GBP/USD Fundamental Analysis – week of May 28, 2018

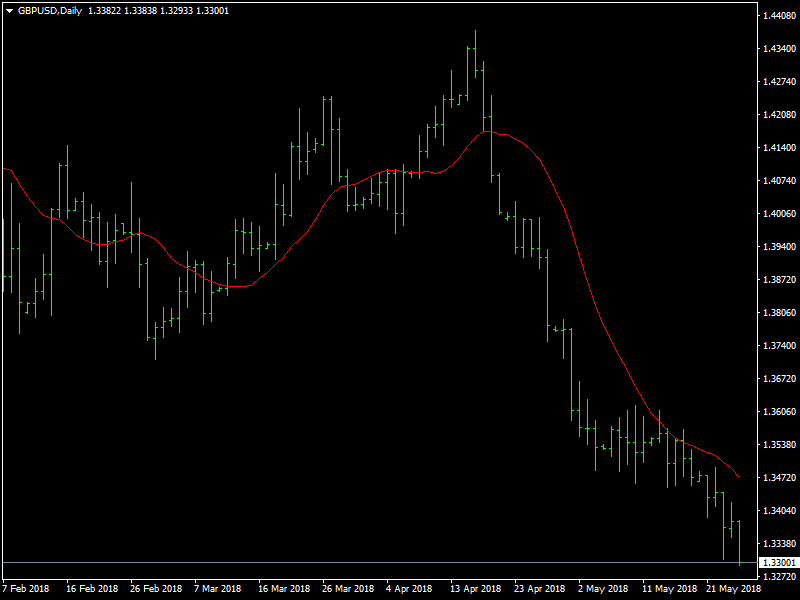

We had mentioned in our forecast last week that the pound had begun to buckle under the pressure from the dollar and had managed to hold out to dollar for sometime but the bulls were slowly losing hope. We saw a follow up of that in the last week as the pound ended the week near the 1.33 region which is likely to point to some more weakness in the coming days.

GBPUSD Under Pressure

There was not much variation from the expected lines as far as the incoming data was concerned from the UK. The inflation did show a slight dip but this was more than compensated by the strong retail sales data from the UK during the middle of the week. But it was the speeches from the BOE Governor Carney which disappointed the markets. The traders were hoping for a hawkish tone from him but none of that followed.

The UK and the BOE run the risk of being left out by the other major central banks who have gone ahead with their cycle of hiking rates and the BOE needs to keep pace with that but the economy has not been supportive of their moves so far. Also, we are seeing the Brexit process casting a shadow over the economy and a combination of all these factors has been dragging down the pound. he dollar, on the other hand, has been moving from strength to strength and this has placed additional pressure on the pound.

Looking ahead to the coming week, we do not have much by way of data from the UK. But we are going to see the end of the month in the coming week which is likely to see some currency flows that are likely to impact the GBPUSD pair in the short term. Also, we are going to see some data from the US towards the end of the week by way of NFP data. Also, the pair is now approaching a region of support between the 1.31 and 1.33 regions and this is likely to see some solid buying in the short and medium term and considering the fact that it is the same case with the euro as well, we could see some dollar weakening and a rebound in the pair in the coming days.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance