Global $1277 Billion Asset Servicing Markets, Analysis & Forecasts, 2017-2022, 2022-2027F, 2032F: Focus on Fund Services, Custody and Accounting, Outsourcing Services, & Securities Lending

Global Asset Servicing Market

Dublin, March 13, 2023 (GLOBE NEWSWIRE) -- The "Asset Servicing Global Market Report 2023" report has been added to ResearchAndMarkets.com's offering.

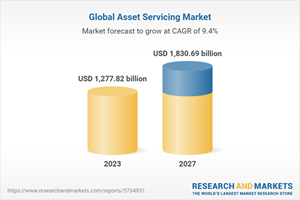

The global asset servicing market will grow from $1159.45 billion in 2022 to $1277.82 billion in 2023 at a compound annual growth rate (CAGR) of 10.2%. The asset servicing market is expected to grow to $1830.69 billion in 2027 at a CAGR of 9.4%.

Major players in the asset servicing market are National Australia Bank Limited, CACEIS, BNY Mellon, HSBC, JP Morgan, Citi, The Bank of New York Mellon Corporation (BNY Mellon), State Street Corporation, UBS, and Clearstream (Deutsche Borse Group).

The asset servicing market consists of revenues earned by entities by providing administration services through a central securities depository (CSD) or custodian in connection with the custody and/or safekeeping of financial instruments (e.g., the processing of corporate events or the handling of taxes) on a fee or commission basis. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

North America was the largest region in the asset servicing market in 2022. Western Europe was the second largest region in the asset management market. The regions covered in the asset servicing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

The main services offered in asset servicing are fund services, custody and accounting, outsourcing services, and securities lending. Securities lending is the process of lending shares of stock, commodities, derivative contracts, or other securities to other investors or firms. The borrower must put up collateral in the form of cash, other assets, or a letter of credit when applying for a security loan. The services are offered to large enterprises, medium-sized and small enterprises, capital markets, and wealth management firms.

Globalization acts as a major driver for the growth of the asset servicing industry. According to a study on global asset servicing, nearly 60% of asset services in Assets Under Administration (AUA) and Assets Under Contract (AUC) predict that globalization is likely to be a strong driver for the asset servicing market's growth over the coming years. The players dealing in the asset servicing industry are majorly focusing on the APAC markets and other growing economies.

Moreover, according to the BNP Paribas Securities Services article published in January 2020, India was expected to experience impressive growth in the asset management and servicing industry owing to the increasing working population, the rising buying power of the populace, and expected growth in the GDP of the country. Thus, globalization creates a large avenue for the expansion and growth of the asset servicing market over the coming years.

The stringent regulatory framework is predicted to limit the growth of the asset servicing industry over the forecast period. According to Funds Europe's asset servicing roundtable, rising global regulation is adding cost and risk to asset servicing, creating a requirement for asset servicers to constantly engage with clients and regulators.

In addition to this, according to EY's new opportunities for asset servicing study, nearly 75% of the companies see the impact of regulations as the greater risk facing the asset servicing industry. Therefore, the increased scrutiny from regulatory agencies is anticipated to hinder the asset service market's growth in the coming years.

Robotic process automation (RPA) or automation is a major trend shaping the growth of the asset servicing market. Robotic process automation alone could reduce the headcount by 60-70% in the asset servicing industry while also achieving cost savings of approximately 30-40%.

The countries covered in the asset servicing market are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, and USA.

Key Attributes:

Report Attribute | Details |

No. of Pages | 175 |

Forecast Period | 2023 - 2027 |

Estimated Market Value (USD) in 2023 | $1277.82 billion |

Forecasted Market Value (USD) by 2027 | $1830.69 billion |

Compound Annual Growth Rate | 9.4% |

Regions Covered | Global |

A selection of companies mentioned in this report includes

National Australia Bank Limited

CACEIS

BNY Mellon

HSBC

JP Morgan

Citi

The Bank of New York Mellon Corporation (BNY Mellon)

State Street Corporation

UBS

Clearstream (Deutsche Borse Group)

Northern Trust Corporation

BNP Paribas Securities Services

SimCrop A/S

Broadridge Financial Solutions Inc.

Pictet Group

Key Topics Covered:

1. Executive Summary

2. Asset Servicing Market Characteristics

3. Asset Servicing Market Trends And Strategies

4. Asset Servicing Market - Macro Economic Scenario

4.1 COVID-19 Impact On Asset Servicing Market

4.2 Ukraine-Russia War Impact On Asset Servicing Market

4.3 Impact Of High Inflation On Asset Servicing Market

5. Asset Servicing Market Size And Growth

5.1. Global Asset Servicing Historic Market, 2017-2022, $ Billion

5.1.1. Drivers Of The Market

5.1.2. Restraints On The Market

5.2. Global Asset Servicing Forecast Market, 2022-2027F, 2032F, $ Billion

5.2.1. Drivers Of The Market

5.2.2. Restraints On the Market

6. Asset Servicing Market Segmentation

6.1. Global Asset Servicing Market, Segmentation By Service, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

Fund Services

Custody and Accounting

Outsourcing Services

Securities Lending

6.2. Global Asset Servicing Market, Segmentation By End User, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

Capital Markets

Wealth Management Firms

6.3. Global Asset Servicing Market, Segmentation By Enterprise Size, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

Large Enterprises

Medium and Small Enterprises

7. Asset Servicing Market Regional And Country Analysis

7.1. Global Asset Servicing Market, Split By Region, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

7.2. Global Asset Servicing Market, Split By Country, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

For more information about this report visit https://www.researchandmarkets.com/r/mxak3n

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance