General Dynamics' (GD) Q3 Earnings Beat, Revenues Down Y/Y

General Dynamics Corporation GD reported third-quarter 2020 earnings from continuing operations of $2.90 per share, which beat the Zacks Consensus Estimate of $2.85 by 1.8%. The bottom line, however, declined 7.6% from the prior-year quarter’s $3.14 per share.

The company reported GAAP earnings of $2.91 per share compared with the year-ago quarter’s $3.17.

Total Revenues

General Dynamics’ third-quarter revenues of $9,431 million missed the Zacks Consensus Estimate of $9,596 million by 1.7%. Further, revenues declined 3.4% from $9,761 million in the year-ago quarter. The year-over-year decrease can be attributed to the decline in the Aerospace and the Information Technology segments.

Backlog

General Dynamics’ total backlog at the end of third-quarter 2020 was $81.5 billion, up 21% from the year-ago quarter. Estimated potential contract value, representing management’s estimate of value in contracts and unexercised options, was $50.4 billion. Total estimated contract value, the sum of all backlog components, was $131.9 billion.

Segmental Performance

Aerospace: The segment reported revenues of $1,975 million, down 20.8% year over year. Operating earnings of $283 million declined 28% from the prior-year quarter’s $393 million.

Combat Systems: Segment revenues rose 3.5% from the prior-year quarter to $1,801 million. Moreover, operating earnings were up 2.3% from the year-ago quarter to $270 million.

Information Systems and Technology: The segment reported revenues of $2,029 million, which declined 2% year over year. Operating earnings of $146 million in the quarter remained flat year over year.

Mission Systems: The segment’s revenues of $1,221 million improved a mere 0.1% from the year-ago quarter’s $1,220 million. Operating earnings of $168 million fell 9.2% from the year-ago quarter’s $185 million.

Marine Systems: The segment’s revenues of $2,405 million were up 7.6% from the year-ago quarter’s $2,235 million. Operating earnings also improved 6.7% year over year to $223 million.

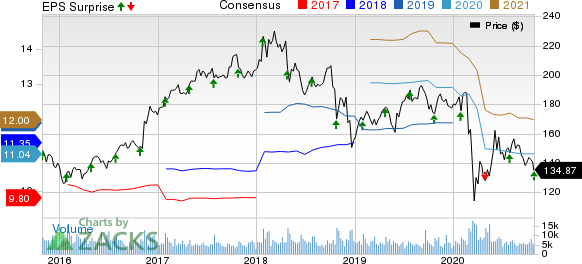

General Dynamics Corporation Price, Consensus and EPS Surprise

General Dynamics Corporation price-consensus-eps-surprise-chart | General Dynamics Corporation Quote

Operational Highlights

Company-wide operating margin contracted 100 basis points (bps) to 11.5% from the year-ago quarter’s 12.5%.

In the quarter under review, General Dynamics’ operating costs and expenses declined 2.3% from the year-ago period to $8,347 million.

Interest expenses in the reported quarter amounted to $118 million, up from $114 million registered in the year-ago quarter.

Financial Condition

As of Sep 27, 2020, General Dynamics’ cash and cash equivalents were $1,469 million compared with $902 million on Dec 31, 2019.

Long-term debt as of Sep 27, 2020, was $9,978 million, which rose from the 2019-end level of $9,010 million.

In the first nine months of 2020, the company’s cash provided by operating activities was $1,296 million compared with $587 million in the year-ago period.

Zacks Rank

General Dynamics currently carries a Zacks Rank #4 (Sell).

Recent Releases

Lockheed Martin LMT, a Zacks Rank #3 (Hold) company, reported third-quarter 2020 earnings from continuing operations of $6.25 per share, which surpassed the Zacks Consensus Estimate of $6.07 by 3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Northrop Grumman NOC, a Zacks Rank #4 company, reported third-quarter 2020 earnings of $5.89 per share, which surpassed the Zacks Consensus Estimate of $5.60 by 5.2%.

Teledyne Technologies TDY, a Zacks Rank #2 (Buy) company, reported third-quarter 2020 adjusted earnings of $2.48 per share, which surpassed the Zacks Consensus Estimate of $2.40 by 3.3%.

Zacks’ 2020 Election Stock Report:

In addition to the companies you learned about above, we invite you to learn more about profiting from the upcoming presidential election. Trillions of dollars will shift into new market sectors after the votes are tallied, and investors could see significant gains. This report reveals specific stocks that could soar: 6 if Trump wins, 6 if Biden wins.

Check out the 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance