General Dynamics' (GD) Arm Secures $655M Deal for M1128

General Dynamics Corporation’s GD business unit, Ordnance and Tactical Systems, recently clinched a $654.5 million contract for the metal parts program for M1128. The contract has been awarded by the Army Contracting Command, Newark, NJ.

Work locations will be determined with each order. The contract is expected to be completed by Apr 12, 2028.

What’s Favoring General Dynamics?

Rising geopolitical tensions, perceived threats and the need to guard national interests are resulting in nations consistently reinforcing their defense capabilities. This has led to augmented spending on military arms and ammunition that play an integral role in military missions.

Such increased defense spending on military arms and ammunition often translates to a boost for companies like General Dynamics, renowned for their extensive expertise in the designing, engineering and production of munitions, energetics, weapons, armaments and missile subsystems worldwide.

Consequently, the company witnesses a consistent order inflow for its manufactured arms and ammunition, like the latest one. The latest order win for M1128, which is an eight-wheeled assault mobile gun system for the Stryker family, reflects the significant demand that this product enjoys, thereby boosting the revenue generation prospects of General Dynamics.

Growth Prospects & Peer Moves

Going forward, per the report from the Markets and Markets firm, the global ammunition market is poised to witness a CAGR of 3.7% over the 2021-2026 period. This could lead to additional contracts for arms and ammunition procurement for General Dynamics. Such a consistent order inflow is likely to boost GD’s order book and backlog.

Other defense majors poised to benefit from the expanding ammunition market are Lockheed Martin LMT, RTX Corporation RTX and Northrop Grumman NOC.

Lockheed Martin provides a wide variety of highly effective and reliable weapon systems. These weapon systems include precision strike weapons with long standoff ranges and smart submunitions to give the warfighter maximum flexibility and fire support mobile artillery and guided munitions to dominate the battlefield.

Lockheed boasts a long-term earnings growth rate of 8.6%. The Zacks Consensus Estimate for its 2023 sales suggests a growth rate of 0.9% from the prior-year reported figure.

RTX manufactures ammunition ranging from shoulder-fired weapons to extended-range precision munitions. Its product portfolio includes Excalibur projectile and a few more.

RTX’s long-term earnings growth rate is pegged at 9.4%. The Zacks Consensus Estimate for its 2023 sales suggests a growth rate of 10.5% from the prior-year reported figure.

Northrop’s ammunition includes air-bursting, proximity and guided munitions, which provide greater precision and the ability to counter unmanned threats and defeat advanced armor. Its portfolio of ammunition includes M865 kinetic energy and the M1002, 120mm M829, M830, M908, M1028 and M1147 cartridges and a few more.

Northrop boasts a long-term earnings growth rate of 2.4%. NOC stock has appreciated 9.1% in the past three months.

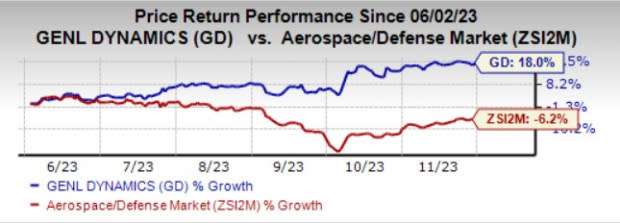

Price Performance

Shares of General Dynamics have increased 18% in the past six months against the industry’s 6.2% decline.

Image Source: Zacks Investment Research

Zacks Rank

General Dynamics currently carries a Zacks Rank #3 (Hold). You can seethe complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance