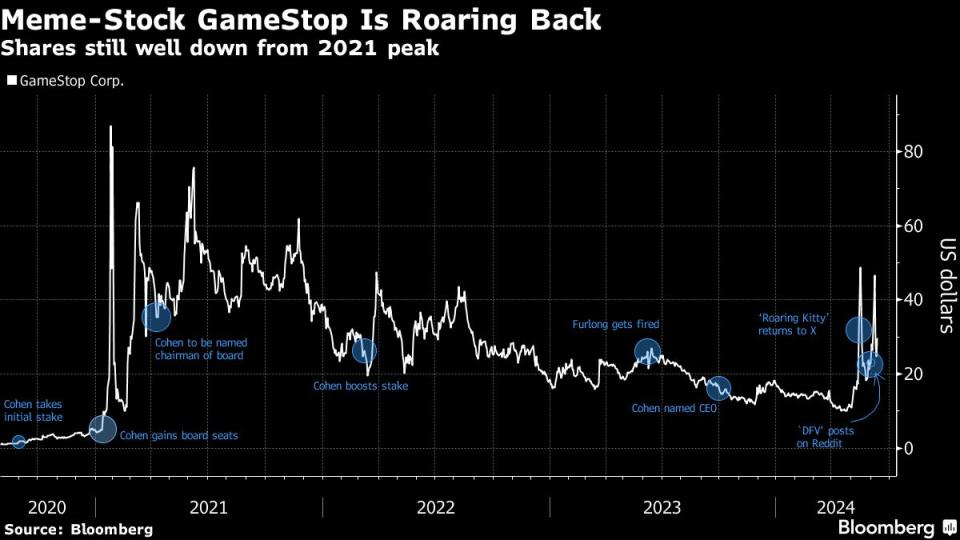

GameStop Raises $2.14 Billion on Back of Roaring Kitty-Led Rally

(Bloomberg) -- GameStop Corp. raised about $2.14 billion from a share sale program as it capitalized on a stock rally fueled by Keith Gill’s return to YouTube.

Most Read from Bloomberg

Dozens of CVS Generic Drug Recalls Expose Link to Tainted Factories

Stocks Rise as Solid Treasury Sale Spurs CPI Bets: Markets Wrap

The video-game retailer has now raised more than $3 billion over the past month via share sales as retail investors powered the stock higher. The latest sale of 75 million shares implied an average price of around $28.49 each, according to Bloomberg calculations based on a statement Tuesday.

The stock rose more than 5% to $32.27 in post-market trading, though it remains well below a June peak of $48. It rallied on Tuesday shortly after 1:30 p.m. in New York, an indication that the selling pressure from issuance was completed. The stock closed 23% higher at $30.49.

Last week, GameStop unexpectedly released earnings and disclosed the plan to sell millions of new shares just hours before Gill, who operates under the “Roaring Kitty” moniker, made his highly anticipated return to YouTube. GameStop more than double in four days, then cratered on Friday after the fundraising plan was announced.

The sale comes on top of the $933 million GameStop raised last month and adds to the $1.08 billion it had in cash and equivalents at the end of the last quarter. Jefferies LLC is acting as the sales agent on the offering, the filing said. The company plans to use the haul for general corporate purposes, which may include acquisitions and investments.

Fellow retail trader darling AMC Entertainment Holdings Inc. also completed a share sale of its own earlier this year.

Most Read from Bloomberg Businessweek

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Food Companies Hope You Won’t Notice Shortages Are Raising Prices

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance