GBP/USD Daily Forecast – Sterling Recovers To Close Weekly Gap

After consolidating in a range since Friday’s US NFP report, the US dollar index (DXY) broke decisively lower on Wednesday, supporting a move higher in GBP/USD.

The greenback gained downside momentum yesterday after the US producer price index came in short of expectations. The Bureau of Labor Statistics reported a rise of 0.1% in the index for December while analysts were looking for the report to come in a tick higher.

Investors will now look to the US retail sales report to asses the health of the US economy. The report is scheduled for release shortly after the North American open.

GBP/USD was weighed earlier in the week after further talks of easing monetary policy. The futures markets have upped the odds of a rate cut at the BoE meeting significantly although the exchange rate seems to have held up quite well.

Considering that GBP/USD has closed the weekly gap, and effectively erased the week’s losses, the near-term bias has shifted to bullish. This is despite the policy easing expectations.

Technical Analysis

There is certainly a divergence between the fundamental outlook for GBP/USD and the technical picture.

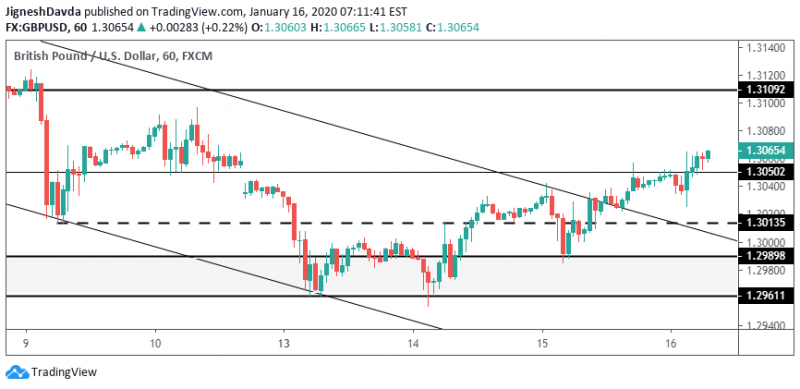

Recent price action shows that the pair respected a major support zone that falls between 1.2960-1.2990. This area was responsible for holding the pair lower from October until early December. The prior resistance area has acted as strong support this week.

The recovery to close the weekly gap is also very significant. More so as the pair has seen little selling pressure since closing the gap.

GBP/USD has also broken higher from a declining trend channel on an hourly chart. All the recent technical developments combined paint a bullish picture for the pair.

While the fundamental side of things suggests more downside for the pair, it also indicates that there was likely some bearish positioning since the idea of more easing came to light last week. This will tend to make the pair vulnerable to stop runs in the current recovery.

Support for the pair in the session ahead is seen at 1.3050 which falls near last weeks close and has generally been a respected level for the pair. The next area of upside resistance is found at 1.3109.

Bottom Line

GBP/USD has regained strength after bouncing higher from a major support zone.

The dollar index has broken lower from a range that had contained since Friday’s NFP report.

This article was originally posted on FX Empire

More From FXEMPIRE:

EUR/USD Daily Forecast – Euro Holds Gains Ahead of US Retail Sales

China and U.S. Sign Phase One, But Plenty of Problems Lie Ahead

Oil Price Fundamental Daily Forecast – Rally Fueled by Trade Deal Optimism, Capped by IEA Report

NZD/USD Forex Technical Analysis – Momentum Shift May Lead to Test of .6671 – .6692

USD/JPY Forex Technical Analysis – Trying to Build Support Base Over Former Tops

Yahoo Finance

Yahoo Finance