GameStop Q2 Earnings Beat Amid Y/Y Sales Dips Across All Categories

GameStop Corp. GME posted second-quarter fiscal 2024 results, wherein the top line missed the Zacks consensus estimate and declined year over year. However, the company’s earnings per share surpass estimates and compared favorably with the year-ago figure. Higher inflationary pressures on consumer spending in the gaming industry have been resulting in lower demand and, in turn, weighing on the company’s results.

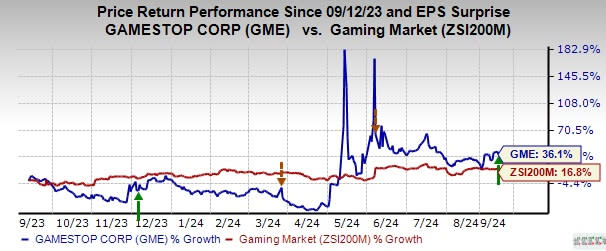

Shares of this Zacks Rank #3 (Hold) company have gained 36.1% in the past year compared with the industry’s 16.8% growth.

GameStop Corp. Price, Consensus and EPS Surprise

GameStop Corp. price-consensus-eps-surprise-chart | GameStop Corp. Quote

More on GameStop’s Q2 Results

GME posted adjusted earnings per share of 1 cent in second-quarter fiscal 2024, beating the Zacks Consensus Estimate of an adjusted loss of 1 cent. The company reported an adjusted loss of 3 cents in the prior-year quarter.

GameStop reported net sales of $798.3 million, which missed the consensus estimate of $900 million. Also, the metric decreased 31.4% from $1,163.8 million in the year-ago quarter. Lower sales across all the categories contributed to soft sales.

By sales mix, hardware and accessories sales fell 24.4% to $451.2 million from $597 million in the year-ago quarter. Software sales were $207.7 million, down 47.7% from $397 million in the year-ago quarter. Sales in the collectibles unit declined 17.9% to $139.4 million from $169.8 million in the year-ago quarter.

The Zacks Consensus Estimate for the software and collectibles units’ net sales was pegged at $376 million and $181.3 million, respectively, for the quarter under review.

Insight Into GME’s Margins & Expenses

Gross profit decreased 18.7% to $248.8 million from $305.9 million in the year-ago quarter. We note that gross margin expanded 490 basis points (bps) year over year to 31.2% in the quarter under review.

Adjusted selling, general and administrative (SG&A) expenses declined 14.1% to $280.4 million from $326.6 million in the year-ago quarter. As a percentage of net sales, adjusted SG&A expenses were 35.1%, up 700 bps from 28.1% in the year-ago period.

The company’s adjusted operating loss was $31.6 million in the reported quarter compared with an adjusted operating loss of $20.7 million in the prior-year period.

Image Source: Zacks Investment Research

GME’s Financial Snapshot: Cash, Debt & Equity Overview

GameStop ended the fiscal second quarter with cash and cash equivalents of $4.19 billion, net long-term debt of $12.4 million, and stockholders’ equity of $4.38 billion. Merchandise inventory was $560 million at the end of the reported quarter compared with $676.9 million at the close of the prior-year quarter.

During the 13 weeks ended Aug. 3, 2024, the net cash flow provided by operations was $68.6 million against an outflow of $109.1 million in the prior-year period. The free cash flow during the same period was $65.5 million. Capital expenditure in the 13 weeks amounted to $3.1 million.

Key Picks

A few better-ranked stocks are DoubleDown Interactive Co. Ltd. DDI, Monarch Casino & Resort, Inc. MCRI and Skillz Inc. SKLZ.

DoubleDown is a developer and publisher of digital social casino games. The company sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for DoubleDown’s 2024 earnings and sales indicates growth of 15.8% and 12.6%, respectively, from the 2023 reported figures. DDI has a trailing four-quarter average earnings surprise of 22.1%.

Monarch is dedicated to delivering the ultimate guest experience by providing exceptional services, and the latest gaming, dining and hospitality amenities. The company currently carries a Zacks Rank of 2 (Buy).

The consensus estimate for Monarch’s current financial-year earnings and sales indicates growth of 10% and 2.3%, respectively, from the fiscal 2023 reported figures. MCRI has a negative trailing four-quarter average earnings surprise of 3.5%.

Skillz provides a mobile games platform that connects players. It has a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for Skillz’s current financial-year earnings indicates growth of 65% from the year-ago period’s reported figures. SKLZ has a trailing four-quarter average earnings surprise of 18.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GameStop Corp. (GME) : Free Stock Analysis Report

Monarch Casino & Resort, Inc. (MCRI) : Free Stock Analysis Report

Skillz Inc. (SKLZ) : Free Stock Analysis Report

DoubleDown Interactive Co., Ltd. Sponsored ADR (DDI) : Free Stock Analysis Report