GBP/USD Daily Fundamental Forecast – February 16, 2018

The pound has managed to perform a Houdini act and escaped the wrath of the markets and the dollar as it has taken advantage of the apparent weakness in the dollar to save itself from further agony. It has been a very volatile trading since the beginning of the year for the pound and it is to the credit of the bulls that they have managed to keep it afloat.

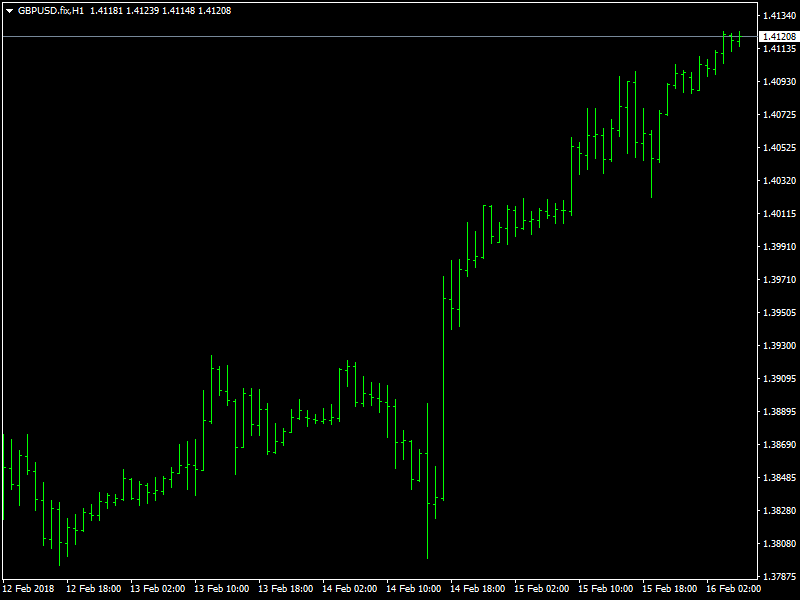

GBPUSD Survives

The pound began to move higher due to dollar weakness and the anticipation over the smooth progress of the Brexit process and this strength continued through the month of January which enabled to push the pair higher by over 800 pips. But once the dollar began to gain in strength, the bulls crumbled, took profit and vacated the place and the pound reversed almost the entire move. The speed and the size of the reversal on the face of slight dollar strength surprised the markets which joined in on the selling and it needed only a bit more strength from the dollar to tip the GBPUSD over.

But just when all seemed lost for the pound, the dollar could not get started as many would have expected it to. Since the beginning of the week, the dollar has been on the backfoot, though for no apparent reason. There has not been any fundamental change and even the data sets that we received have only been steady and choppy and do not represent anything wrong with the economy. But the rise in the stock markets seem to have pushed the dollar on the backfoot and this has helped the GBPUSD to recover through the 1.40 region and head higher.

Looking ahead to the rest of the day, we do not have any major economic data from the US but we have the retail sales data from the UK later in the London session which is likely to have an impact on the pound.

This article was originally posted on FX Empire

More From FXEMPIRE:

Alt Coins Price Forecast February 16, 2018, Technical Analysis

UK Retail Sales and the GBP in Focus as the Dollar Slide Continues

Stock Investors Regaining Confidence Despite Sharp Rise in Treasury Yields

S&P 500 Price Forecast February 16, 2018, Technical Analysis

Dow Jones 30 and NASDAQ 100 Price Forecast February 16, 2018, Technical Analysis

Yahoo Finance

Yahoo Finance