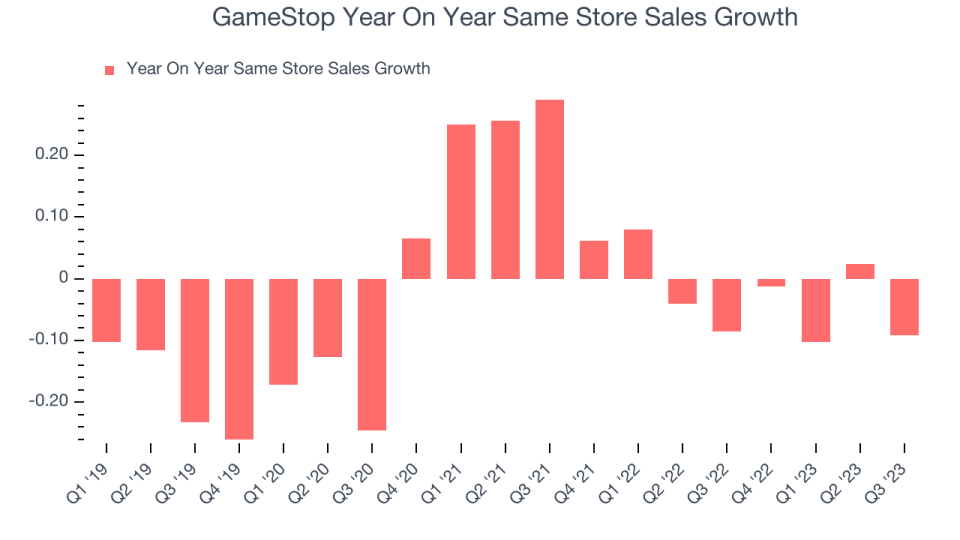

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

GameStop's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 5.1% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

Key Takeaways from GameStop's Q1 Results

This was an interesting quarter for GameStop. It was initially slated to report earnings on June 11 but pre-announced the results, likely in an attempt to capitalize on the hype generated by Reddit star Roaring Kitty's return. It certainly worked, and the stock is up huge in pre-market trading.

From a fundamental perspective, however, this was a bad quarter for GameStop. Its revenue and EPS missed analysts' expectations, and it didn't share an outlook for the rest of the year. It also announced a stock sale plan to take advantage of the run-up in its shares, a potentially dilutive event for shareholders.

Investors unsurprisingly didn't seem to care, and the stock is up 22.8% after reporting. It currently trades at $57.16 per share, and Roaring Kitty's position is likely now in the upper hundreds of millions of dollars. His call options on the company are rumored to expire on June 21, which will be a big catalyst for its share price.

So should you invest in GameStop right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance